The Environmental Protection Agency (EPA) is a federal agency tasked with protecting human health and the environment. One of its most critical responsibilities is setting and enforcing emissions standards for various industries, including transportation. For decades, the EPA has played a central role in shaping how vehicles, especially heavy-duty trucks, are designed, manufactured, and operated, all in an effort to reduce air pollution and combat climate change.

In recent years, the EPA has introduced a series of increasingly strict emissions regulations targeting the trucking industry. These EPA changes are part of a broader initiative to cut harmful pollutants such as nitrogen oxides (NOx), particulate matter, and greenhouse gases (GHGs) from commercial vehicles. The latest rules impact everything from engine standards to vehicle design and are set to influence both new truck purchases and ongoing fleet management strategies.

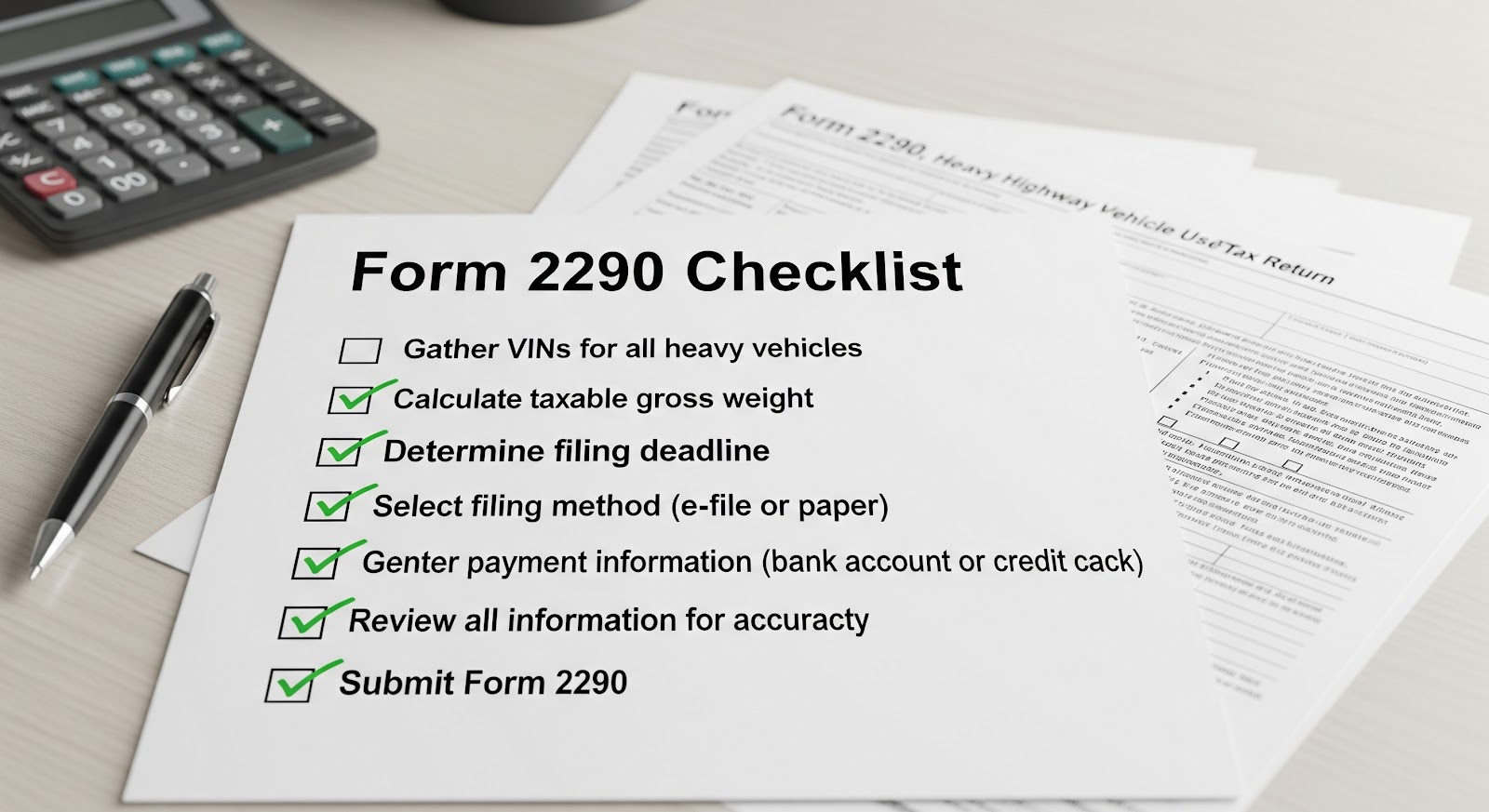

For trucking businesses, staying up to date with these regulatory changes is not optional, it’s essential. Non-compliance can lead to penalties, downtime, increased costs, and potential disruptions to operations. Moreover, understanding how these EPA changes intersect with tax obligations like the Heavy Vehicle Use Tax (HVUT) and Form 2290 filings can help businesses avoid costly mistakes and stay fully compliant with both IRS and environmental regulations.

Overview of the Latest EPA Changes

The EPA’s latest round of emissions regulations represents one of the most ambitious updates to commercial vehicle standards in decades. These changes are part of the agency’s broader strategy to reduce pollution from the transportation sector, one of the largest contributors to greenhouse gas emissions in the United States.

Clean Trucks Plan and Phase 3 GHG Standards

The cornerstone of these updates is the Clean Trucks Plan, a multi-phase initiative launched by the EPA to reduce emissions from heavy-duty vehicles over time. Most recently, the EPA finalized the Phase 3 Greenhouse Gas (GHG) Standards, which apply to model years 2027 through 2032. These rules build upon previous GHG phases and are designed to drive further innovation in cleaner engine technology and alternative fuel solutions.

The Phase 3 standards, announced in 2023 and set to take effect beginning with model year 2027, tighten the limits on CO₂ emissions from newly manufactured trucks. In addition, the EPA has also implemented tougher requirements under the Heavy-Duty NOx (nitrogen oxides) rule, which targets pollutants that contribute to smog and respiratory issues.

Key Targets and Goals

These new EPA regulations are centered on three primary goals:

- Significant Reduction in Nitrogen Oxides (NOx) and Greenhouse Gases (GHGs)

- The rules aim to cut NOx emissions by up to 80% compared to current standards.

- They also push for a stronger annual reduction in GHGs, helping to curb the transportation sector’s environmental impact.

- The rules aim to cut NOx emissions by up to 80% compared to current standards.

- Stricter Engine Standards for Model Years 2027 and Beyond

- Engine manufacturers will be required to meet new durability and emissions performance standards.

- Compliance will require improved aftertreatment systems, longer-lasting components, and more robust emissions monitoring technologies.

- Engine manufacturers will be required to meet new durability and emissions performance standards.

- Increased Focus on Zero-Emission Vehicles (ZEVs)

- While not mandatory, the new rules are designed to incentivize the adoption of ZEVs, including battery-electric and hydrogen fuel cell trucks.

- Fleets investing in zero-emission technologies may qualify for state or federal incentives while future-proofing against even tighter regulations.

- While not mandatory, the new rules are designed to incentivize the adoption of ZEVs, including battery-electric and hydrogen fuel cell trucks.

Affected Vehicle Categories

The EPA’s latest changes affect a wide range of commercial vehicles, including but not limited to:

- Heavy-Duty Trucks – Class 7 and 8 tractors used in long-haul operations.

- Vocational Vehicles – Dump trucks, cement mixers, refuse trucks, and delivery vans.

- Transit and School Buses – Encouraging cleaner options for public transportation.

- Medium-Duty Trucks – Often used in urban delivery and utility sectors.

These updates will impact OEMs, fleet operators, leasing companies, and owner-operators alike, especially as compliance becomes more tied to vehicle design, maintenance, and emissions monitoring.

As these changes begin to roll out, understanding how they affect your operations and planning accordingly, will be critical for long-term success in the trucking industry.

Timeline & Implementation Phases

Understanding when the new EPA changes take effect is just as important as understanding what they are. The EPA’s Clean Trucks Plan and Phase 3 GHG standards are being rolled out in stages, with critical milestones in 2025, 2027, and 2030. These phased implementation dates are designed to give manufacturers and fleets time to adapt, while still pushing the industry toward cleaner, more sustainable technologies.

2025: Early Technology Preparation and Compliance Shifts Begin

- Although most new emission standards take effect in 2027, 2025 is a key year for preparation.

- Truck and engine manufacturers are expected to begin phasing in compliant technologies, including upgrades to emission control systems.

- Fleets should begin assessing their vehicles for retirement or retrofitting in preparation for upcoming rules.

- States like California may begin enforcing their own, more aggressive timelines based on California Air Resources Board (CARB) regulations, prompting earlier adoption in some areas.

2027: Major Federal Regulations Take Effect

- Model year 2027 is the official start date for the EPA’s new Phase 3 GHG standards and Heavy-Duty NOx rules.

- Manufacturers will be required to meet stricter NOx and GHG emissions limits, triggering design changes in engines and aftertreatment systems.

- Fleet operators purchasing new vehicles in or after 2027 will likely see:

- Higher upfront vehicle costs.

- Improved fuel efficiency.

- Extended emissions system warranties.

- Higher upfront vehicle costs.

- Compliance tracking will intensify, requiring more detailed recordkeeping and potentially new tools for monitoring emissions performance.

- Trucking businesses should prepare now by planning vehicle replacement schedules and updating compliance protocols.

2030: Continued Tightening and Transition Toward Zero Emissions

- The 2030 target is part of a long-term EPA roadmap aimed at accelerating the shift toward zero-emission vehicles (ZEVs).

- While not a regulatory mandate yet, by 2030:

- A significant portion of newly sold trucks may be battery-electric or hydrogen-powered.

- More states may adopt ZEV sales targets, especially those aligned with CARB standards.

- Additional incentives and funding opportunities for clean vehicle adoption are expected.

- A significant portion of newly sold trucks may be battery-electric or hydrogen-powered.

- Fleet managers will need to explore infrastructure planning for charging stations, fueling hubs, and ZEV-compatible maintenance practices.

State vs. Federal Adoption: EPA vs. CARB Standards

- While the EPA sets national regulations, individual states, most notably California, can adopt stricter standards through the California Air Resources Board (CARB).

- CARB regulations often go into effect earlier than EPA rules and can serve as a model for other states.

- Currently, more than a dozen states have adopted or are considering adopting CARB standards, including:

- New York

- New Jersey

- Washington

- Oregon

- Massachusetts

- New York

- This creates a dual-compliance landscape where fleets operating across multiple states may need to meet both federal and state-specific standards.

- Trucking businesses should stay updated on which states have adopted CARB regulations to avoid compliance gaps.

As deadlines approach, early action will give fleets more flexibility, cost savings, and a competitive advantage in adapting to the evolving emissions landscape.

How EPA Changes Tie into HVUT and Form 2290 Filings

While the EPA’s emissions regulations are environmental in nature, they have a direct impact on your tax obligations, particularly when it comes to the Heavy Vehicle Use Tax (HVUT) and IRS Form 2290. Any modifications you make to stay compliant with the EPA’s new rules, such as upgrading engine components, retrofitting equipment, or purchasing newer, heavier vehicles, could change your taxable vehicle classification and, by extension, your HVUT liability.

How Vehicle Changes Can Affect HVUT Liability

EPA compliance often requires significant vehicle modifications or replacements. For instance:

- Adding aftertreatment systems or battery packs may increase the vehicle’s gross weight.

- Replacing older trucks with newer, emissions-compliant models may shift a vehicle into a higher weight category (e.g., from 55,000 lbs to 75,000 lbs or more).

- If you originally filed your vehicle as “suspended” (i.e., driving under 5,000 miles annually), increased usage due to more efficient engines or route changes may exceed that mileage limit.

All of these factors must be reflected in your IRS Form 2290 filing to avoid penalties, rejected returns, or issues with DMV registration.

The Importance of Filing a 2290 Amendment

If your truck’s:

- Taxable gross weight increases due to upgrades or changes in vehicle classification, or

- Mileage exceeds the 5,000-mile limit (7,500 for agricultural vehicles) for a vehicle initially reported as suspended,

You are required to file a Form 2290 Amendment with the IRS immediately. This ensures that your tax liability is accurately reported and that your Schedule 1 remains valid for registration and compliance purposes.

Failing to update your filing can result in:

- IRS penalties and interest

- Delays in vehicle registration or renewal

- Invalid Schedule 1 for fleet audits or DOT inspections

How ExpressTruckTax Helps You Stay Compliant

ExpressTruckTax is designed specifically to support fleets, owner-operators, and tax professionals in navigating changes like these with ease. Here’s how we simplify HVUT compliance as EPA rules evolve:

Free VIN Corrections

- If your VIN was entered incorrectly on your original filing (especially common when updating fleet info during EPA-related upgrades), we allow free VIN corrections, as long as the return was originally filed through ExpressTruckTax.

Streamlined 2290 Amendments for Weight or Mileage Changes

- Our platform walks you step-by-step through filing 2290 Amendments, whether you’re updating:

- A gross weight increase due to equipment modifications, or

- A change from suspended status to taxable because mileage exceeded 5,000.

- A gross weight increase due to equipment modifications, or

- You can file amendments anytime during the tax period and receive an updated stamped Schedule 1 instantly.

Accurate Recordkeeping and IRS Filing Support

- ExpressTruckTax maintains organized digital records for all your 2290 filings, amendments, and Schedule 1s.

- Our platform performs built-in error checks to reduce rejections and ensure compliance, especially when you’re updating vehicle weights or statuses related to EPA modifications.

- We also offer support for bulk uploads, helping large fleets manage multiple vehicle changes efficiently.

As EPA changes begin affecting more fleets, it’s critical to ensure that your IRS tax filings reflect the reality of your vehicles. Whether you’re adding weight, changing usage, or updating your fleet to meet emissions standards, ExpressTruckTax ensures your 2290 filings stay accurate, compliant, and stress-free.

The trucking industry is entering a pivotal era of change. With the latest EPA regulations rolling out in phases through 2030, businesses that depend on heavy-duty vehicles must begin preparing now. These new standards are not just about emissions, they represent a shift in how fleets are built, maintained, taxed, and managed.

Adapting early to EPA changes gives your business a significant advantage. By understanding the regulations, auditing your fleet, and updating vehicle and tax information proactively, you can avoid costly penalties, prevent disruptions to operations, and maintain a competitive edge in an increasingly sustainability-focused industry.

Just as important as regulatory readiness is tax compliance. Changes in vehicle weight, emissions systems, or usage often lead to changes in your HVUT liability and failure to reflect those changes in your Form 2290 filings can result in serious IRS consequences.

This is where ExpressTruckTax comes in.

We provide a reliable, IRS-authorized platform to:

- Accurately file and amend Form 2290 for all vehicle changes.

- Instantly receive your IRS-stamped Schedule 1, essential for registration and compliance.

- Make free VIN corrections, handle weight increases, and manage mileage exceedance amendments with ease.

- Store all documentation securely and access it anytime, from anywhere.

Take Action Now:

- Review your fleet for upcoming EPA-related changes.

- Plan your vehicle upgrades and stay ahead of emissions deadlines.

- Log into ExpressTruckTax to update or amend your 2290 filings.

- Reach out to our bilingual, U.S.-based support team for help with any filing questions or compliance concerns.

The road ahead may bring new challenges, but with trusted tools like ExpressTruckTax, you’ll be ready to navigate every mile of it with confidence.