Form2290

PRE-FILING IS NOW OPEN for 2290 Tax Year 2025-2026 File Now

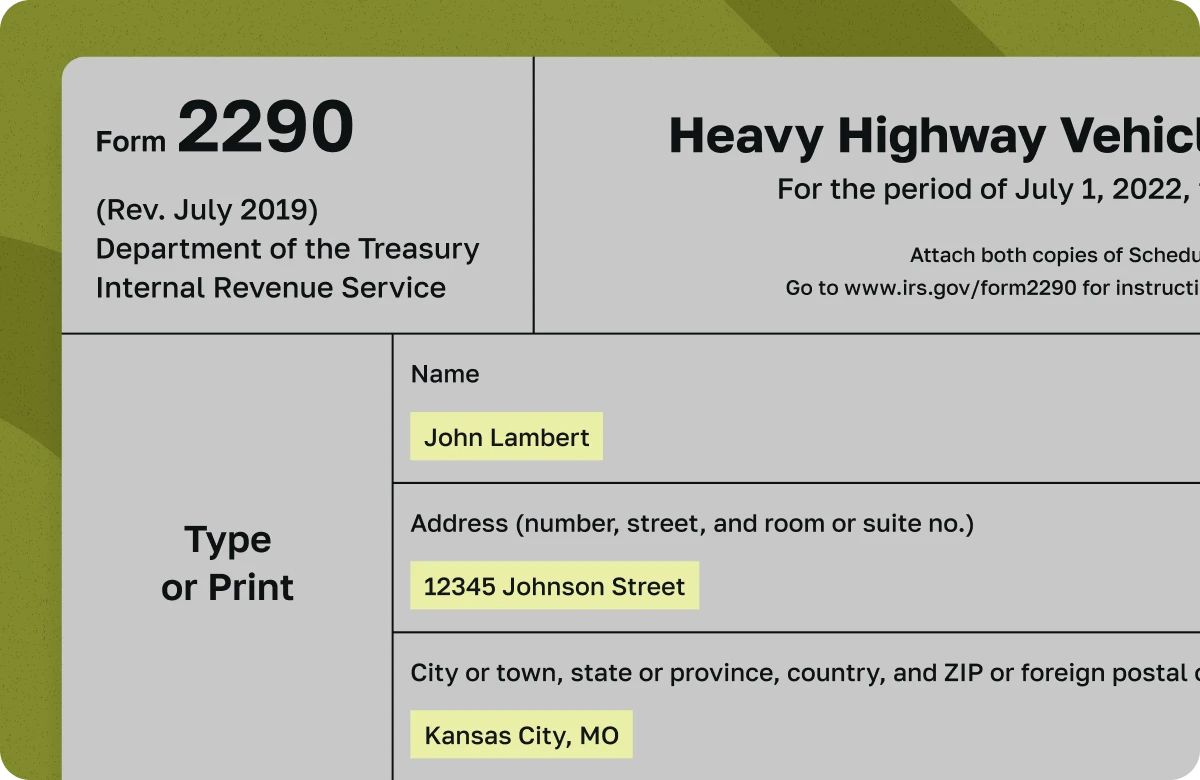

Manage Your Clients Form 2290, 8849, 2290 Amendments, and IFTA

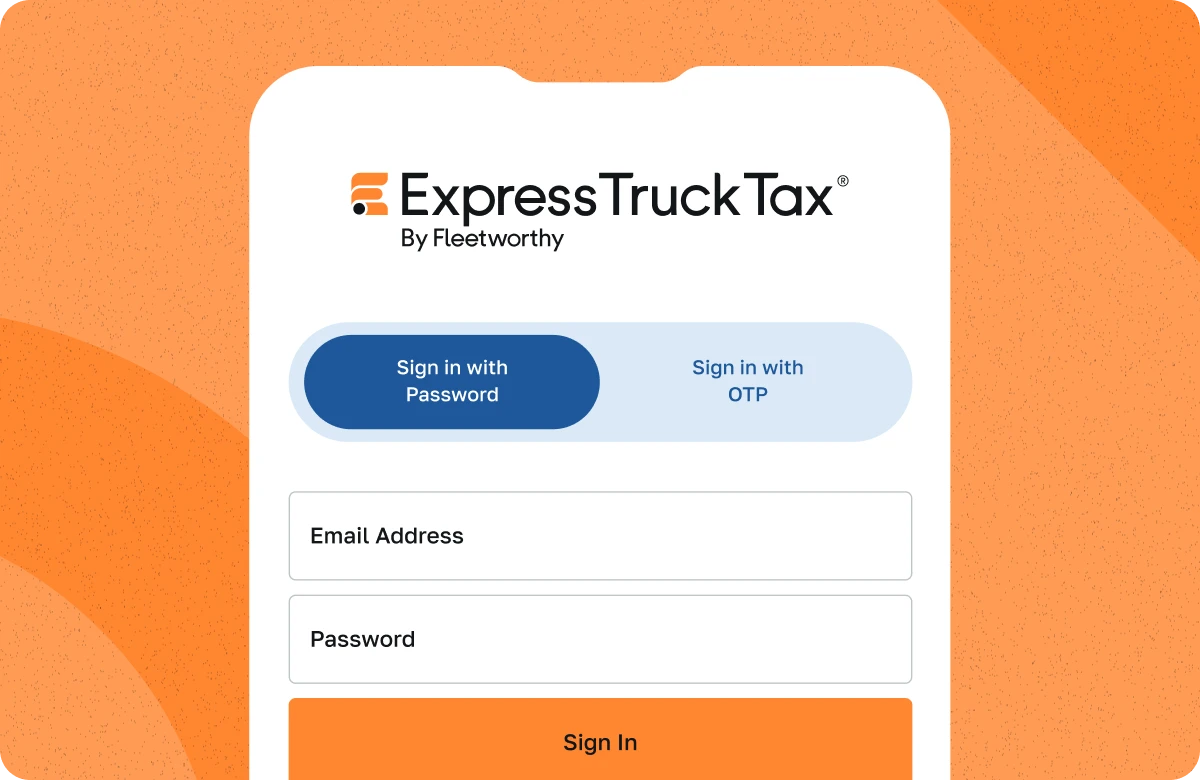

Why is ExpressTruckTax the #1 choice for Tax Professionals?

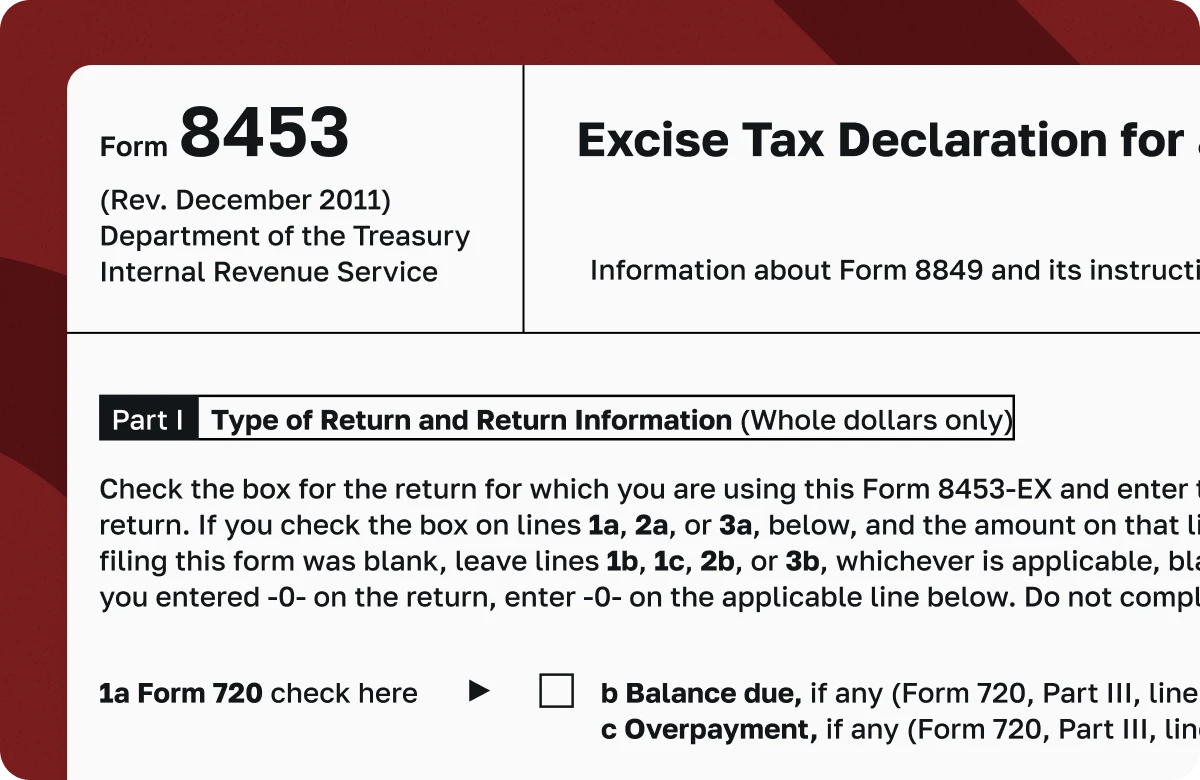

Quickly and conveniently have your clients e-Sign Form 8453-EX, the excise declaration, to authorize the transmission of federal tax forms on their behalf.

Enhance your software with our advanced API integration.

Upload information about multiple vehicles and businesses in a single click.

Our experts will handle all your data integration and make you’re filing effortless.

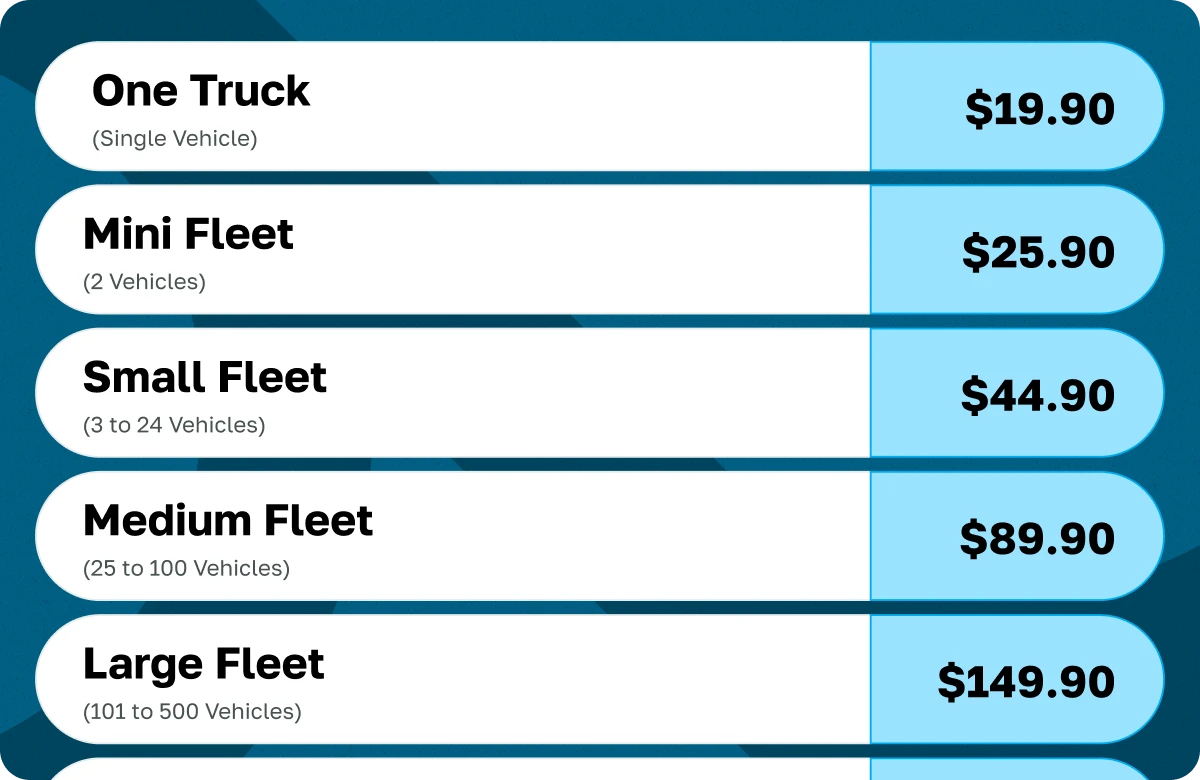

Choose the pricing package designed for your business’s needs

Custom pricing package for your business’s needs.

Pay once and no limit on the returns you file for the entire tax year.

Purchase prepaid filing credits today to receive a discounted pricing of 10% or more.

Online IRS-Authorized HVUT E-Filing Software You Can Trust