Form2290

Your 2024-25 Form 2290 is Expired!

File Your 2025-26 Form 2290 Now with ExpressTruckTax!

The 2025-2026 Form 2290 Tax Season Has Arrived File Now

E-file Form 8849 Schedule-6 to get refund of excise taxes reported on Form 2290.

File Your 2025-26 Form 2290 Now with ExpressTruckTax!

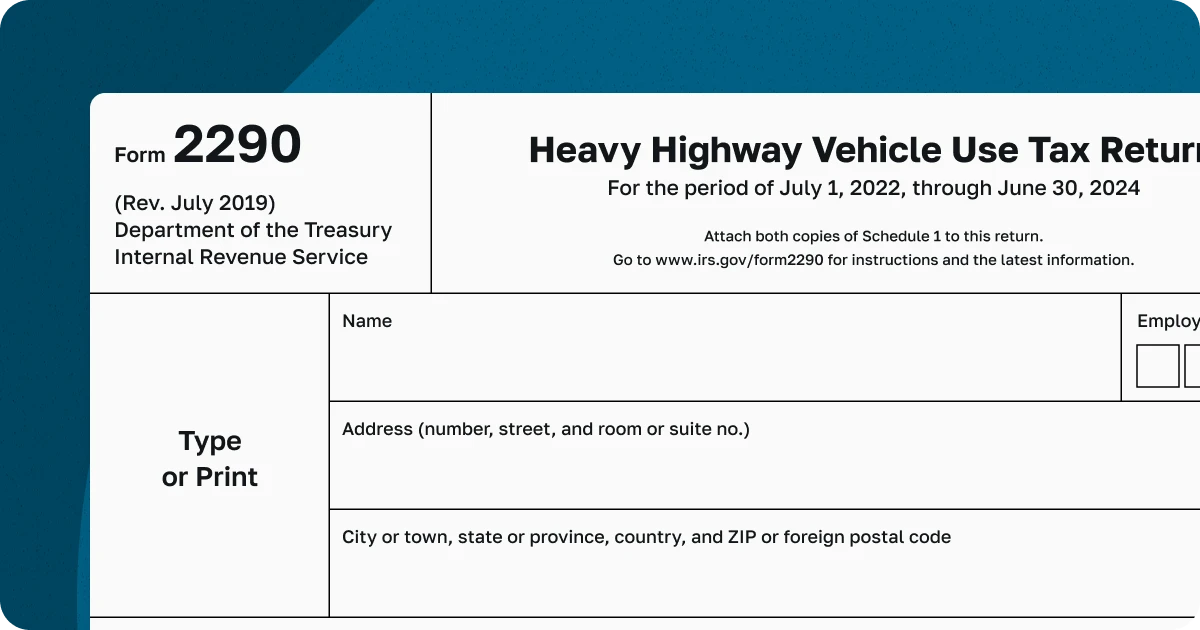

Quickly E-file IRS Form 2290 (HVUT) with ExpressTruckTax and receive your stamped Schedule 1 in minutes once the IRS accepts your return.

Correct your Form 2290 VIN errors online. If you had e-filed your original Form 2290 return with ExpressTruckTax, file your Form 2290 VIN Correction for free!

Retransmit your rejected Form 2290 return filed with ExpressTruckTax for free.

Bulk upload information about 40,000 trucks at once using our Bulk Upload Template while filing your Form 2290 return for multiple vehicles.

Online IRS-Authorized HVUT E-Filing Software You Can Trust

E-file your 8849 in minutes!

Claim refund of taxes paid for sold, destroyed, stolen, and low-mileage credit vehicles.

Choose December as the last month of the Tax Year.

Add vehicle information; specify stolen/destroyed/sold, low mileage or tax overpayment.

Review & Transmit Form 8849 to the IRS.

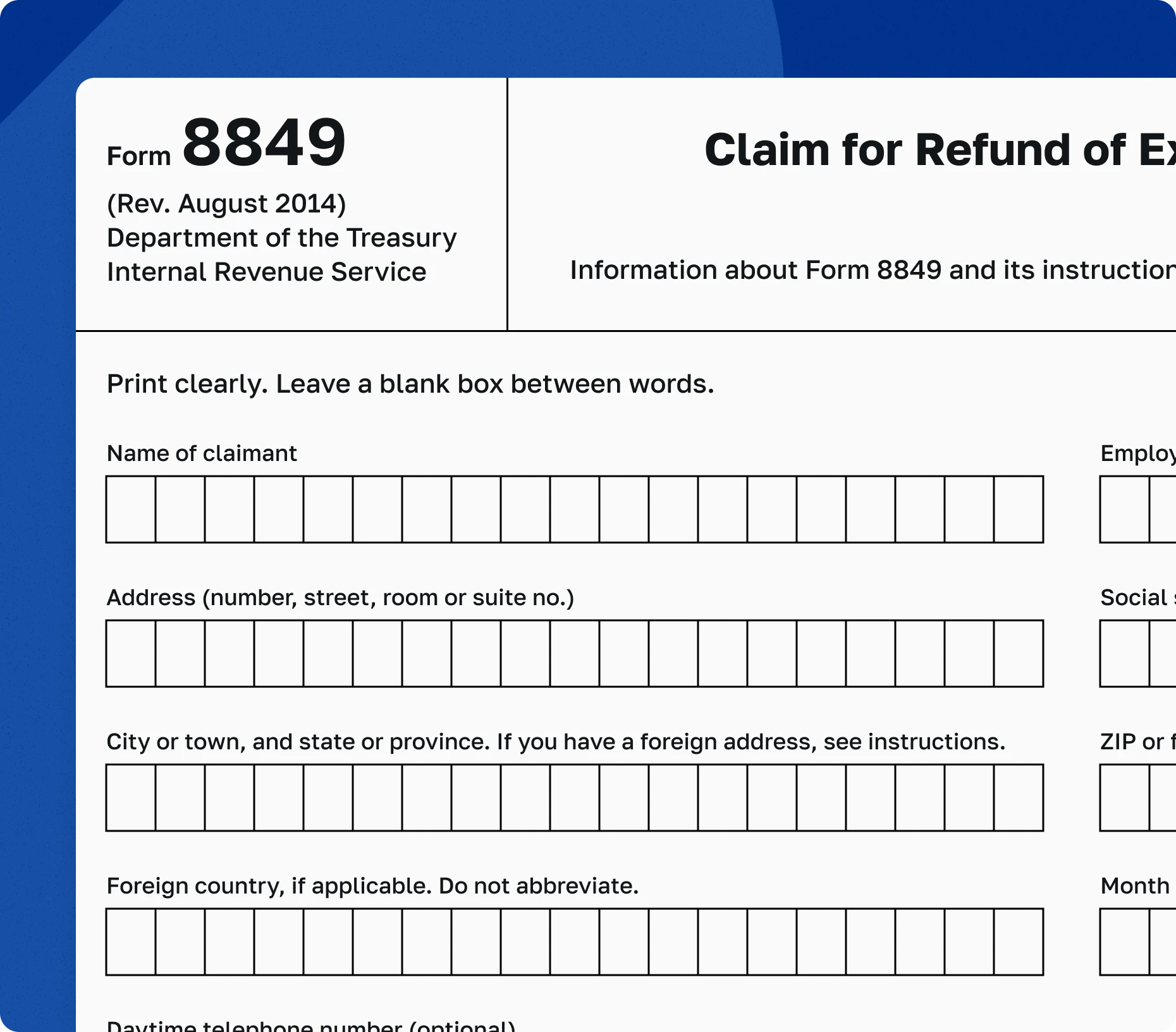

The Form 8849 is used to file a claim for a refund of excise taxes, or to claim certain refunds, such as when a vehicle was stolen, destroyed, or sold.

Generally, you can file a claim for a refund of excise taxes using Form 8849 along with the appropriate schedule form.

– Schedule 1: Nontaxable Use of Fuels

– Schedule 2: Sales by Registered Ultimate Vendors

– Schedule 3: Certain Fuel Mixtures and the Alternative Fuel Credit

– Schedule 5: Section 4081(e) Claims

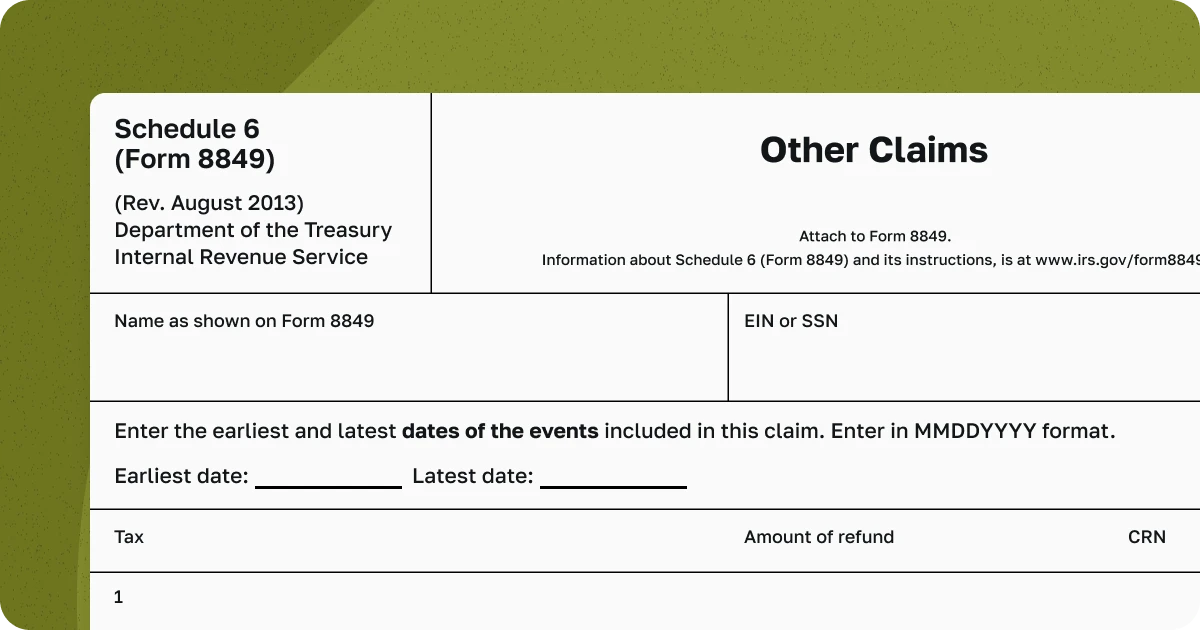

– Schedule 6: Other Claims including the credit claim from Form 2290

– Choose your IRS payment method

– Schedule 8: Registered Credit Card Issuers

Use Schedules 1, 2, 3, 5, and 8 to claim certain fuel related refunds such as nontaxable uses (or sales) of fuels. A list of the schedules by number and title can be found on the Form 2290.

Schedule 6 is intended for claims not reportable on Schedules 1, 2, 3, 5, and 8, including refunds of excise taxes reported on:

– Form 720, Quarterly Federal Excise Tax Return;

– Form 730, Monthly Tax Return for Wagers

– Form 11-C, Occupational Tax and Registration Return for Wagering and

– Form 2290, Heavy Highway Vehicle Use Tax Return

– Anyone who overpaid on their Form 2290

– Owners of vehicles sold, stolen or destroyed after the Form 2290 tax period

– Owners of vehicles that traveled 5,000 miles or less on public highways during the Form 2290 tax period

– Owners of vehicles that traveled 7,500 miles or less for agricultural purposes during the Form 2290 tax period

Form 8849 should not be used to make adjustments to liability reported on a Form 720. Instead, use Form 720X, the Amended Quarterly Federal Excise Tax Return. Similarly, do not use Form 8849 to claim what you took or will take as a credit on Schedule C (Form 720), Form 730, Form 2290, or Form 4136.

ExpressTruckTax will automatically generate your Form 8849 when the credits on your Form 2290 exceed the tax you owe. We also offer bundle pricing so that you can E-File both Form 2290 and Form 8849 for one low price.

Online IRS-Authorized HVUT E-Filing Software You Can Trust