Managing a fleet of trucks is far more than keeping vehicles on the road — it’s a dynamic balance of operations, compliance, costs, and people. Whether you’re an owner-operator with a small fleet or a logistics manager overseeing hundreds of vehicles, efficient fleet management is critical to keeping your business profitable, compliant, and competitive.

Importance of Efficient Fleet Management

Efficient fleet management directly impacts your bottom line and reputation. When trucks are well-maintained, routes are optimized, and drivers are supported, your fleet operates with fewer delays, reduced costs, and minimal downtime. Here’s why it matters:

- Cost Control: Optimized fleet operations reduce fuel expenses, maintenance costs, and IRS penalties from late filings.

- Safety & Compliance: Ensures vehicles meet DOT and IRS requirements, reducing the risk of accidents, violations, or audits.

- Customer Satisfaction: Timely deliveries and professional service help retain clients and attract new business.

- Sustainability: Efficient use of resources means less fuel waste and lower emissions.

- Scalability: An efficient system makes it easier to grow your fleet without losing operational control.

Challenges in Managing Multiple Trucks

Fleet management becomes increasingly complex as you add more vehicles. Some of the most common challenges include:

- Maintenance Coordination: Tracking routine service and repairs across dozens (or hundreds) of trucks can lead to oversights and breakdowns if not properly managed.

- Driver Oversight: Hiring, training, and retaining reliable drivers while ensuring compliance with hours-of-service (HOS) rules is a constant task.

- Regulatory Compliance: Staying up-to-date with HVUT (Form 2290), DOT audits, IFTA reporting, and safety inspections can be overwhelming without a system in place.

- Data Overload: Managing mileage logs, fuel receipts, VINs, insurance info, and tax documents manually increases the risk of costly errors.

- Communication Gaps: Poor coordination between dispatchers, drivers, and administrators can result in missed deadlines and low driver morale.

This guide will walk you through best practices, tools, and strategies to overcome these challenges and manage a fleet of trucks efficiently — whether you’re running a small business or a growing enterprise.

Understanding Fleet Management Basics

Fleet management involves the administration, coordination, and monitoring of commercial vehicles used by a business. In the trucking industry, this includes overseeing:

- Vehicle acquisition, maintenance, and retirement

- Driver recruitment, training, and scheduling

- Compliance with state and federal transportation regulations (like Form 2290 for HVUT)

- Route planning and fuel tracking

- Managing insurance, safety, and performance metrics

Effective fleet management ensures that all trucks are operating legally, efficiently, and reliably — with the right resources in the right place at the right time.

Core Components of Fleet Management

Managing a fleet requires attention to several critical areas:

Vehicle Maintenance

- Routine inspections, oil changes, tire checks, and brake servicing

- Preventative maintenance to reduce unplanned repairs or breakdowns

- Maintenance scheduling tools and logs to ensure DOT compliance

Regulatory Compliance

- Filing Form 2290 for Heavy Vehicle Use Tax (HVUT)

- Ensuring all vehicles are registered with valid VINs and EINs

- Meeting FMCSA requirements for driver hours, safety inspections, and insurance

- Keeping documentation like IRS-stamped Schedule 1s up-to-date for DMV registration

Cost Control

- Monitoring fuel usage and reducing idle time

- Managing tolls, maintenance costs, and insurance premiums

- Leveraging technology to detect inefficiencies and eliminate waste

Driver Management

- Hiring qualified CDL drivers and ensuring proper training

- Monitoring driver behavior through telematics (speeding, harsh braking, etc.)

- Promoting safety, retention, and morale through consistent communication and support

Key Goals of Fleet Management

A well-run fleet management system is designed to achieve four major goals:

1. Safety

- Protecting your drivers, vehicles, cargo, and the public by enforcing safety policies and maintaining reliable equipment.

2. Efficiency

- Minimizing downtime, maximizing mileage, and ensuring vehicles are routed and maintained strategically.

3. Profitability

- Reducing operating costs through better planning, fuel management, and timely tax filings to avoid penalties.

4. Compliance

- Staying aligned with IRS, DOT, FMCSA, and state regulations to avoid fines, audits, or disruptions in operations.

By mastering these basics, fleet managers can lay a strong foundation for operational success. The rest of this guide will show you how to put these principles into action with practical tools and proven strategies.

Building a Fleet Management Strategy

An efficient fleet doesn’t run on guesswork—it runs on a clear, actionable strategy. Building a strong fleet management strategy means identifying your business goals, setting measurable standards, and putting systems in place that support safety, reliability, and profitability. This section outlines how to define your operational objectives and establish a Standard Operating Procedure (SOP) to ensure your fleet runs smoothly and consistently.

A. Define Your Operational Goals

Every trucking operation is different, but successful fleets typically share a few common priorities. Start by identifying which goals are most important to your business and tailor your fleet management practices around them.

Cost Reduction

Keeping operational costs under control is essential to staying competitive. Consider strategies such as:

- Optimizing fuel usage with route planning and idle time tracking

- Scheduling preventative maintenance to avoid costly repairs

- Filing tax forms like Form 2290 on time to avoid IRS penalties

- Leveraging bulk upload and prepaid credit features from platforms like ExpressTruckTax to save time and money

Delivery Timelines

Reliability is key in the logistics world. Delays can mean lost business or contract penalties. Improve your on-time performance by:

- Using GPS tracking for live route management

- Minimizing breakdowns with regular vehicle checks

- Improving dispatch and communication processes with real-time updates to drivers and customers

Regulatory Compliance

Fleet operations are governed by numerous regulations from the IRS, DOT, FMCSA, and more. Stay compliant by:

- E-filing Form 2290 annually and maintaining IRS-stamped Schedule 1s for DMV renewals

- Keeping accurate VINs and EINs on file

- Monitoring Hours of Service (HOS) using electronic logging devices (ELDs)

- Staying ahead of IFTA and state-specific rules

Sustainability

Many fleets are also focusing on environmental impact. Sustainable practices not only reduce emissions but can also improve public image and cut fuel costs. Strategies include:

- Reducing empty miles and fuel waste through better route planning

- Maintaining proper tire pressure and engine performance

- Exploring fuel-efficient or alternative-fuel vehicles where feasible

B. Create a Standard Operating Procedure (SOP)

Once your goals are set, formalize them through a Standard Operating Procedure (SOP). An SOP acts as your playbook—keeping your team aligned, reducing miscommunication, and ensuring accountability across your fleet.

Routine Checks

- Establish pre-trip and post-trip inspection routines for all vehicles

- Include tire pressure, lights, fluids, brakes, and visible wear/damage

- Train drivers to log issues and report defects immediately

Maintenance Schedules

- Develop a maintenance calendar that includes oil changes, tune-ups, and compliance inspections

- Use fleet management software to automate reminders

- Track service history and costs to identify trends and reduce downtime

Driver Protocols

- Set clear expectations around safe driving behavior, logbook updates, and communication procedures

- Include training guidelines, accident protocols, and delivery standards

- Monitor driver performance with GPS and telematics, and use metrics to offer feedback and incentives

Emergency Response Plans

- Outline step-by-step procedures for vehicle breakdowns, accidents, weather delays, and medical emergencies

- Provide emergency contact lists and roadside assistance info in each truck

- Train drivers on how to document incidents, secure cargo, and communicate with dispatch

With clear goals and a solid SOP in place, your fleet will be well-positioned for consistent performance, regulatory compliance, and long-term growth. In the next section, we’ll dive deeper into vehicle maintenance and inspections—the foundation of a safe and reliable fleet.

Vehicle Maintenance & Inspection

Vehicle maintenance and inspection are the foundation of safe, reliable fleet operations. Poorly maintained trucks not only lead to costly repairs and breakdowns but also pose serious safety risks and can result in failed inspections, fines, and lost revenue. A strong maintenance plan ensures that your fleet stays on the road, performs efficiently, and meets all regulatory requirements.

Importance of Preventative Maintenance

Preventative maintenance is all about fixing issues before they become problems. Instead of waiting for a breakdown, fleet managers should schedule regular inspections and services that keep each truck in peak condition.

Benefits of preventative maintenance include:

- Reduced Downtime: Scheduled maintenance is far less disruptive than emergency repairs.

- Improved Safety: Reduces the risk of brake failure, tire blowouts, and engine malfunctions.

- Lower Costs: Prevents small issues (like fluid leaks or worn belts) from turning into major, expensive repairs.

- Compliance: Helps ensure your vehicles pass roadside inspections and remain DOT compliant.

Routine maintenance should include oil and fluid changes, brake and tire inspections, battery checks, lights, HVAC systems, and engine diagnostics.

Using Digital Logs and Scheduling Tools

Gone are the days of relying on paper inspection forms and manual calendars. Today’s fleets can take advantage of digital tools to streamline maintenance tracking:

- Fleet Management Software: Automatically logs maintenance history, tracks repair costs, and alerts you when service is due.

- Mobile Apps: Allow drivers to submit inspection reports in real-time, including photos or notes for mechanics.

- Telematics Systems: Monitor engine diagnostics, tire pressure, and mileage data to trigger alerts for upcoming service.

Digitizing your maintenance process reduces errors, increases visibility, and creates a reliable record for audits or internal reviews.

FMCSA Inspection Requirements

To stay compliant with federal law, all commercial motor vehicles must meet the Federal Motor Carrier Safety Administration (FMCSA) standards. These include:

- Annual DOT Inspections: Every vehicle over 10,000 lbs must pass a full inspection annually by a qualified mechanic.

- Driver Vehicle Inspection Reports (DVIRs): Drivers are required to complete pre-trip and post-trip inspections daily.

- Recordkeeping: Maintenance and inspection records must be kept for at least 12 months (or 14 months for annual inspections).

Failing to comply with these regulations can result in out-of-service violations, fines, or even disqualification from operating.

Partnering with Trusted Service Centers

Choosing the right service provider is key to keeping your fleet in top shape. Look for:

- Experienced Technicians: Providers familiar with heavy-duty vehicles and FMCSA regulations.

- Fast Turnaround: Minimize downtime with prompt, efficient service.

- Fleet Maintenance Programs: Many shops offer contracts or volume discounts for recurring service.

- Mobile Repair Services: Great for on-the-road emergencies or in-yard repairs.

Building long-term relationships with trusted service centers also ensures consistent quality and better pricing over time.

How ExpressTruckTax Helps with VIN Validation and Corrections

Vehicle Identification Numbers (VINs) are essential for maintenance tracking, tax filing, and vehicle registration. A single typo in a VIN can delay IRS filings, cause rejections, and prevent DMV registration.

ExpressTruckTax offers powerful tools to prevent and correct VIN errors:

- Free VIN Checker: Verifies that each VIN is valid and correctly formatted before you file.

- VIN Correction Filing: If you originally filed your Form 2290 with ExpressTruckTax and made a VIN mistake, you can file a VIN correction for free.

- Bulk Upload with Smart Checks: If managing a large fleet, you can upload vehicle data in bulk with built-in validation to avoid costly copy-paste errors.

- DMV Integration: Ensures your corrected and validated Schedule 1 is accepted for truck registration.

These features help maintain accurate records, reduce IRS rejections, and ensure your vehicle documentation aligns with maintenance and inspection logs.

With proactive maintenance, the right digital tools, and trusted service partners, your fleet can avoid costly setbacks and stay road-ready.

Compliance with IRS and DOT Regulations

Staying compliant with federal and state regulations is non-negotiable in the trucking industry. Non-compliance can result in heavy fines, vehicle impoundments, delayed registrations, and even the suspension of business operations. To manage your fleet efficiently, you must be fully aware of the legal requirements from agencies like the IRS, DOT, FMCSA, and state tax authorities—and have reliable systems in place to meet them.

Overview of Key Regulations

Fleet managers need to navigate a complex web of regulatory requirements, including:

DOT (Department of Transportation)

- Sets vehicle safety standards, driver qualifications, and operating procedures.

- Requires routine inspections, maintenance logs, and up-to-date licenses and medical certificates for drivers.

FMCSA (Federal Motor Carrier Safety Administration)

- Oversees Hours of Service (HOS), Electronic Logging Devices (ELDs), and driver safety ratings.

- Manages the Compliance, Safety, Accountability (CSA) scoring system that affects your fleet’s safety profile.

IFTA (International Fuel Tax Agreement)

- Requires multi-state carriers to track fuel purchases and mileage in each jurisdiction.

- Reports must be filed quarterly, and errors can lead to audits or additional tax liability.

HVUT (Heavy Vehicle Use Tax)

- Mandated by the IRS for vehicles with a gross weight of 55,000 lbs or more.

- Must be filed annually using Form 2290, and proof of payment (Schedule 1) is required for registration with most state DMVs.

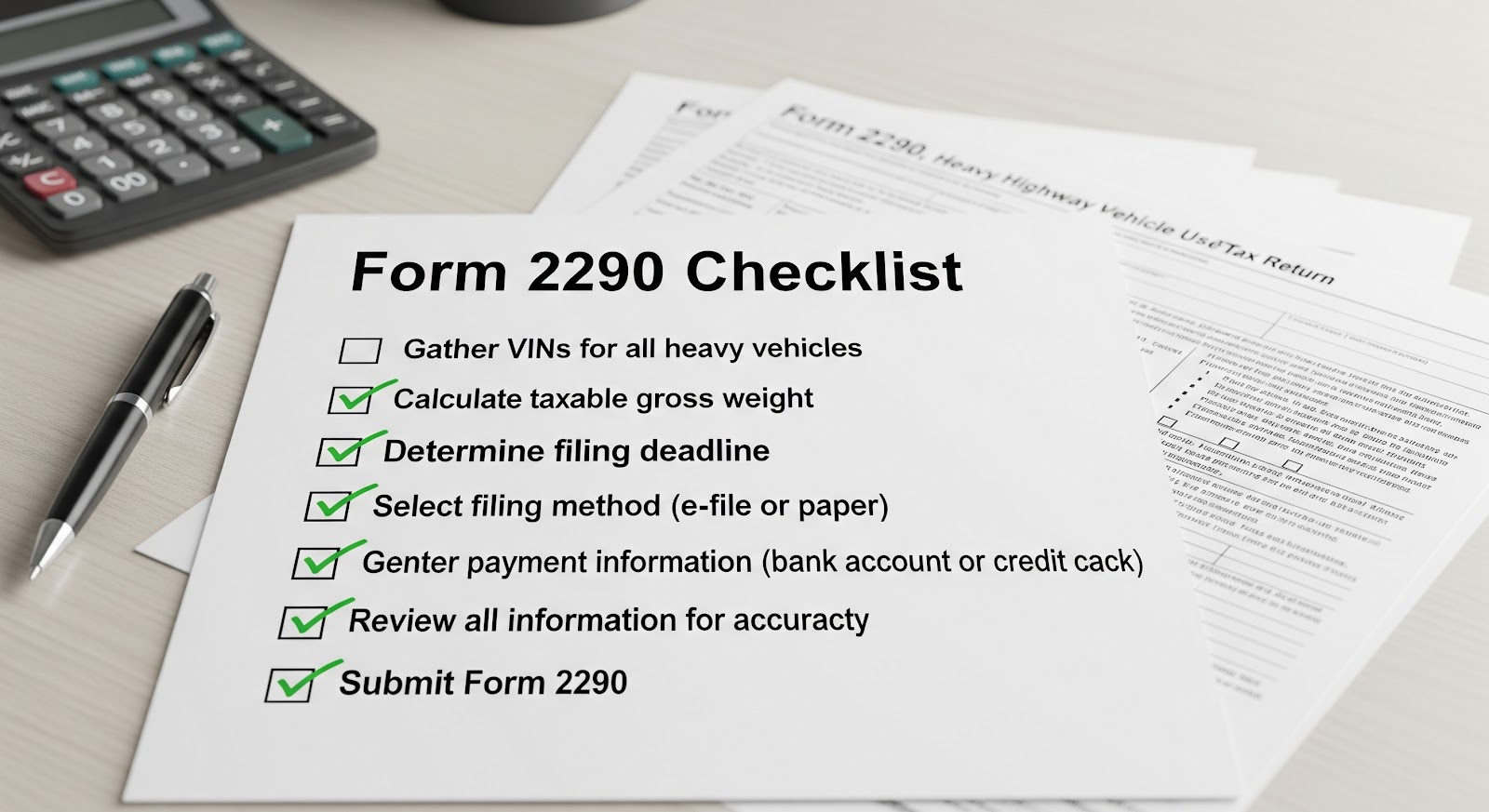

Filing Form 2290 for HVUT with ExpressTruckTax

One of the most important IRS requirements for fleet owners is filing Form 2290 to report and pay Heavy Vehicle Use Tax.

ExpressTruckTax makes this process fast, accurate, and IRS-compliant:

- Step-by-step e-filing: Easily file for one vehicle or thousands with guided instructions.

- Instant IRS-stamped Schedule 1: Get your proof of payment via email, mobile app, or fax within minutes.

- Bulk upload tools: File up to 40,000 vehicles at once using templates with built-in error checks.

- VIN Corrections & Amendments: Make free corrections or submit weight/mileage amendments anytime.

- Ready Return Feature: Automatically reuses last year’s data for quicker filing.

- Multiple payment options: Choose EFTPS, direct debit, credit/debit card, or check/money order.

Filing on time through ExpressTruckTax helps you avoid costly IRS penalties and ensures uninterrupted registration with the DMV.

Maintaining Up-to-Date Records

Accurate, well-organized records are critical not just for audits—but also for tax filings, maintenance planning, and fleet expansion. Key records include:

- EIN (Employer Identification Number): Required for IRS filings; SSNs are not accepted.

- VIN (Vehicle Identification Numbers): Must be accurate for each vehicle on your Form 2290 and in your inspection logs.

- Mileage Logs: Track mileage for HVUT purposes (especially for suspended vehicles), IFTA reporting, and maintenance planning.

- Fuel Receipts and Route Data: Required for IFTA and tax deductions.

- Inspection and Maintenance Records: Must be stored for DOT compliance and CSA audits.

ExpressTruckTax helps by securely storing your IRS records and offering tools to validate VINs and prevent data entry errors.

Avoiding Penalties Through Timely Filings and Audits

Late filings or inaccurate data can lead to serious consequences:

- IRS Penalties: Late Form 2290 filings may incur penalties of up to 4.5% of the total tax due, plus interest.

- DOT Fines: Missing or falsifying logs and inspection records can result in violations during roadside inspections.

- IFTA Audits: Inconsistent mileage or fuel data can lead to retroactive tax bills and interest charges.

- DMV Registration Delays: Without a valid IRS-stamped Schedule 1, you won’t be able to register or renew your vehicles.

Avoid these issues by:

- Setting calendar reminders for HVUT, IFTA, and DOT deadlines.

- Using fleet management software or platforms like ExpressTruckTax that send filing notifications and audit alerts.

- Establishing an internal audit process to regularly check for missing, expired, or inaccurate documentation.

Proper compliance isn’t just about avoiding penalties—it builds trust with clients, protects your drivers, and sets the foundation for a professional, growth-ready fleet.

Fuel & Cost Management

Fuel is one of the largest and most volatile expenses for any fleet. Combined with costs like tolls, maintenance, insurance, and unexpected repairs, effective cost management is essential to running a profitable trucking operation. Implementing a smart fuel and expense strategy allows fleet managers to control spending, forecast budgets more accurately, and boost overall efficiency.

Fuel Card Programs

Fuel cards are a powerful tool for controlling and tracking fuel expenses across your fleet. Unlike credit cards, fuel cards are designed specifically for trucking operations and come with built-in controls and benefits:

Key Benefits of Fuel Card Programs:

- Discounted Rates: Access to nationwide fuel discounts at partner stations.

- Spending Controls: Set limits by dollar amount, gallons, time of day, or location to prevent misuse.

- Real-Time Tracking: Monitor transactions as they occur and flag unusual activity.

- Simplified IFTA Reporting: Many cards track fuel purchases and tax data by state, helping with quarterly IFTA filings.

Popular programs include Comdata, EFS, and Fleet One, among others. Choose a card that aligns with your routes and fuel station preferences.

Route Planning to Reduce Fuel Consumption

Efficient routing can significantly cut down on fuel usage, vehicle wear, and delivery delays. Route planning tools use real-time data to calculate the most efficient paths, avoiding traffic congestion, road closures, and steep gradients.

Strategies for Fuel-Efficient Routing:

- Use GPS and Telematics: Tools like Omnitracs, Motive, or Samsara offer advanced routing and tracking features.

- Minimize Empty Miles: Use load boards and dispatch tools to plan return loads and avoid fuel-wasting deadhead trips.

- Avoid High-Fuel Zones: Plan routes that bypass areas with consistently high diesel prices.

- Time Deliveries Strategically: Avoid peak hours to reduce idling in traffic.

Monitoring Idle Time and Engine Diagnostics

Unnecessary engine idling is a major source of wasted fuel—and it also contributes to engine wear and emissions. Using telematics and diagnostics tools can help monitor and reduce idle time across your fleet.

Benefits of Monitoring Engine Activity:

- Reduce Fuel Waste: Cutting down idle time can save hundreds of gallons per vehicle annually.

- Identify Mechanical Issues Early: Engine diagnostics tools catch warning signs before they lead to major breakdowns.

- Improve Driver Behavior: Track excessive idling, hard braking, or aggressive acceleration to coach drivers on efficient habits.

- Maintain Emissions Compliance: Reducing engine strain also helps meet EPA and state emissions standards.

Telematics systems can integrate with your fleet management software to provide real-time alerts and historical reporting.

Managing Tolls, Repairs, and Insurance

Fuel isn’t the only variable cost you need to track. Tolls, repairs, and insurance premiums can add up quickly—and vary widely depending on how your fleet is operated.

Toll Management:

- Use Transponders: Devices like EZ Pass, PrePass, or Bestpass streamline toll collection and reduce administrative time.

- Review Toll Routes: Regularly evaluate routes for toll alternatives or discounts.

- Audit Monthly Statements: Look for duplicate or incorrect charges.

Repair Management:

- Preventative Maintenance: Catching small issues early reduces the risk of high-cost breakdowns.

- Track Repair Histories: Identify recurring issues and assess whether certain vehicles are becoming cost-inefficient.

- Use Approved Vendors: Partnering with trusted service centers ensures quality work and may result in volume discounts.

Insurance Cost Control:

- Bundle Policies: Consolidating coverage under one provider can reduce premiums.

- Evaluate Risk Scores: Insurance costs are often tied to CSA scores and driver safety history—investing in training and safety improves your rates.

- Compare Annually: Shop around each year to ensure your policy remains competitive.

By managing fuel, routes, idle time, and variable expenses with precision, you can drastically reduce operational costs and increase your fleet’s profitability. Up next, we’ll explore how to maintain your fleet’s records and documentation—a key to staying organized and compliant.

Common Mistakes to Avoid

Even experienced fleet managers can fall into costly traps that impact efficiency, compliance, and profitability. By recognizing and avoiding these common mistakes, you can keep your fleet running smoothly and avoid preventable setbacks. Below are five critical missteps to watch out for—and how to stay ahead of them.

1. Ignoring Preventative Maintenance

One of the biggest and most expensive mistakes in fleet management is neglecting routine maintenance. Waiting until something breaks to take action leads to:

- Increased downtime from unplanned repairs

- Higher costs for emergency service and replacement parts

- Safety hazards, putting drivers and the public at risk

- Failed DOT inspections, resulting in fines or out-of-service violations

Solution: Establish a preventative maintenance schedule with digital reminders, detailed inspection logs, and a trusted repair network. This not only extends the life of your vehicles but also ensures regulatory compliance and operational reliability.

2. Delayed IRS Filings

Missing deadlines for IRS filings—especially Form 2290 for Heavy Vehicle Use Tax (HVUT)—can lead to:

- Late penalties of up to 4.5% of the total tax due, plus monthly interest

- Delays in DMV registration or renewal, which can keep vehicles off the road

- IRS audits, especially if prior year filings show inconsistencies

Solution: Use tools like ExpressTruckTax to file accurately and on time. With features like filing reminders, bulk uploads, auto-filled Ready Returns, and instant Schedule 1 access, you can eliminate the risk of late filings.

3. Poor Communication with Drivers

Drivers are the backbone of any trucking operation. Poor communication leads to:

- Missed or delayed deliveries

- Frustration and turnover among drivers

- Safety and compliance risks, including incomplete logs or unreported maintenance issues

Solution: Foster a culture of communication by:

- Using mobile apps or fleet management systems for real-time updates

- Encouraging daily check-ins and feedback loops

- Providing clear SOPs and expectations for reporting vehicle issues, delivery delays, or changes in route

4. Not Using Tech Tools Effectively

Technology is essential for managing modern fleets, yet many businesses underutilize or ignore the tools available. The consequences include:

- Disorganized data and lost records

- Manual errors in tax filings, logs, or maintenance tracking

- Wasted time from paper-based systems or outdated processes

Solution: Invest in and fully utilize technology such as:

- Fleet management software for scheduling, compliance, and maintenance

- GPS and telematics systems for tracking routes, fuel use, and driver behavior

- ExpressTruckTax for easy e-filing and recordkeeping of IRS documents like Schedule 1 and Form 2290

Training your team to use these tools ensures you get the full value of your investment.

5. Mismanaging Fuel Costs

Fuel is one of your largest controllable expenses. Without a clear strategy, it’s easy to overspend due to:

- Inefficient routes

- Unmonitored idling

- Untracked purchases or unauthorized fueling

- Failure to leverage discounts or fuel cards

Solution: Build a fuel cost management plan that includes:

- Route optimization using telematics and GPS software

- Monitoring idle time and engine diagnostics

- Issuing and managing fuel cards with spending controls and real-time tracking

- Analyzing fuel data regularly to identify trends or problem areas

By steering clear of these common pitfalls, fleet managers can drastically improve operations, reduce costs, and maintain a safer, more compliant fleet.