If you operate a heavy vehicle on public highways in the United States, chances are you’re required to file HVUT, or Heavy Vehicle Use Tax. HVUT is an annual federal tax imposed by the IRS on trucks, tractors, and buses with a taxable gross weight of 55,000 pounds or more. The purpose of this tax is to help fund highway maintenance and infrastructure development, as heavy vehicles cause greater wear and tear on roads.

Filing HVUT is not just a legal requirement—it’s essential for staying compliant and avoiding costly penalties. Whether you’re a solo owner-operator, manage a small fleet, or oversee a large transportation company, you must file IRS Form 2290 and receive a stamped Schedule 1 to renew your vehicle registration and remain on the road legally.

For many truck owners, the HVUT filing process can seem confusing or time-consuming. But with the right guidance and tools, it’s easier than ever to complete. In this guide, we’ll walk you through the HVUT filing process step by step and show you how to file accurately and efficiently using ExpressTruckTax—an IRS-authorized e-file provider trusted by thousands of truckers nationwide.

Who Needs to File HVUT?

Not everyone on the road is subject to the Heavy Vehicle Use Tax (HVUT), but if you operate certain types of vehicles, it’s a mandatory part of staying compliant with IRS regulations.

Taxable Vehicles: 55,000 Pounds or More

You are required to file Form 2290 and pay HVUT if you own a highway motor vehicle with a taxable gross weight of 55,000 pounds or more. This includes most trucks, truck tractors, and buses used on public highways. Gross weight is calculated by adding the weight of the vehicle, any trailers it may pull, and the maximum load it is customarily designed to carry.

Who Is Responsible for Filing?

The responsibility for filing and paying HVUT typically falls on the owner of the vehicle, which may include:

- Owner-Operators: Individuals who own and operate their own trucks

- Fleet Managers: Those who manage multiple vehicles under a single business or EIN

- Leasing Companies: If the vehicle is leased for a year or more, the lessee is usually responsible for filing

Whether you’re an independent driver or managing a fleet of thousands, HVUT applies if you meet the weight and usage requirements.

Individuals vs. Businesses

Filing requirements are essentially the same whether you’re filing as an individual or a business entity:

- Individuals must have a valid Employer Identification Number (EIN)—the IRS does not accept Social Security Numbers (SSNs) for HVUT filing.

- Businesses must file under their registered business name and EIN. They can also benefit from bulk upload features and multi-vehicle management tools, especially when using platforms like ExpressTruckTax.

Mandatory E-Filing for 25 or More Vehicles

If you are filing Form 2290 for 25 or more vehicles, the IRS requires you to e-file. Paper filing is not allowed in this case. E-filing is not only faster and more secure, but also reduces the chances of errors and IRS rejections.

ExpressTruckTax is specifically designed to handle both individual and fleet filings with ease, offering features like:

- Bulk upload templates

- Instant error checks

- Multi-user access for teams

Understanding who needs to file HVUT and under what circumstances helps ensure you’re always compliant—and helps you avoid unnecessary penalties or registration delays.

When to File HVUT

Understanding the timing of your HVUT filing is just as important as knowing how to file. Filing on time helps you avoid IRS penalties and ensures that you receive your stamped Schedule 1, which is required for vehicle registration and renewal at the DMV.

HVUT Tax Year: July 1 – June 30

The HVUT tax year runs from July 1 to June 30 of the following year, regardless of when your vehicle was purchased or placed in service. This annual schedule is set by the IRS and applies to all heavy vehicles operating on public highways.

Annual Filing Deadline: August 31

For vehicles that are active on July 1, the filing deadline is August 31. This means you must file Form 2290 and pay the tax by this date every year to remain compliant and avoid disruptions in your operations.

It’s important to note:

- Even if your vehicle is not currently being used, if it was operational on July 1, the filing is still due by August 31.

- If August 31 falls on a weekend or federal holiday, the deadline is extended to the next business day.

Pro-Rated Deadlines for Newly Acquired or First-Use Vehicles

If you purchase or place a vehicle into service after July 1, your HVUT payment is pro-rated based on the month the vehicle was first used. In this case:

- The tax is due by the end of the month following the first month of use.

- For example, if your truck hits the road in October, you must file by November 30.

Pro-rated filing ensures that you only pay tax for the months your vehicle is actually in service, rather than the full tax year.

Consequences of Late Filing

Failing to file your HVUT return or pay the tax on time can result in:

- IRS Penalties: Typically 4.5% of the total tax due, assessed monthly for up to five months

- Interest Charges: An additional 0.5% per month on unpaid tax

- DMV Registration Delays: Without a valid stamped Schedule 1, you won’t be able to register or renew your vehicle with the state DMV

- Possible Audits or compliance issues

To avoid these issues, it’s best to file early and choose an IRS-authorized provider like ExpressTruckTax, which ensures secure, accurate, and timely submissions.

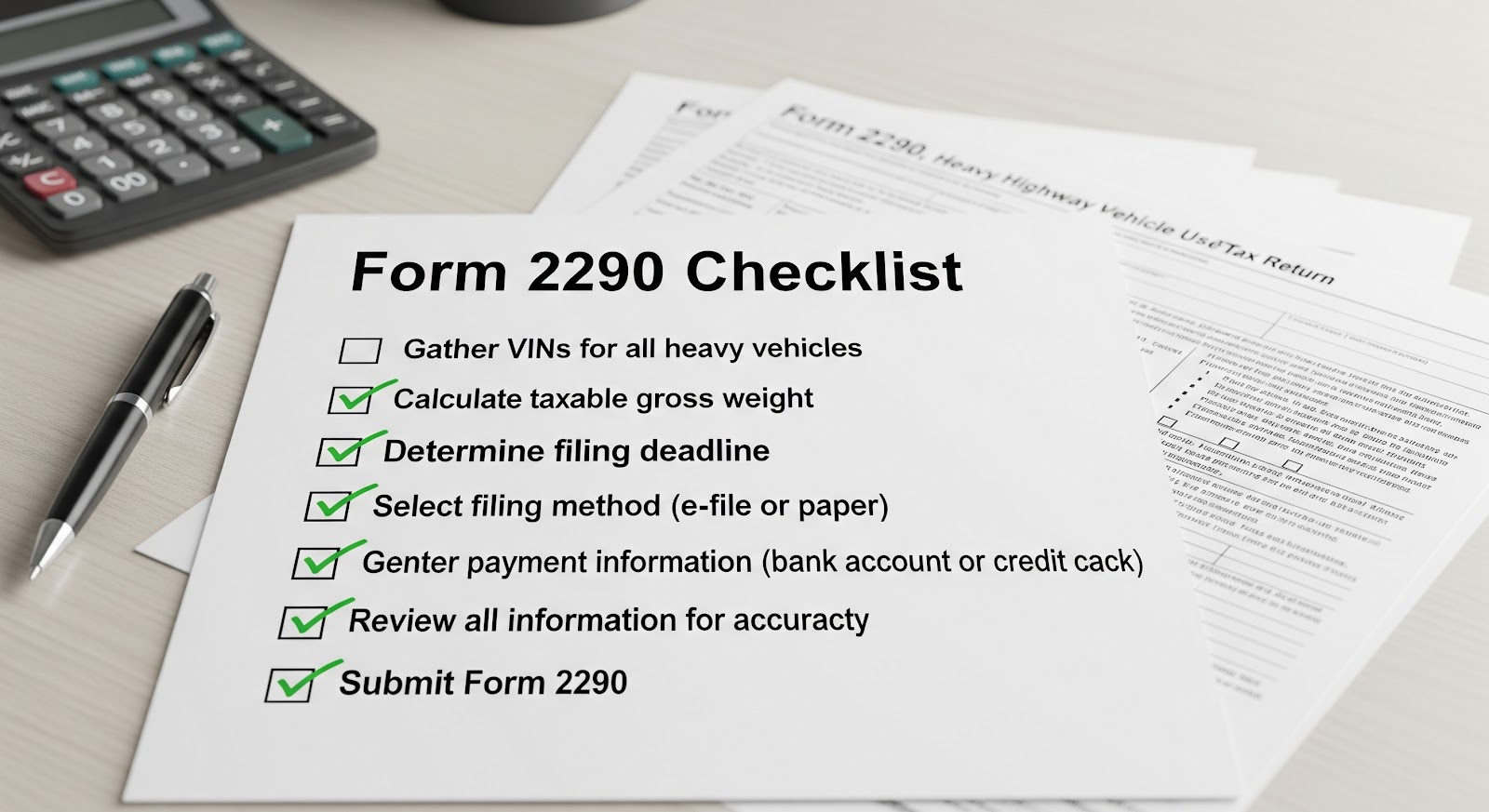

What You Need Before Filing

Before you begin the HVUT filing process, it’s essential to gather all the required information and documents. Having these details on hand will make the process faster, smoother, and more accurate—reducing the risk of IRS rejections or delays in receiving your Schedule 1.

1. Employer Identification Number (EIN) – Not a Social Security Number

The IRS requires an EIN (Employer Identification Number) for all HVUT filings. Social Security Numbers (SSNs) are not accepted. Even if you’re a sole proprietor or owner-operator, you still need an EIN to file Form 2290.

Important: If you recently applied for an EIN, it can take up to 10 business days before the IRS activates it in their e-filing system. Plan ahead to avoid delays.

If you don’t have an EIN yet, you can apply for one quickly through the IRS website.

2. Vehicle Identification Numbers (VINs)

Each vehicle you’re filing for must be listed with its 17-character Vehicle Identification Number (VIN). Accuracy is critical here—a single incorrect character can cause your return to be rejected or delay your Schedule 1.

If you’re unsure about the VIN, use the free VIN checker offered by ExpressTruckTax before submitting your return.

3. Taxable Gross Weight of Each Vehicle

You’ll need to determine the taxable gross weight of each vehicle. This includes:

- The unloaded weight of the vehicle

- The unloaded weight of any trailers typically used with it

- The maximum load customarily carried

This total weight determines which weight category the vehicle falls into for tax purposes (categories range from Category A (55,000 lbs) to Category V (over 75,000 lbs)).

Note: Logging vehicles are taxed at reduced rates. Make sure to indicate logging status if applicable.

4. Business Name and Address

Make sure you enter the legal name of your business and its mailing address exactly as registered with the IRS. This helps prevent mismatches that could cause processing delays or rejections.

If you’re an owner-operator filing as an individual with an EIN, use your personal name and address that matches IRS records.

5. IRS Payment Method

You’ll need to choose how you want to pay the HVUT amount due. The IRS offers several methods:

- EFTPS (Electronic Federal Tax Payment System): Recommended for businesses already enrolled.

- Electronic Funds Withdrawal (EFW): Direct debit from your bank account during filing.

- Debit or Credit Card: Pay through a third-party processor (additional service fees may apply).

- Check or Money Order: Must be mailed to the IRS with the payment voucher (Form 2290-V).

Each method has its own processing time and requirements, so choose the one that works best for your situation.

Being prepared with the right information up front helps ensure a quick and hassle-free filing experience—especially when using a streamlined platform like ExpressTruckTax, which walks you through each step with built-in checks for accuracy.

Step-by-Step Guide to HVUT Filing with ExpressTruckTax

Filing your HVUT Form 2290 doesn’t have to be complicated or time-consuming. With ExpressTruckTax, the entire process is streamlined into just a few easy steps. Whether you’re an individual truck owner or managing a fleet, the platform is designed to save you time and ensure accuracy.

Step 1: Create or Log in to Your ExpressTruckTax Account

To get started, visit ExpressTruckTax.com and either log in to your existing account or create a new one in minutes.

- You also have the option to file on the go using the ExpressTruckTax mobile app, available for both iOS and Android.

- Creating an account gives you access to valuable features like:

- Secure document storage

- Easy access to prior-year filings

- Instant download of your stamped Schedule 1

- The ability to copy and reuse data for faster future filings

Pro Tip: If you’ve filed with ExpressTruckTax in the past, your vehicle and business info can be pre-filled using the Ready Return feature—saving you even more time.

Step 2: Enter Business Details

Next, you’ll enter your business name, EIN, and contact information. Be sure the details match what’s on record with the IRS to avoid any mismatches or rejections.

- ExpressTruckTax supports multi-EIN management, which is ideal for accountants or fleet managers handling returns for multiple businesses under different EINs.

Need help? ExpressTruckTax offers bilingual U.S.-based support via phone, chat, or email if you’re unsure about any entry.

Step 3: Enter Vehicle Information

In this step, provide the following for each vehicle:

- VIN (Vehicle Identification Number)

- Taxable gross weight

- Logging status (if the vehicle is used primarily for logging operations, you may qualify for a reduced tax rate)

For fleet managers or businesses with many trucks, ExpressTruckTax offers a bulk upload feature, allowing you to import vehicle details for up to 40,000 trucks at once using a spreadsheet template.

This feature not only saves time but also reduces manual entry errors.

Step 4: Choose IRS Payment Method

Once your vehicle information is in, it’s time to select how you’ll pay the IRS:

- EFTPS (Electronic Federal Tax Payment System): Ideal if you’re already enrolled with EFTPS; must schedule your payment separately through the EFTPS website.

- EFW (Electronic Funds Withdrawal): Directly withdraws the tax amount from your bank account when you e-file.

- Check or Money Order: Mail your payment to the IRS along with the payment voucher (Form 2290-V).

- Credit/Debit Card: Pay through an IRS-approved third-party payment processor (note: processing fees may apply).

Each payment method has its own timeline and requirements. ExpressTruckTax gives you clear instructions for whichever option you choose.

Step 5: Review and Transmit to the IRS

Before you submit, ExpressTruckTax runs a built-in error check to catch common mistakes such as:

- Duplicate VINs

- Mismatched EIN information

- Invalid tax periods

Once everything looks good, click “Transmit to IRS” to file your Form 2290.

- Your return is instantly transmitted to the IRS using a secure, encrypted connection.

- In most cases, you’ll receive your IRS-stamped Schedule 1 within minutes via email. You can also download it directly from your account or request it by fax.

With this step-by-step process, ExpressTruckTax simplifies HVUT filing—helping truck owners and fleet managers stay compliant, avoid penalties, and keep trucks on the road.

Take the Hassle out of HVUT Filing

With ExpressTruckTax, America’s trusted IRS-authorized HVUT e-filing platform, you’ll navigate Form 2290 filing with ease—securely, accurately, and within minutes. From single-owner operators to large fleet managers, ExpressTruckTax simplifies the entire process, providing instant error checks, bulk upload options, and prompt delivery of your IRS-stamped Schedule 1 right to your inbox.

Don’t risk falling behind on your HVUT obligations—file confidently, timely, and stress-free with ExpressTruckTax today!