Get Your 2290 Stamped Schedule 1 Now

File your 2290 for the 2025-2026 tax period and get your stamped Schedule 1 in minutes!

The 2025-2026 Form 2290 Tax Season Has Arrived File Now

Federal Excise Tax FAQ: Common Questions About Forms 2290 & 8849

Guaranteed Schedule 1 or Your Money Back

Free VIN Checker & VIN Corrections

Copy Details From Your Last Return

US-Based Customer Support in Both English & Spanish

File Your 2025-26 Form 2290 Now with ExpressTruckTax!

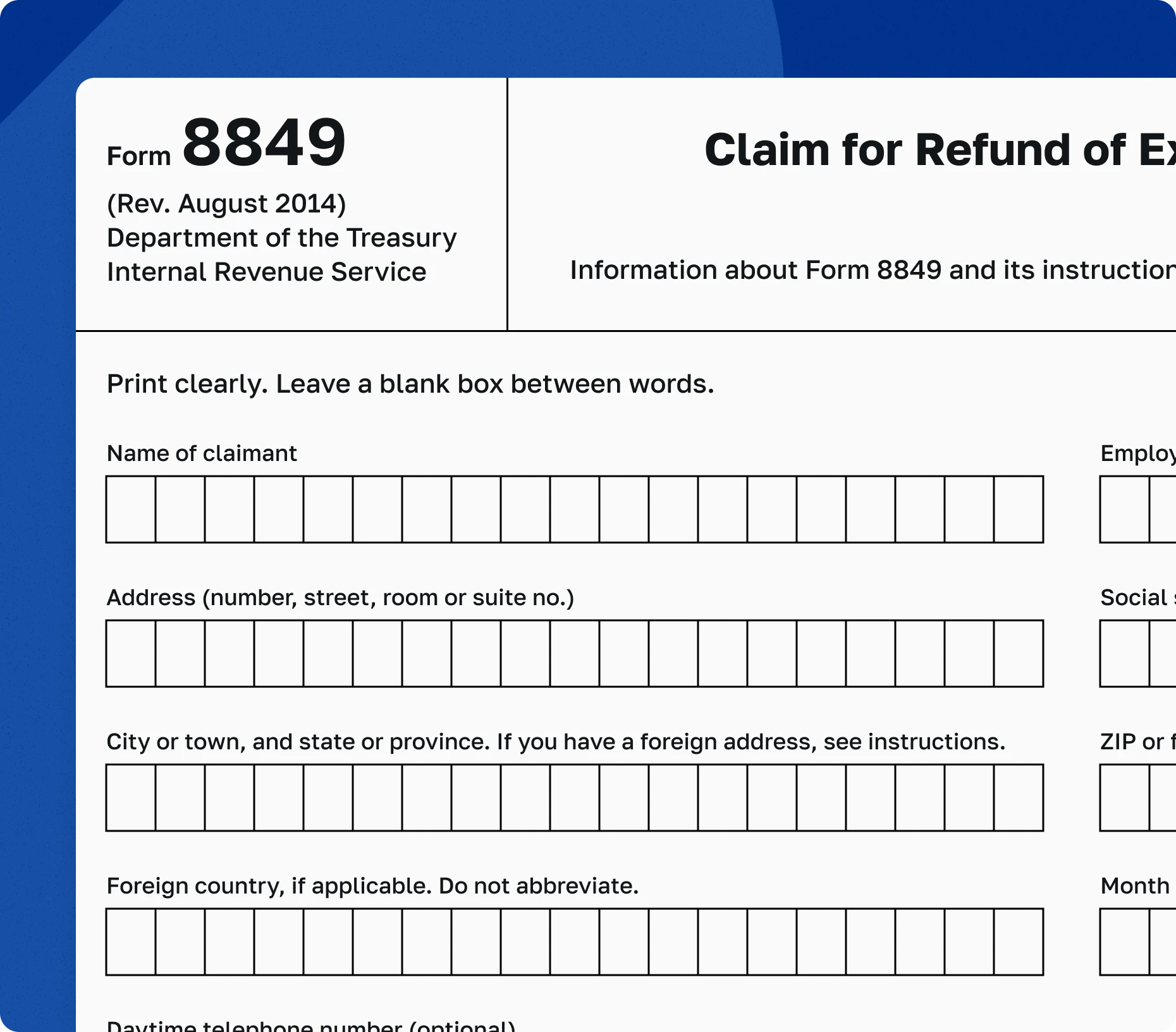

Form 8849, Claim for Refund of Excise Taxes, is a tax form used to claim credits when a vehicle was stolen, destroyed, or sold. You also claim credits if you overpaid taxes mistakenly.

If you want to claim refunds of excise taxes, use Form 8849 Schedule 6. Alternatively, you can use those funds to pay your taxes for the current year. When you e-file Excise Tax Form 2290, our system auto-generates Form 8849 Schedule 6 if your tax credits are greater than your HVUT.

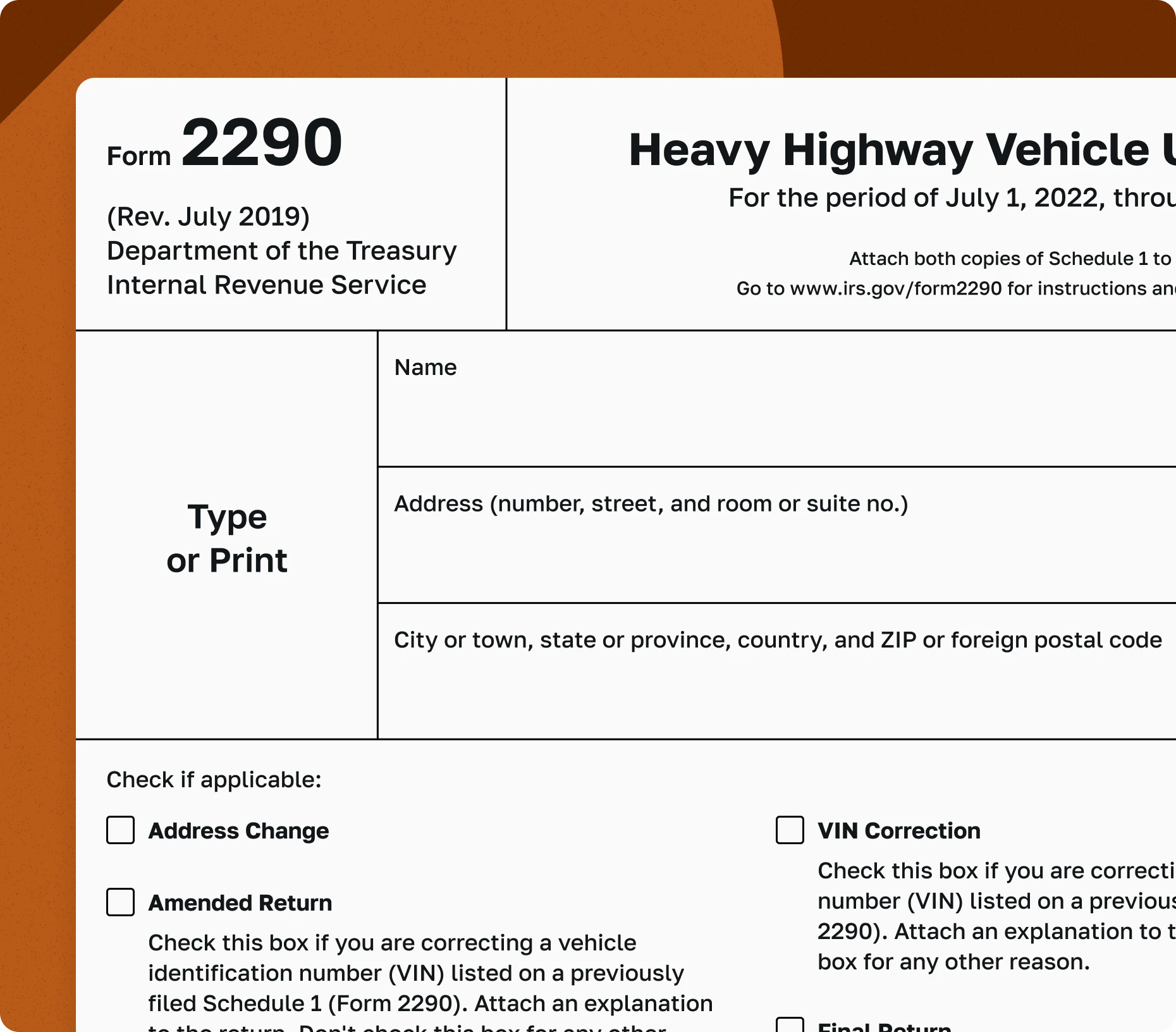

Heavy Vehicle Use Tax (HVUT) is also a kind of excise tax paid to use heavy vehicles on public highways. The purchaser/truck owner must file Form 2290 and pay HVUT.

You can either file Form 2290 electronically or on paper. However, electronic filing is mandatory if you are filing for 25 or more trucks. E-filing is more convenient, and you will receive your Stamped Schedule 1 in a few minutes. If you file Form 2290 on paper, it will take weeks to get your stamped Schedule 1 back from the IRS. It’s always better to file excise tax Form 2290 online, regardless of how many trucks you are filing for.

Why wait? E-file your Form 2290 today and receive your stamped Schedule 1 in minutes.

Online IRS-Authorized HVUT E-Filing Software You Can Trust