Form2290

Guaranteed Schedule 1 or Your Money Back

Free VIN Checker & VIN Corrections

Copy Details From Your Last Return

US-Based Customer Support in Both English & Spanish

The 2025-2026 Form 2290 Tax Season Has Arrived File Now

Form 2290 Schedule 1 is your IRS-stamped proof of HVUT payment, delivered in minutes when e-filed with ExpressTruckTax.

Guaranteed Schedule 1 or Your Money Back

Free VIN Checker & VIN Corrections

Copy Details From Your Last Return

US-Based Customer Support in Both English & Spanish

File Your 2025-26 Form 2290 Now with ExpressTruckTax!

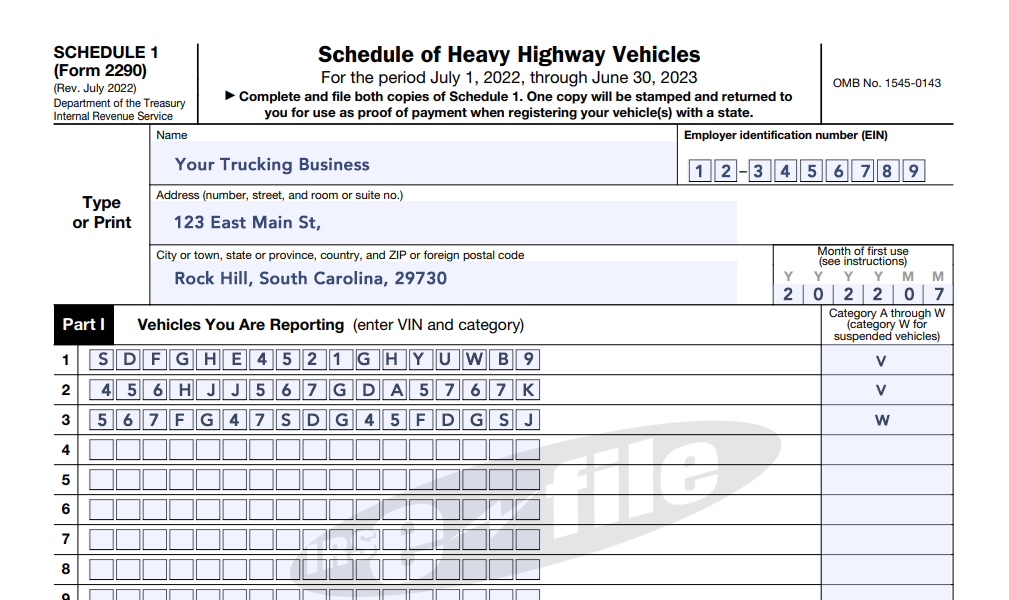

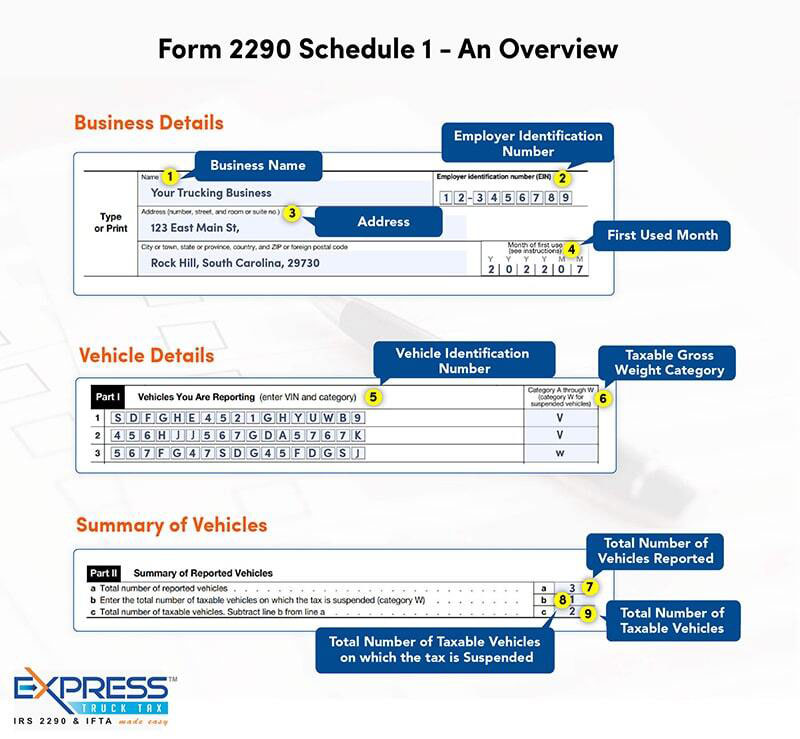

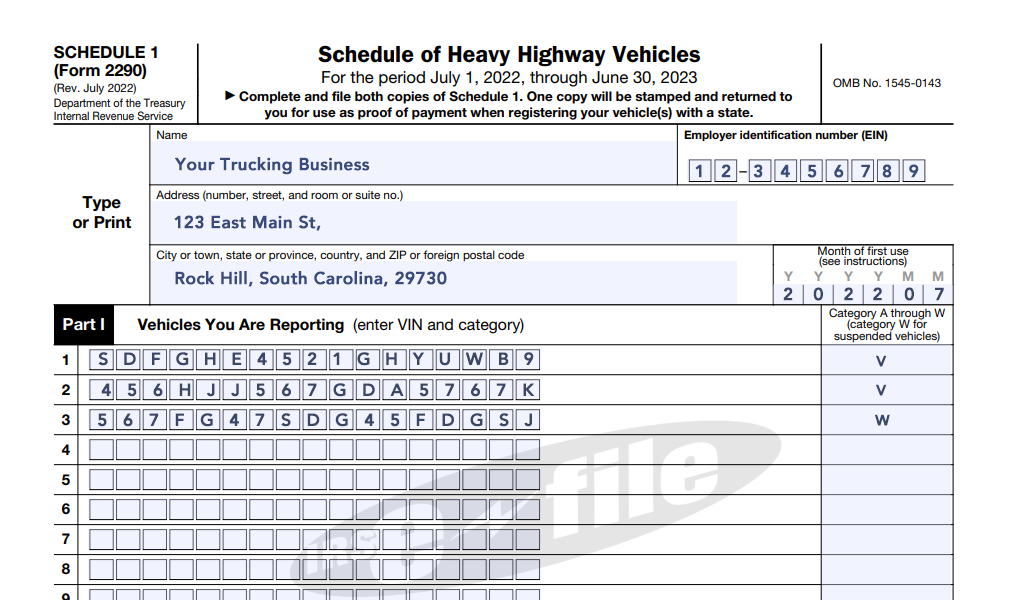

Form 2290 Schedule 1 is proof of payment for heavy vehicle use tax that was paid by truckers to the IRS. Form 2290 must be filed with the IRS every year to report the HVUT payment made for the taxable vehicles and also to report the information about tax suspended vehicles.

Once the IRS processes the 2290 tax return, it will stamp the Schedule 1 and send it back to truckers to use as a proof of HVUT payment.

Truckers can use this Form 2290 Schedule 1 to renew their tags, Register their vehicles at DMVs, and Operate their vehicles on any public highways.

It takes only a few minutes to renew your HVUT proof of payment (2290 Schedule 1) with ExpressTruckTax.

Business Details

Vehicle Details

You will receive your 2290 Schedule 1 in minutes to your registered email.

You can also opt to have us fax your 2290 Schedule 1

If you want a hard copy, you can have us mail the copies to your address.

ExpressTruckTax has partnered with more than 300+ carriers where your 2290 Schedule 1 will be directly sent to the carrier that you are working for.

Download the ExpressTruckTax app to conveniently e-file your Form 2290 from anywhere. Get notifications when your return is accepted and access a copy of your stamped Schedule 1.

Online IRS-Authorized HVUT E-Filing Software You Can Trust