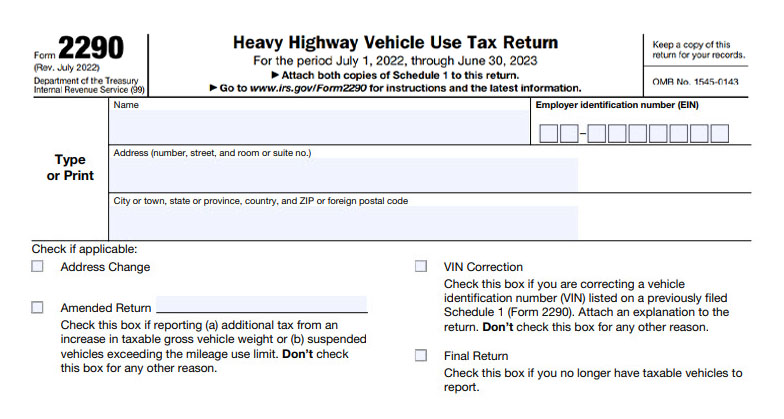

Form2290

DMV

HVUT Form 2290 Filing Solution for Truckers from Alabama (AL)

Only $19.90 for a single vehicle

The 2025-2026 Form 2290 Tax Season Has Arrived File Now

Only $19.90 for a single vehicle

Trucking is the dominant transportation source in Alabama. No other mode delivers the goods as effectively and efficiently as trucking. We are the wheels of Alabama’s diverse and thriving economy.

The trucking industry pays about 40% of all taxes owed by Alabama motorists: a typical five-axle tractor-semitrailer owner pays about $15,000 annually in state and federal highway user fees and taxes. Alabama has about 100,000 miles of public roads, with all motorists traveling about 65 billion miles, 10% of which is by truckers.

HVUT is the Heavy Vehicle Use Tax (HVUT) collected annually on heavy vehicles with gross weight of 55,000 pounds or more, operating on public highways.

Truckers from Alabama can e-File Form 2290, the Heavy Vehicle Use Tax (HVUT) return with ExpressTruckTax, and receive your stamped Schedule 1 from the IRS in minutes.

ExpressTruckTax has partnered with the Alabama State Department of Motor Vehicles (DMVs) to speed up the process of vehicle registrations and tag renewals by having them verified online for the authenticity of Schedule 1’s.

Check Schedule 1 online using either EIN or VIN

The quick verification process for registration or renewal of license plates

Identify fraudulent HVUT payment proof

Stay HVUT compliant

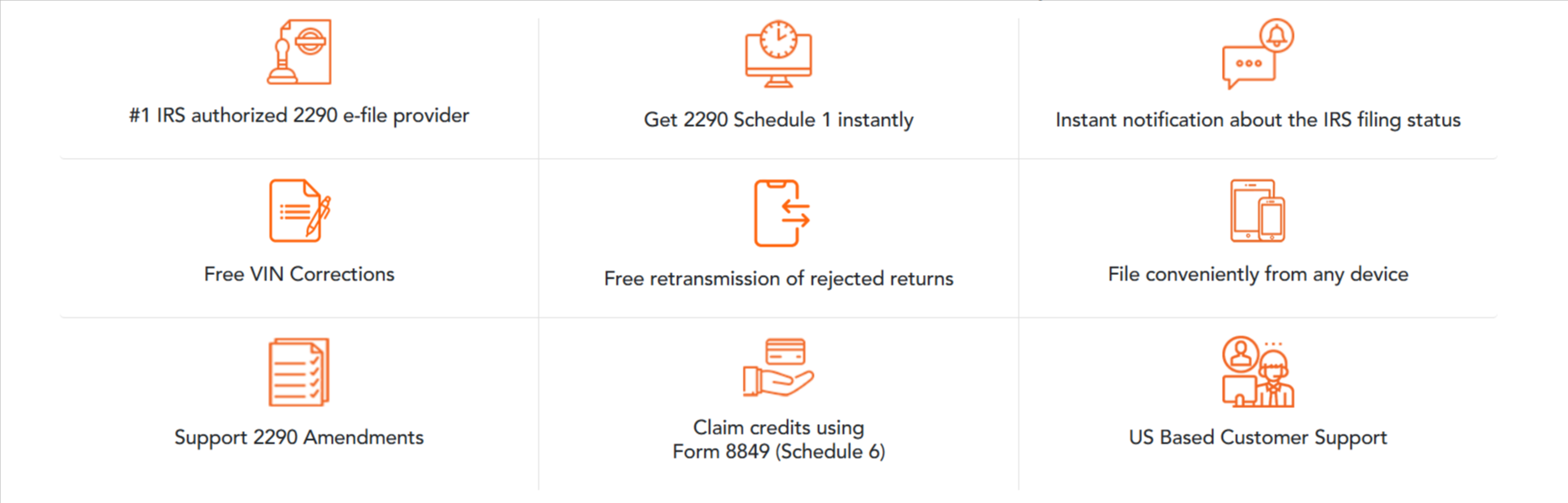

Online IRS-Authorized HVUT E-Filing Software You Can Trust