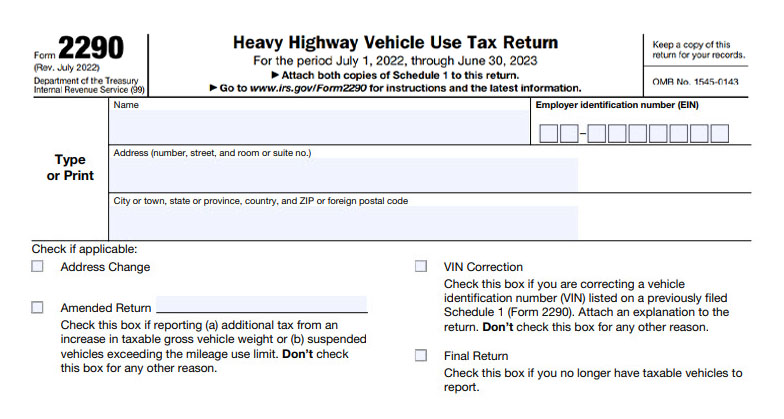

Get Your 2290 Stamped Schedule 1 Now

File your 2290 for the 2025-2026 tax period and get your stamped Schedule 1 in minutes!

The 2025-2026 Form 2290 Tax Season Has Arrived File Now

Only $19.90 for a single vehicle

The Kansas Department of Revenue collects taxes and fees, administers Kansas tax laws, issues a variety of licenses, and provides assistance to Kansas citizens and units of government.

The Kansas Department of Revenue is committed to hard work every day for the people of Kansas; to treat our taxpayers, our employees and each other with respect; to conduct business with integrity, fairness and civility; and to be held accountable for our efforts. We will collect taxes and fees fairly, cheerfully, accurately and efficiently.

HVUT is the Heavy Vehicle Use Tax (HVUT) collected annually on heavy vehicles with gross weight of 55,000 pounds or more, operating on public highways.

Truckers from Alabama can e-File Form 2290, the Heavy Vehicle Use Tax (HVUT) return with ExpressTruckTax, and receive your stamped Schedule 1 from the IRS in minutes.

ExpressTruckTax has partnered with the Kansas State Division Motor Vehicle(DMVs) to speed up the process of vehicle registrations and tag renewals by having them verified online for the authenticity of Schedule 1’s.

Online IRS-Authorized HVUT E-Filing Software You Can Trust