Get Your 2290 Stamped Schedule 1 Now

File your 2290 for the 2025-2026 tax period and get your stamped Schedule 1 in minutes!

The 2025-2026 Form 2290 Tax Season Has Arrived File Now

Only $19.90 for a single vehicle

North Carolina’s truck transportation industry has grown from a small operation in the 1920s to a vast system transporting a substantial portion of the state’s freight and other materials-often at the expense of the railroads and air freight carriers. The trucking industry in the early twenty-first century represented about 80 percent of the state’s commercial freight transportation market. Private carriers, comprising by far the largest component of the industry, were owned or leased and operated by industrial concerns, farmers, and others. So-called exempt carriers (those exempt from certain government regulations) transported only special kinds of goods or used their trucks only for specific purposes, such as hauling certain agricultural products or carrying newspapers.

The trucking industry is particularly sensitive to economic climates and changes in government regulations, particularly at the federal level.

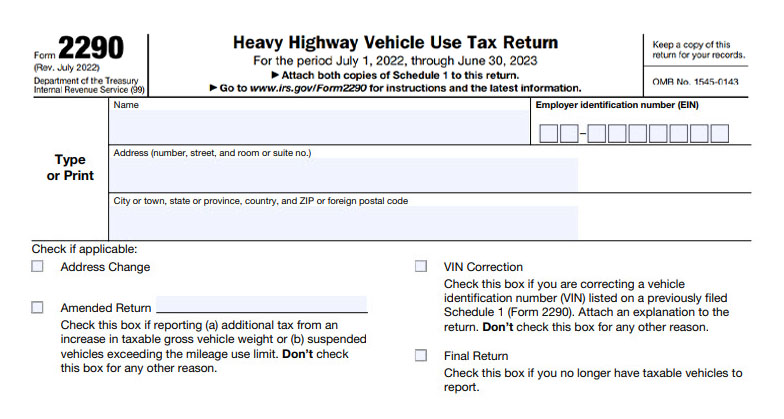

The Heavy Vehicle Use Tax is required and administered by the Internal Revenue Service (IRS). Federal law requires proof that the HVUT tax was paid when you register a vehicle that has a combination or loaded gross vehicle weight of 55,000 pounds or more.

Truckers from North Carolina can e-File Form 2290, the Heavy Vehicle Use Tax (HVUT) return with ExpressTruckTax, and receive your stamped Schedule 1 from the IRS in minutes.

ExpressTruckTax has partnered with the North Carolina State Bureau of Motor Vehicles (BMVs) to speed up the process of vehicle registrations and tag renewals by having them verified online for the authenticity of Schedule 1’s.

Online IRS-Authorized HVUT E-Filing Software You Can Trust