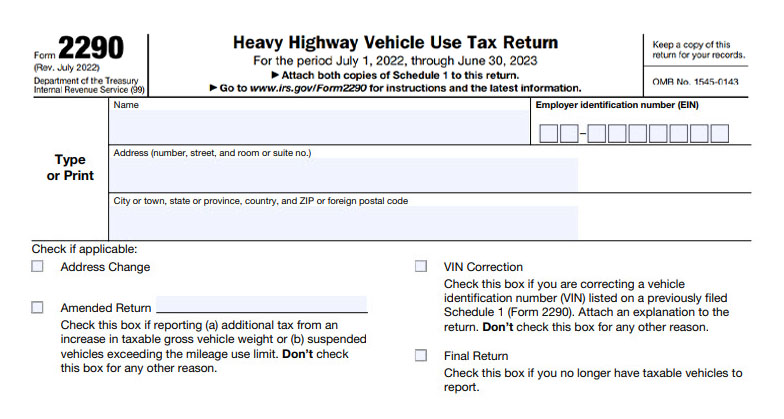

Get Your 2290 Stamped Schedule 1 Now

File your 2290 for the 2025-2026 tax period and get your stamped Schedule 1 in minutes!

The 2025-2026 Form 2290 Tax Season Has Arrived File Now

Only $19.90 for a single vehicle

As part of the Oregon Department of Transportation, the Driver and Motor Vehicle Services Division is continually developing innovative strategies to promote driver safety, protect financial and ownership interests in vehicles, and collect revenue to finance Oregon’s intermodal transportation system.

DMV is constantly adapting ideas that bring efficiencies to help our agency and the public save time and money. We are updating our technology to meet our customers’ preferred ways of doing business.

The Heavy Vehicle Use Tax is an annual fare collected from heavy vehicles that operate on public highways with a gross weight equal to or exceeding 55,000 pounds.

Truckers from Oregon can e-File Form 2290, with ExpressTruckTax, and take your stamped Schedule 1 from the IRS in minutes. Quick, Secure, & Easy.

ExpressTruckTax has partnered with the Oregon State Bureau of Motor Vehicles (BMVs) to speed up the process of vehicle registrations and tag renewals by having them verified online for the authenticity of Schedule 1’s.

Online IRS-Authorized HVUT E-Filing Software You Can Trust