Form2290

DMV

HVUT Form 2290 Filing Solution for Truckers from Washington (WA)

Only $19.90 for a single vehicle

Only $19.90 for a single vehicle

Trucking is a multifaceted industry in the state of Washington. In addition to the hauling of goods into and through the state, many other business activities fall under the umbrella of the “trucking” industry. These businesses include fuel stations, repair facilities, broker services, and leasing companies, to name a few.

The taxability of trucking and trucking related businesses depends on the activity performed. This guide is intended to provide general information regarding tax obligations and tax reporting instructions. In addition, Departmental resources are included to provide multiple ways to obtain tax related information.

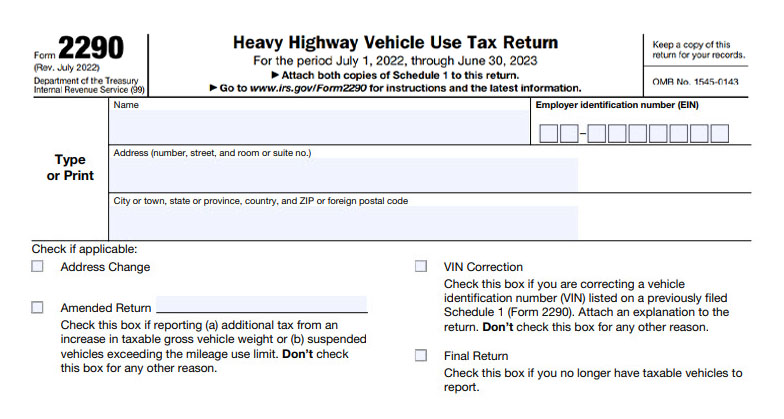

HVUT is the Heavy Vehicle Use Tax collected annually on heavy vehicles with gross weight of 55,000 pounds or more, operating on public highways.

Truckers from Washington can e-File Form 2290, the Heavy Vehicle Use Tax (HVUT) return with ExpressTruckTax, and receive your stamped Schedule 1 from the IRS in minutes.

ExpressTruckTax has partnered with the Washington State Bureau of Motor Vehicles (BMVs) to speed up the process of vehicle registrations and tag renewals by having them verified online for the authenticity of Schedule 1’s.

Online IRS-Authorized HVUT E-Filing Software You Can Trust