Form2290

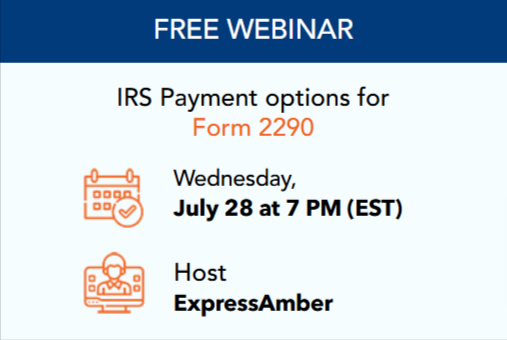

Webinar

What You Need To Know About Making Your HVUT Payment To The IRS in 2021

Date: 28-July-2021 Time: 7PM EST

The 2025-2026 Form 2290 Tax Season Has Arrived File Now

Date: 28-July-2021 Time: 7PM EST

ExpressTruckTax was designed to help trucking businesses file their Form 2290 in minutes. As the industry-leaders, we strive to make the filing process as simple and straightforward as possible.

To help answer your questions, we are offering a live training webinar on July 28, 2021! Register for this exclusive event to learn every method you can use to make your heavy vehicle use tax payment to the IRS. The webinar will be taught by our very own truck tax expert, Amber Tabb.

Amber Tabb is Director of Transportation Products from Span Enterprises LLC, the parent company of ExpressTruckTax™. She is famously known as the trucking guru who could answer you with any questions that you may have for Form 2290. Follow her on Youtube

Online IRS-Authorized HVUT E-Filing Software You Can Trust