Why Choose ExpressTruckTax for HVUT Filing?

File your Form 2290 Now in minutes with ExpressTruckTax

PRE-FILING IS NOW OPEN for 2290 Tax Year 2025-2026

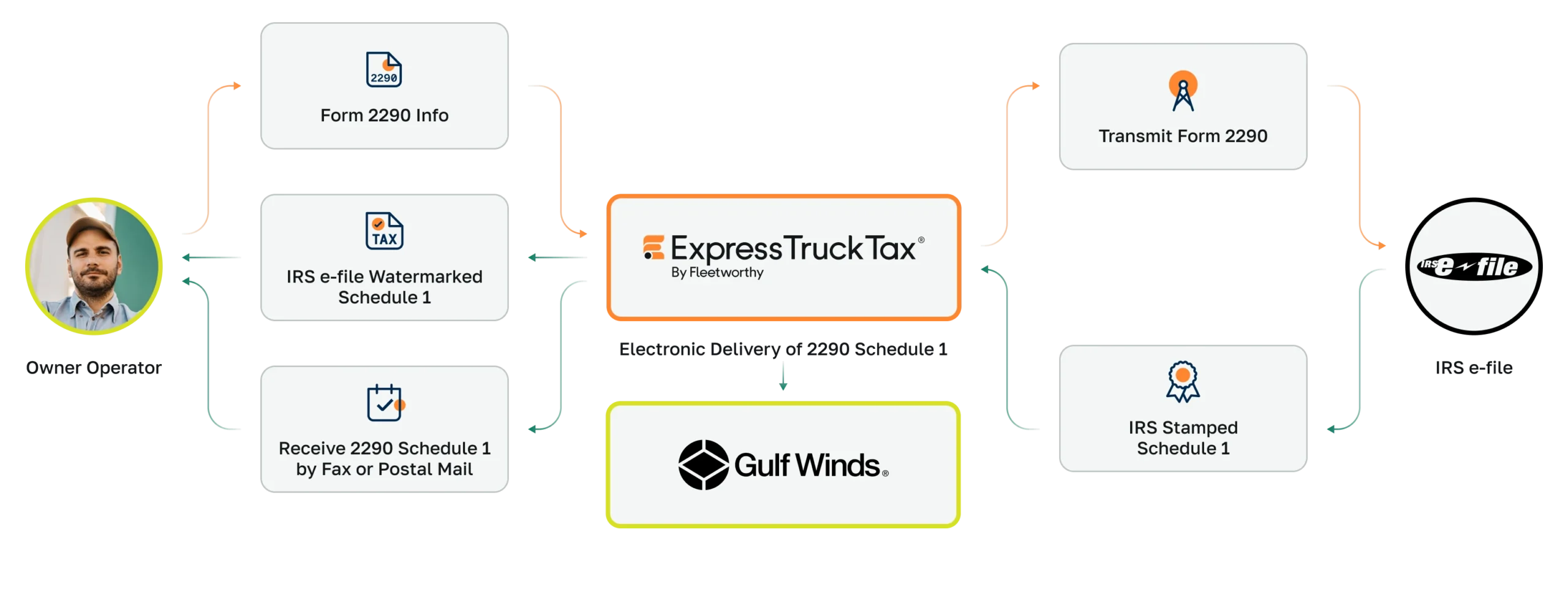

Get your 2290 Schedule 1 in minutes.

Your Stamped Schedule 1 will be automatically sent to Gulf Winds.

File your Form 2290 Now in minutes with ExpressTruckTax

Get notified about your filing status Instantly

Information Required

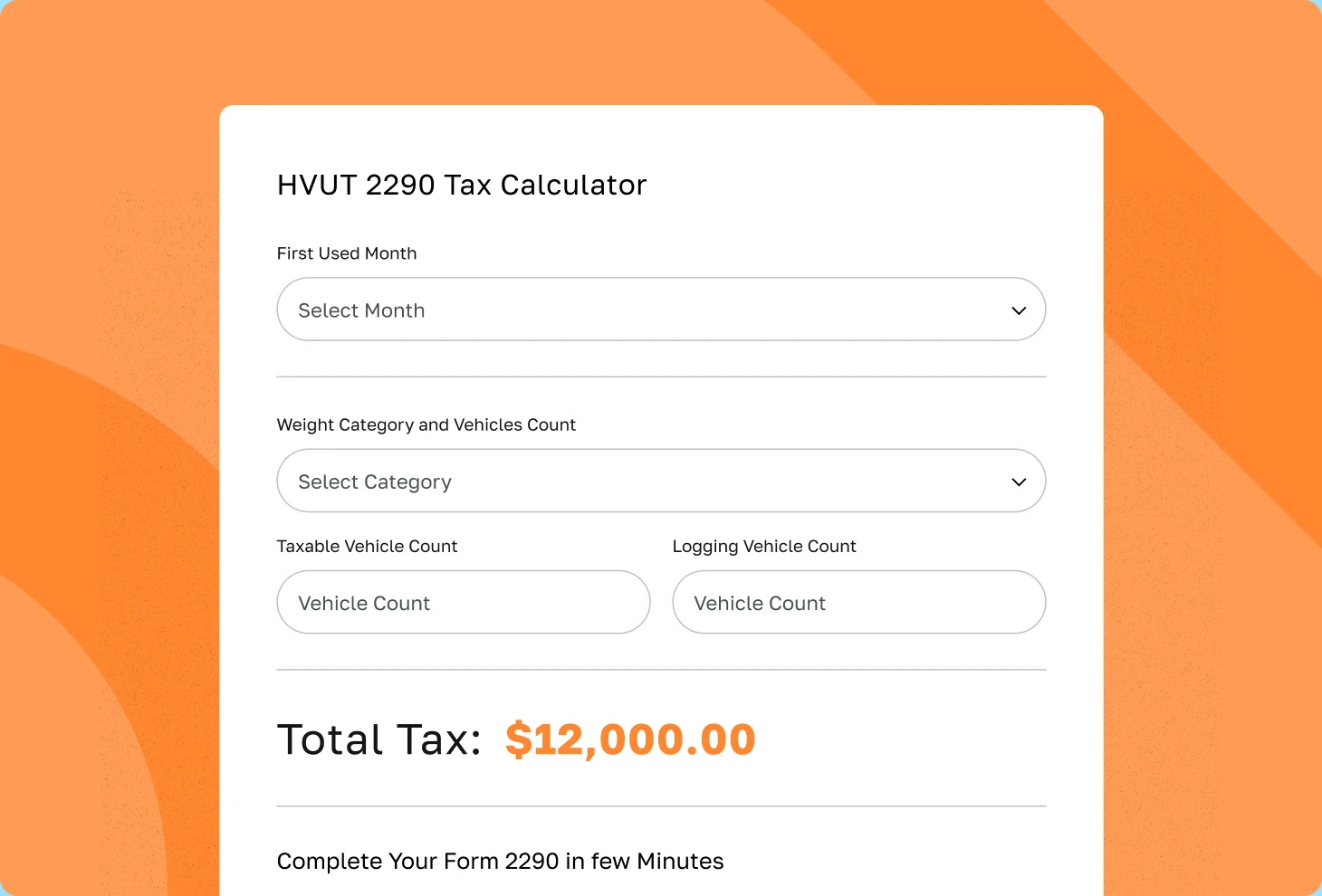

Take the guesswork out of estimating your taxes with ExpressTruckTax’s Free HVUT Calculator. Quickly figure out your 2290 tax amount and know how much your HVUT will be.

Gulf winds has partnered with ExpressTruckTax to offer its members an inexpensive and simple way to file your 2290 Form. They have made their program as easy to use as possible. You’ll find contextual help bubbles and support text all over the place, guiding you through the process step by step. We know we’re not the only ones providing this service, but we do know we’re the only ones doing it at this price with this level of quality. Choose ExpressTruckTax for all of your HVUT and e-filing needs.

ExpressTruckTax is an IRS authorized e-filing service provider of Form 2290, Form 8849 and 2290 Amendments. We believe strongly in solid, long-term customer relationships. That’s why we provide live phone, chat, and email support in English and Spanish from our Support Center based in Rock Hill, SC. We also provide our users with dedicated account managers so you’re never speaking with a stranger. Our business model is founded on building exclusive features and custom services that can be accessed from any location. We believe in providing the best product at the best price to support our trucking industry, which proudly keeps our nation moving.

(Single Vehicle)

(2 Vehicles)

(3 to 24 Vehicles)

(25 to 100 Vehicles)

(101 to 500 Vehicles)

(> 500 Vehicles)

(Sch.6 Other Claims)

(Taxable Gross Weight Increase + Mileage Exceeded)

*For returns originally filed with ExpressTruckTax, otherwise it is $26.91

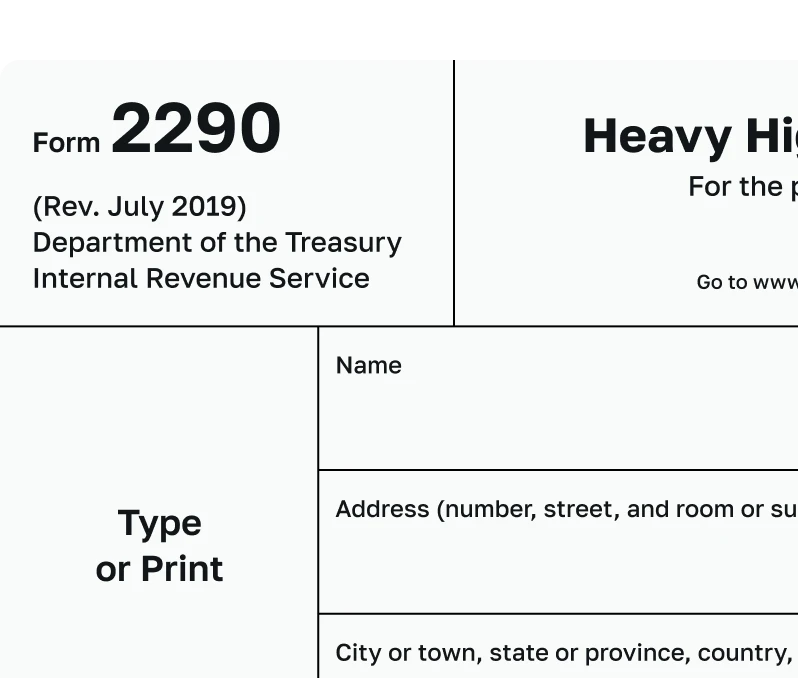

Online IRS-Authorized HVUT E-Filing Software You Can Trust

Form 2290 is the Heavy Vehicle Use Tax Return. It is the form used to figure out and pay the tax due on motor vehicles operating on public highways with a taxable gross weight of 55,000 pounds or more. The taxation period runs from July 1st to June 30th of the following year and is due by August 31st. However, for first used vehicles your HVUT is due the last day of the month following the first used month. For example, if you first use a new vehicle in April then your 2290 is due by May 31st.

Anyone who is filing a return for 25 or more vehicles is required to file electronically.

The electronic version of IRS Form 2290 will improve excise tax processing, expedite refunds, save personal resources (e.g., time & postage), and reduce preparation and processing errors. Your 2290 Schedule 1 will be available almost immediately (once your return is accepted by the IRS).

E-file online with ExpressTruckTax to put an end to waiting for your form to come in the mail or standing in long lines at the IRS office!

Once you have transmitted your return to the IRS, and it is accepted, you will receive your stamped Schedule 1 in minutes! It’s that simple.

To learn more about Form 2290, please visit at https://www.irs.gov/forms-pubs/about-form-2290

Form 2290 must be filed by the last day of the month following the month of first use. Usually, Form 2290 will be due by August 31st, for the vehicles first used in July for the tax period starting from July 1st to June 30th.

Yes! The IRS will be accepting credit and debit card payments.

You can also pay your IRS Form 2290 Heavy Vehicle Use Tax using any of the following methods:

(1) Electronic Funds Withdrawal (EFW)

(2) Electronic Federal Tax Payment System (EFTPS)

(3) Check or Money Order

(4) Credit or Debit card

The Heavy Vehicle Use Tax is paid by Form 2290 annually for heavy vehicles operating on public highways with registered gross weights equal to or exceeding 55,000 pounds.

The IRS Form 8849 Schedule 6 is used to file in order to claim your credit. If your vehicle was sold, stolen, destroyed, or for any vehicle on which the tax was paid on Form 2290 if the vehicle was used 5,000 miles or less on public highways (7,500 or less for agricultural vehicles) during the tax period.

If the gross taxable weight is between 55,000 to 75,000 pounds, the HVUT is $100, plus $22 per 1,000 pounds over 55,000 pounds. For over 75,000-pound vehicles, the maximum HVUT is $550 per year. The taxes are lower for logging vehicles—vehicles primarily used for exclusive transport of products harvested from the forest and that are registered with a state agency as such.

| Taxable Gross Weight | Heavy Vehicle Use Tax Rate | Logging Vehicle Rate |

|---|---|---|

| Below 55,000 lbs | No Tax | No Tax |

| 55,000 to 75,000 lbs | $100 plus $22 per 1000 lbs over 55,000 lbs | $75 plus $16.5 per 1000 lbs over 55,000 lbs |

| Over 75,000 lbs | $550 | $412.50 |

For any vehicles placed into service after July, the taxes are prorated.

Filing your Form 2290 and 8849 can be confusing and time consuming. Our customer support experts are here to help you out. We will help you use the program, follow the simple steps, and be finished in minutes. If you need assistance feel free to email, call or live chat with us. We’ll help you through the process. We’re here to make taxes less taxing.

To get in touch with ExpressTruckTax please contact us at the number or email below for customer support. (We are available from 8.30 AM to 5.30 PM EST Monday to Friday)