Form2290

File Your 2290 In Minutes

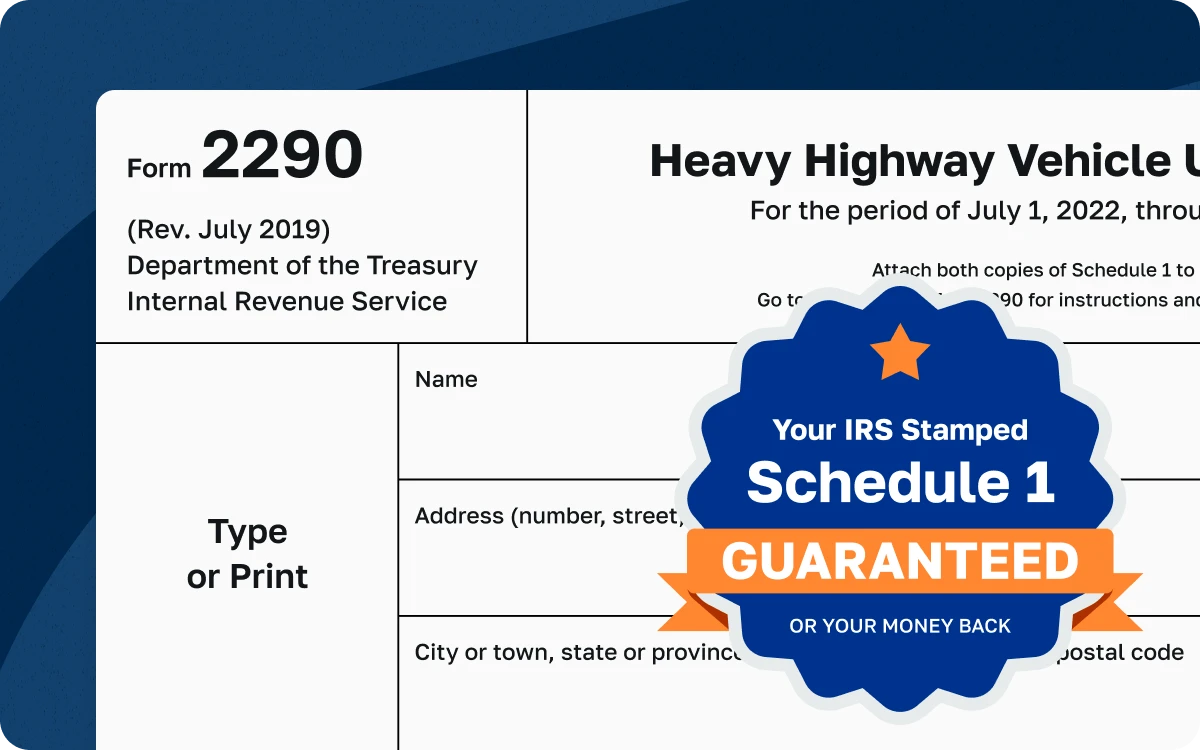

No Paperwork. Instant Schedule 1 with ExpressTruckTax

File Form 2290 Now - Fast, Secure, IRS-Authorized

The 2025-2026 Form 2290 Tax Season Has Arrived File Now

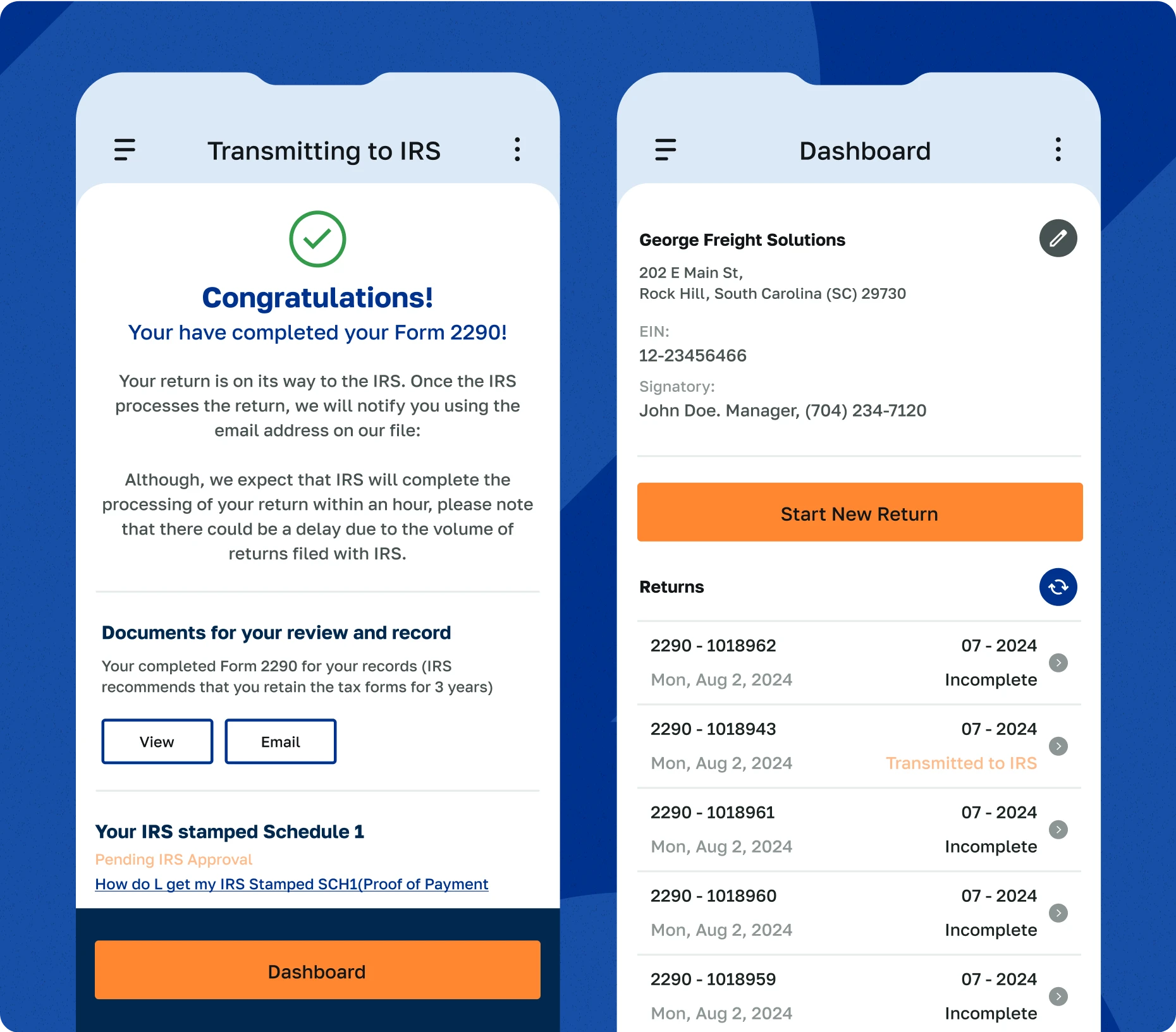

Enter your Form 2290 Information

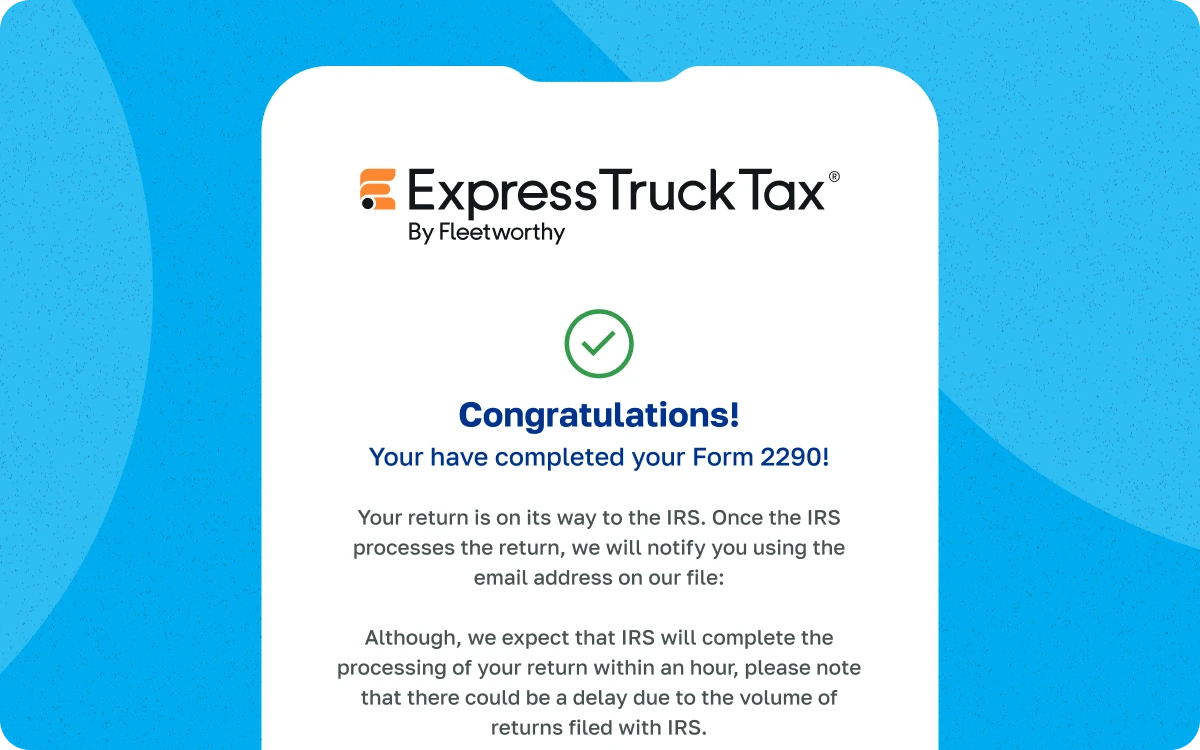

Review and Transmit to the IRS

Receive your stamped Schedule 1

Filing your IRS HVUT 2290 can be stressful and confusing, especially if you’re not using a 2290 online solution. ExpressTruckTax provides a step-by-step e-filing guide and US-based bilingual customer support. With over 10 years of experience as an IRS-authorized HVUT e-file provider, we take every precaution to keep your data safe. Trucking businesses throughout the U.S trust ExpressTruckTax.

ExpressTruckTax Has The 2290 E-filing Features Every Trucking Business Needs

Online IRS-Authorized HVUT E- Filing Software You Can Trust

Online IRS-Authorized HVUT E-Filing Software You Can Trust