If you employ any truck drivers (whether full-time employees or independent contractors) you have to report information about how you paid them to the IRS.

If you are a trucking company employee or a trucking independent contractor, you also have to report information about your income to the IRS.

For both parties, this is where 1099s and W-2s come in.

Let’s go over everything you need to know about 1099 Forms and W-2s.

W-2s for employers

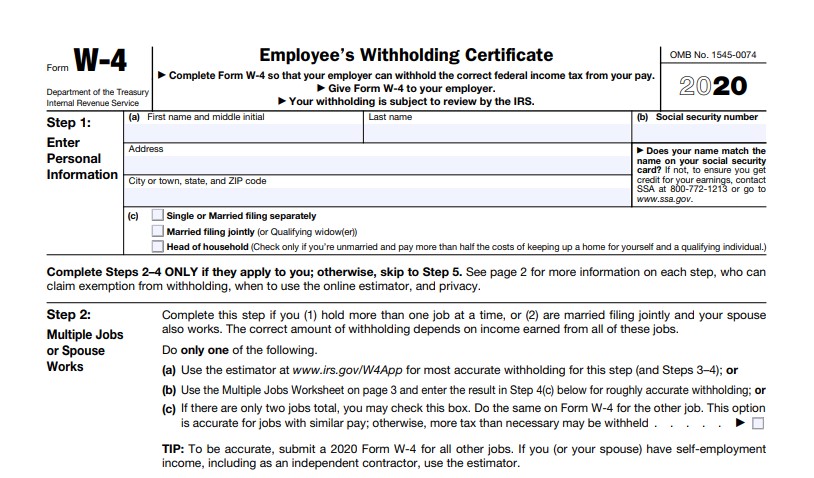

The W-2 is designed to report tax information about full or part-time employees (i.e. any employees who receive income that had social security tax, income tax, or Medicare tax withheld).

As an employer, you will use the W-2 to report whatever salary, income with social security, income tax, or Medicare tax you withheld, and any compensations you offered throughout the tax year. You must also send a copy of the W-2 to each of your employees for their personal taxes.

W-2s for truck drivers

As an employee, you will use the information from your employer’s W-2 to file your personal taxes. This will include information like the amount of state and federal tax withheld and total income.

1099s for Employers

The 1099 is designed for anyone who is paid $600 or more in the tax year and does not have taxes withheld for them.

As an employer, you will use Form 1099-MISC to report what the compensation you gave independent contractors.

What employers need to file 1099s

Here’s all the information you’ll need to file 1099s:

Your Information:

- Business Name

- Business Address

- EIN (Employer Identification Number)

Independent Contractor Information:

- EIN

- OR Social Security Number

- Address

1099s for trucking independent contractors

You will take the information provided to you by your employer on their 1099 and use it to report income that was not previously taxed. This means you will most likely end up owing money to the IRS for state and federal taxes, social security and medicare.

The easiest way to file trucking 1099s and W-2s

The easiest solution for filing trucking 1099s and W-2s (and even those W-9s we talked about) is to use our sister product TaxBandits.

Their e-filing solutions make everything simple for you! Just follow the step by step questions and they will populate your forms for you! Pricing starts at just $1.99 per form.