As a truck driver, you already deal with enough on the road: long hours, tight deadlines, vehicle maintenance, and DOT compliance. The last thing you need is a complicated, time-consuming tax process thrown into the mix. Unfortunately, that’s exactly what many truckers experience every year, especially when it comes to filing IRS Form 2290 for the Heavy Vehicle Use Tax (HVUT).

Unlike standard income taxes, trucker-specific taxes come with their own unique set of challenges:

- You’re always on the move, making it hard to sit down and fill out paperwork.

- Deadlines are strict, and missing them could delay your vehicle registration or result in IRS penalties.

- Filing errors are common, especially with VIN numbers or weight categories.

- Form 2290 rules can be confusing, especially for first-time filers or those managing multiple trucks.

- And to make matters worse, paper filing is slow and increases the risk of rejections or lost forms.

The good news? There’s a much simpler, faster, and more reliable way to file, one that’s built with truckers in mind. In this guide, we’ll walk you through the easiest way to do taxes for truck drivers, with step-by-step instructions and tips to avoid costly mistakes.

Whether you’re an owner-operator or manage a large fleet, this process will save you time, reduce stress, and get you back on the road, fully compliant and worry-free.

Why Truck Driver Taxes Are Different

When it comes to taxes, truck drivers don’t have it easy. The requirements for the trucking industry are unique, especially due to the Heavy Vehicle Use Tax (HVUT), a federal tax that applies to heavy vehicles operating on public highways. Understanding these requirements is key to staying compliant and avoiding costly delays or penalties.

What is HVUT and Who Needs to Pay It?

The Heavy Vehicle Use Tax (HVUT) is an annual tax imposed by the IRS on trucks, tractors, and buses with a taxable gross weight of 55,000 pounds or more. It’s meant to help fund the maintenance of public highways since heavy vehicles cause more wear and tear on roads.

Anyone who owns or operates a qualifying heavy vehicle, whether you’re an owner-operator, part of a fleet, or leasing long-term, is required to file and pay this tax if the vehicle is used on public highways.

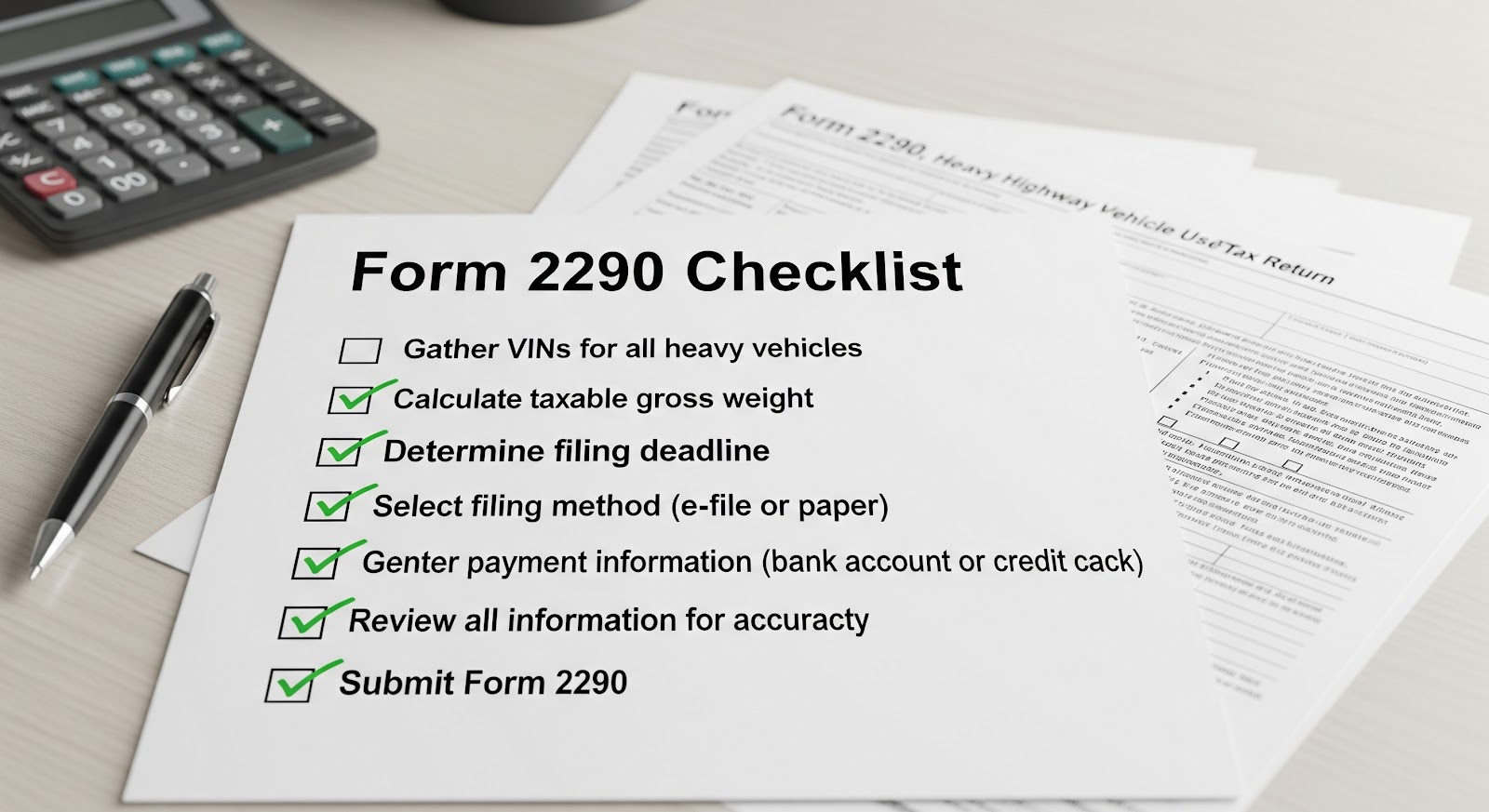

IRS Form 2290: What It Is

The form used to report and pay the HVUT is IRS Form 2290. It must be filed annually, and the IRS issues a stamped Schedule 1 as proof of payment, a document that’s required by most DMVs for vehicle registration or renewal.

If you’re a trucker with a qualifying vehicle, you can’t legally register your truck without this form.

Why Filing Taxes is Harder for Truckers

Most tax filers don’t have to deal with vehicle-specific federal excise taxes. But truckers do and that creates a unique set of challenges:

1. Constant Travel

Truckers are rarely in one place for long, which makes it difficult to keep up with paperwork and deadlines. You might be hundreds of miles from your home office when a tax notice arrives or your Schedule 1 is due for DMV registration.

2. Short Filing Windows

The HVUT tax year runs from July 1 to June 30, and the deadline to file Form 2290 for most truckers is August 31. Miss it, and you’re immediately at risk of IRS late filing penalties. Even more, new vehicles must be filed for on a pro-rated basis by the end of the following month after their first use, so timing is always tight.

3. DMV Registration Requirements

Most DMVs will not register or renew a heavy vehicle without a current IRS-stamped Schedule 1. If your filing is delayed, rejected, or contains errors, it can hold up your registration, potentially sidelining your truck and costing you income.

4. IRS Penalties for Errors or Late Filings

Mistakes like entering the wrong VIN, using a Social Security Number instead of an EIN, or forgetting to file an amendment can lead to IRS rejections, delays, or even penalties. And if you miss the deadline, the IRS can assess late fees, interest, and even audit flags.

For truck drivers, tax filing isn’t just about getting it done, it’s about getting it done right and on time. That’s why having a reliable, trucker-focused e-filing solution is so important and that’s exactly what we’ll walk through in the next section.

What Makes Filing Complicated

Filing taxes as a truck driver, especially for the Heavy Vehicle Use Tax (HVUT) can be more complicated than it seems. What might look like a simple one-page form can quickly become a frustrating experience if you’re not familiar with the process. From small data entry mistakes to missing critical IRS requirements, even minor issues can delay your Schedule 1 and impact your ability to keep your truck on the road.

Here’s a closer look at what typically makes HVUT filing more challenging than it needs to be:

1. VIN Errors, Wrong Tax Year, or Missed Deadlines

A small mistake can lead to IRS rejections and lost time. Some of the most common errors include:

- Incorrect VINs — Typing a “0” instead of an “O” or reversing numbers can invalidate your return.

- Wrong Tax Year Selected — Many filers accidentally choose the wrong filing period, especially if they’re filing off-season or for a newly purchased vehicle.

- Missed Deadlines — The annual deadline is August 31, but new vehicles have their own due dates based on the month they first hit the road. Miss these, and you’ll face penalties and DMV delays.

These errors are easy to make but costly to fix, especially if you’re in a hurry to register your truck.

2. Not Knowing IRS Payment Options

Many truckers aren’t aware that the IRS offers several payment options for HVUT, and choosing the wrong one (or forgetting to complete it) can result in an unpaid return.

- EFTPS

- Electronic Funds Withdrawal

- Debit or Credit Card Payments

- Check or Money Order

Each method has its own processing time, and failing to follow the correct steps, especially with EFTPS, could mean the IRS doesn’t receive your payment on time, even if you filed correctly.

3. Paper Filing Delays

Paper filing is still allowed for those reporting fewer than 25 vehicles, but it’s not ideal. Why?

- Longer processing times

- No instant confirmation

- Increased risk of rejection due to manual errors

- Delays in receiving your IRS-stamped Schedule 1

In contrast, e-filing provides instant error checks, faster IRS response times, and digital proof of filing, making it a much smoother process.

4. Managing Large Fleets or Multiple Trucks

If you’re handling taxes for more than a few vehicles, things can get messy fast. Managing VINs, taxable weights, suspended vehicles, and payment methods for dozens or even thousands of trucks opens the door to:

- Copy/paste errors

- Duplicate entries

- Missing vehicles

- Incorrect categorization

Without the right tools, managing multiple trucks becomes a manual nightmare and mistakes here can lead to IRS audits or DMV issues.

5. Lack of an EIN (and Confusion with SSNs)

One of the most common and easily overlooked issues: trying to file with a Social Security Number (SSN) instead of a required Employer Identification Number (EIN).

The IRS does not accept SSNs on Form 2290. Every trucker or business must have a valid EIN to file. If you’re newly registered and just got your EIN, keep in mind it can take up to 2 weeks before it becomes active in the IRS e-file system.

Using an invalid or inactive EIN will cause your filing to be rejected, delaying your Schedule 1 and possibly preventing you from registering your truck on time.

These complications are why many truckers dread tax season. But the good news is, they’re all avoidable. The right e-filing solution, built for the trucking industry, helps eliminate these common problems with automatic checks, guided steps, and real-time IRS communication.

The Easiest Way to Do Taxes: Use an IRS-Authorized E-File Provider

If you’re tired of tax headaches, long lines, and paperwork delays, there’s a better way: e-filing with an IRS-authorized provider.

For truck drivers, e-filing isn’t just more convenient, it’s smarter, faster, and safer. Whether you’re filing Form 2290 for one truck or thousands, e-filing takes the guesswork out of the process and gives you peace of mind that your return is accurate, secure, and on time.

Why E-Filing Is the Simplest Solution

Compared to paper filing, e-filing offers major advantages:

- Speed: Get your IRS-stamped Schedule 1 in minutes, not weeks.

- Accuracy: Built-in error checks help catch VIN errors, wrong tax years, and missed fields before submission.

- Convenience: File anytime, anywhere, from your laptop, tablet, or phone.

- Instant Confirmation: Know immediately when your return is accepted or rejected by the IRS.

- Easier Corrections: Fix and resubmit rejected returns quickly (often for free).

- Deadline Compliance: Get alerts so you never miss a due date or required amendment.

Why ExpressTruckTax is the #1 Choice for Truckers

When it comes to filing Form 2290, ExpressTruckTax is the leading IRS-authorized e-file provider trusted by over a million trucking professionals across the U.S. Since 2010, ExpressTruckTax has processed over 5 million Form 2290 filings and facilitated more than $1.6 billion in HVUT payments.

Here’s what makes it the easiest and most reliable solution:

Processed Over 5 Million Form 2290s

With over a decade of experience, ExpressTruckTax has refined the filing process to meet the real-world needs of truckers. From single vehicle owner-operators to enterprise-level fleets, the platform supports everyone with intuitive tools and support.

Get Your IRS-Stamped Schedule 1 Instantly

After you file, you’ll receive your official IRS Schedule 1 in minutes, delivered to your email and stored in your account for future access. No waiting. No mailing delays. This is the proof you need to register your truck at the DMV.

IRS-Authorized and 100% Secure

ExpressTruckTax is directly connected to the IRS and follows the highest security standards, including SSL encryption and Comodo Hacker Safe certification. Your sensitive business and vehicle information is protected every step of the way.

Free VIN Corrections

Entered the wrong VIN by mistake? If you filed with ExpressTruckTax originally, VIN corrections are 100% free. This saves you time, money, and stress when it matters most.

Mobile App for On-the-Go Filing

Always on the road? No problem. ExpressTruckTax offers a free mobile app that lets you:

- File from your phone

- Calculate your HVUT

- Receive push notifications when your return is accepted

- Store and access your Schedule 1 digitally, wherever you are

It’s built for truckers who don’t have time to be tied to a desk.

Other Time-Saving Features

- Ready Return: If you’ve filed before, your information is saved to generate a new return in just a few clicks.

- Bulk Upload for Fleets: Easily file for up to 40,000 trucks at once with built-in checks to prevent copy/paste errors.

- Bilingual U.S.-Based Support: Call, email, or chat with a real person who understands Form 2290 and speaks your language.

- Free Re-transmission: If the IRS rejects your return, you can correct and resubmit at no extra cost.

E-filing with ExpressTruckTax gives you control over the process and eliminates the stress and errors that come with traditional filing. Whether you’re a new filer or a seasoned pro, you’ll get your Schedule 1 quickly and accurately, with support every step of the way.

Start filing the easy way today and get back to the road faster.

Make Tax Season Easy

For truck drivers, time is money and tax season shouldn’t slow you down. Filing your HVUT Form 2290 doesn’t have to be complicated, stressful, or time-consuming. With the right tools in place, it can be fast, accurate, and completely hassle-free.

That’s where using a trusted IRS-authorized e-file provider like ExpressTruckTax makes all the difference.

Whether you’re an owner-operator filing for one vehicle or a fleet manager handling hundreds, ExpressTruckTax simplifies every step of the process. From preventing common errors like incorrect VINs or missed deadlines, to delivering your IRS-stamped Schedule 1 instantly, it’s built to meet the real-world needs of truckers.

Here’s a quick recap of why ExpressTruckTax is the easiest way to do taxes for truck drivers:

- Fast: Get your stamped Schedule 1 in minutes, not days or weeks.

- Accurate: Built-in error checks and free VIN corrections reduce rejections.

- Convenient: File anytime, anywhere with the mobile app or web platform.

- Secure: IRS-authorized and fully encrypted for your protection.

- Supported: Bilingual U.S.-based support team ready to help when you need it.

- Affordable: Transparent pricing and prepaid credit savings for frequent filers.

So instead of letting tax season throw a wrench in your schedule, choose the smart, simple way to file and stay compliant without the stress.

Ready to file your 2290 the easy way?

Get started now and receive your IRS-stamped Schedule 1 in minutes. Start Filing with ExpressTruckTax