The IRS Form 2290, also known as the Heavy Vehicle Use Tax (HVUT) return, is a mandatory tax form for truckers, owner-operators, and fleet owners who operate vehicles weighing 55,000 pounds or more on public highways. This tax helps fund the maintenance and improvement of U.S. roadways, ensuring safe and reliable transportation infrastructure for all motorists.

The IRS mandates that HVUT payments be made annually, with the filing deadline falling on August 31st for most truckers. Additionally, late or incorrect filings can delay the Schedule 1, the proof of HVUT payment required for truck registration and renewal with the Department of Motor Vehicles (DMV).

Accurate and timely IRS 2290 payment not only keeps truckers compliant with IRS regulations but also helps avoid unnecessary delays that could impact operations. With streamlined e-filing solutions like ExpressTruckTax, truckers can ensure their HVUT filings are quick, secure, and hassle-free, receiving their IRS-stamped Schedule 1 within minutes of submission.

Deadlines for IRS 2290 Payment (Heavy Vehicle Use Tax – HVUT)

Understanding the Form 2290 deadline is critical for truckers, owner-operators, and fleet managers. The HVUT tax year runs from July 1 to June 30 of the following year, and payments must be made annually for vehicles weighing 55,000 pounds or more that are used on public highways.

Annual Form 2290 E-Filing Deadline

For most truck owners, the standard filing deadline for Form 2290 is August 31 of each year. This applies to vehicles that were first used in July, which marks the beginning of the HVUT tax year. If a truck is placed in service after July, the deadline is the last day of the month following the vehicle’s first use.

For example:

- If a truck is first used in July, the HVUT deadline is August 31.

- If a truck is first used in September, the deadline to file Form 2290 is October 31.

- If a truck is first used in March, the deadline to file Form 2290 is April 30.

Failing to meet the IRS Form 2290 deadline results in penalties and interest charges. Additionally, late filings can delay the stamped Schedule 1, which is required for vehicle registration and renewal.

Circumstances That May Alter the Form 2290 Deadline

There are a few situations where the filing deadline may change:

- Weekends or Holidays: If August 31 falls on a weekend or a federal holiday, the deadline moves to the next business day.

- New Vehicle Purchase: If you purchase a truck mid-year, Form 2290 must be filed by the last day of the month following the vehicle’s first use.

- Suspended Vehicles (Low Mileage Trucks): If a vehicle is driven less than 5,000 miles (7,500 for agricultural vehicles), it may qualify for tax suspension, but the form must still be filed to notify the IRS.

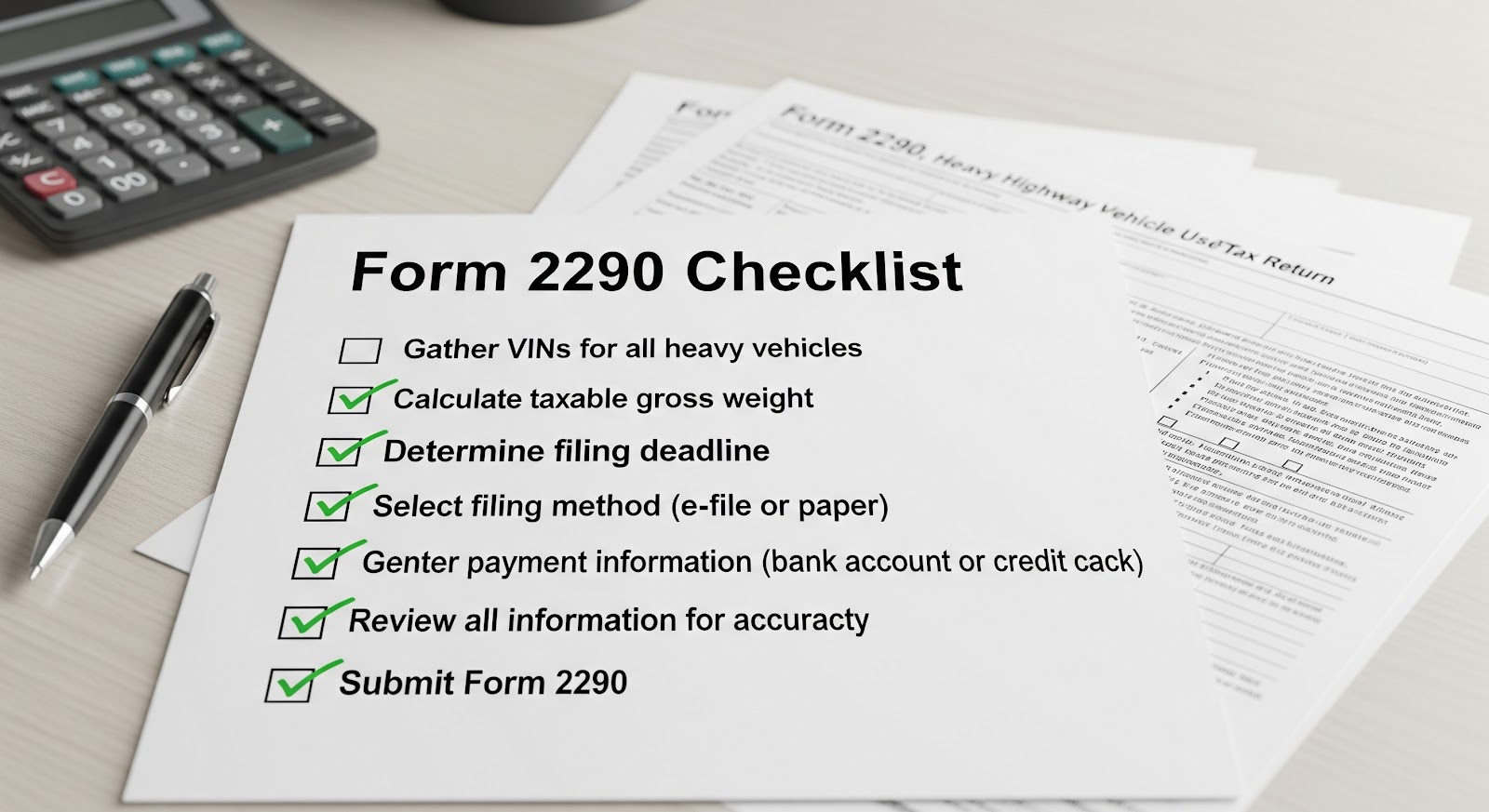

HVUT Filing Calendar & Checklist

To help truckers keep track of important Form 2290 deadlines, here’s a simple checklist:

- July 1 – Start of the HVUT tax year. Prepare to file Form 2290.

- August 31 – IRS deadline for vehicles used in July (most common deadline).

- Last Day of the Month Following First Use – Deadline for newly purchased or first-used trucks.

- December 31 – Last day to file Form 8849 for refund claims on sold, stolen, or destroyed vehicles.

- March 31 – Final reminder to file if a truck was first used in February.

- June 30 – Last day of the tax year. Ensure records are in order for the next filing period.

By following this schedule and filing Form 2290 electronically with ExpressTruckTax, truckers can ensure a smooth, penalty-free process, receive their stamped Schedule 1 within minutes, and stay compliant with IRS regulations.

IRS Form 2290 Payment Options

When filing Form 2290 for the Heavy Vehicle Use Tax (HVUT), truckers and fleet owners must also submit their tax payment to the IRS. The IRS provides multiple payment options to accommodate different preferences and financial situations. Below, we’ll break down each method, its advantages, and potential drawbacks to help truckers choose the best option.

1. Electronic Funds Withdrawal (EFW) – Direct Debit

How It Works:

- When filing Form 2290 online using an IRS-authorized e-file provider like ExpressTruckTax, users can choose Electronic Funds Withdrawal (EFW) to have the HVUT amount directly debited from their bank account.

- You must provide bank account details (routing number and account number) at the time of filing.

Advantages:

- Fast and secure – Payment is processed directly through the IRS system.

- No additional fees – Unlike credit card payments, there are no processing fees.

- Convenient – No need to log into another platform or visit a bank.

2. Electronic Federal Tax Payment System (EFTPS)

How It Works:

- Truckers can schedule their 2290 tax payment in advance via the Electronic Federal Tax Payment System (EFTPS), a free service offered by the U.S. Department of the Treasury.

- Users must enroll at EFTPS.gov before making a payment, which can take 5-7 business days for approval.

- Payments can be scheduled for a future date, giving truckers greater control over cash flow.

Advantages:

- More flexibility – Truckers can schedule payments ahead of time.

- IRS-verified and secure – Transactions are processed through the Treasury Department.

- No processing fees – Unlike credit/debit card payments.

3. Credit or Debit Card Payment

How It Works:

- The IRS allows HVUT payments via credit or debit card through IRS-approved third-party payment processors.

- Payments are made separately after filing Form 2290 online, and users must visit the IRS payment website to complete the transaction.

Advantages:

- Fast and convenient – Payments can be made instantly.

- Flexibility – If using a credit card, truckers can manage cash flow by paying over time.

4. Check or Money Order Payment

How It Works:

- Truckers who prefer traditional payment methods can mail a paper check or money order payable to the “United States Treasury.”

- The check/money order must include:

- EIN (Employer Identification Number)

- Form 2290 tax period (e.g., 2025-2026)

- “IRS Form 2290” in the memo section

- Payments should be mailed to the IRS address provided on the Form 2290 instructions, depending on the filer’s location.

Advantages:

- No processing fees – Unlike credit/debit payments.

- Good for businesses that prefer paper records.

Avoid IRS Penalties with Timely Payment

Regardless of which IRS Form 2290 payment method you choose, it’s important to file and pay on time to avoid penalties. If you e-file through ExpressTruckTax, you can select EFW for an instant payment, or choose another method and get step-by-step guidance to ensure your tax is paid correctly and on time.

By selecting the right payment method, truckers can ensure a smooth HVUT filing process and stay compliant with IRS regulations while keeping their vehicles legally registered.

Electronic Funds Withdrawal (EFW) Explained for IRS Form 2290

What is Electronic Funds Withdrawal (EFW)?

Electronic Funds Withdrawal (EFW) is a secure and convenient payment option offered by the IRS for truckers filing Form 2290 online. With EFW, the HVUT payment is automatically withdrawn from a taxpayer’s designated bank account when they electronically file their IRS Form 2290 through an authorized e-file provider like ExpressTruckTax.

This method allows truckers to combine filing and payment in a single step, ensuring timely payment and reducing the risk of IRS penalties for late or missed payments.

Key Features of EFW for Form 2290

- One-Step Process – Payment is directly linked to the IRS Form 2290 e-filing.

- Instant Payment Processing – No need for additional steps after filing.

- No Processing Fees – Unlike credit/debit card payments, EFW does not incur extra fees.

- Secure Transactions – The IRS uses encrypted systems to protect sensitive bank information.

- Avoid Late Penalties – Ensures that payment is made on time without manual intervention.

Required Details for EFW Payment

To successfully use Electronic Funds Withdrawal (EFW) for your HVUT payment, truckers must provide the following bank account details during the Form 2290 e-filing process:

- Bank Routing Number (a 9-digit number identifying the financial institution).

- Bank Account Number (the personal or business checking account number).

- Account Type (Checking or Savings).

- Authorized Signer’s Name (must match the bank account owner’s name).

The IRS does not accept credit union accounts that require special approval for ACH debits, so truckers should confirm with their bank that their account allows IRS direct debits.

How to Set Up EFW for IRS Form 2290 Payment

If you choose EFW when filing Form 2290 electronically, follow these simple steps:

Step 1: File Form 2290 Online

- Use an IRS-authorized e-file provider like ExpressTruckTax to file your HVUT Form 2290.

- Enter all required vehicle and tax details, including VIN (Vehicle Identification Number) and First Used Month (FUM).

Step 2: Choose Electronic Funds Withdrawal (EFW) as the Payment Method

- When prompted, select Electronic Funds Withdrawal (EFW) as your preferred payment method.

Step 3: Enter Bank Account Information

- Provide your bank routing number and account number in the designated fields.

- Select Checking or Savings as the account type.

- Verify that the account has sufficient funds to cover the HVUT payment.

Step 4: Review and Submit Your Form 2290

- Confirm that all details are correct before submitting the form.

- After submission, the IRS will process the return and withdraw the tax payment directly from your bank account.

Step 5: Receive Your Stamped Schedule 1

- Once the IRS processes the payment, you will receive your IRS-stamped Schedule 1 as proof of HVUT payment.

- With ExpressTruckTax, this document is available within minutes of IRS acceptance.

Important Considerations for EFW Payments

- Funds Availability: Ensure there are sufficient funds in your bank account on the withdrawal date. If the payment fails due to insufficient funds, the IRS may impose penalties and interest.

- No Future Date Scheduling: Unlike EFTPS, EFW payments are processed immediately upon IRS acceptance of Form 2290. If you need to schedule a future payment date, consider using EFTPS instead.

- Bank Restrictions: Some credit unions and smaller banks have ACH debit restrictions. Check with your financial institution to confirm if IRS withdrawals are allowed.

- Correct Bank Details: If incorrect account information is entered, the payment may be rejected, leading to filing delays and potential late penalties.

Using Electronic Funds Withdrawal (EFW) with ExpressTruckTax is the fastest and most efficient way to ensure timely payment of the Heavy Vehicle Use Tax (HVUT). With instant payment processing, no extra fees, and a secure system, EFW is the best option for truckers looking for a hassle-free Form 2290 payment solution.

Make your IRS 2290 Payment with ExpressTruckTax!

Are you a trucker, fleet owner, or tax preparer seeking a reliable e-filing solution for IRS Form 2290? Look no further than ExpressTruckTax! Ensure your Heavy Vehicle Use Tax (HVUT) is filed on-time and accurately.

With ExpressTruckTax, receive your IRS-stamped Schedule 1 within minutes, maintain compliance effortlessly, and choose from multiple payment methods to suit your needs.

Take advantage of ExpressTruckTax’s expert service and experience a stress-free filing season. File with us today and stay on the road to compliance.