Running your own trucking business comes with freedom, flexibility, and a significant amount of responsibility, especially when it comes to taxes. Unlike company drivers who receive a W-2 and have taxes automatically withheld from their paychecks, owner-operators are considered self-employed. That means you’re responsible for reporting your income, tracking your business expenses, and calculating and paying your own taxes, both income tax and self-employment tax.

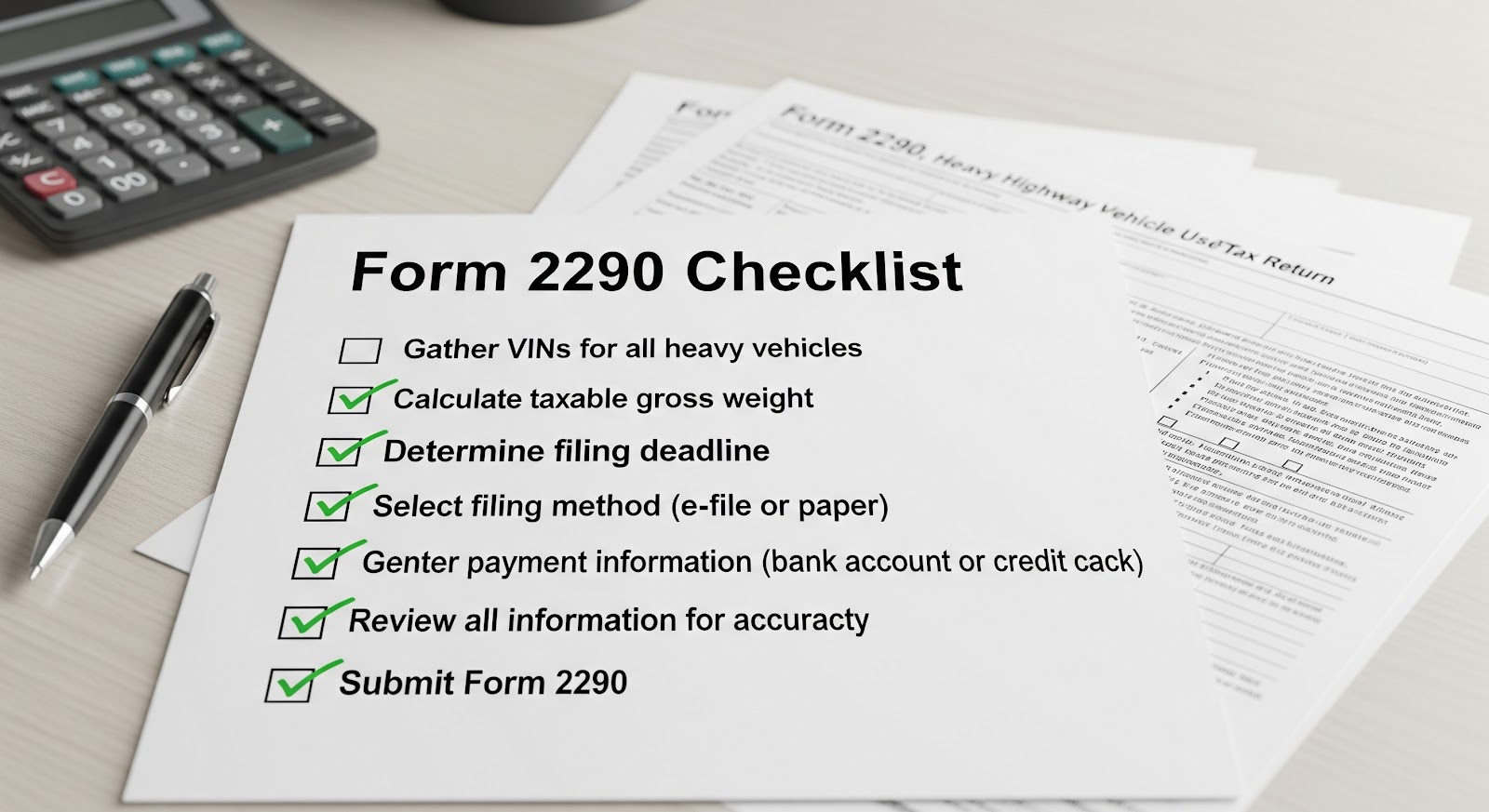

One of the most important tax obligations unique to truckers is the Heavy Vehicle Use Tax (HVUT), filed using IRS Form 2290. This annual federal tax applies to vehicles with a taxable gross weight of 55,000 pounds or more and must be filed before August 31 each year if the vehicle was in use on July 1. Additionally, owner-operators often owe quarterly estimated taxes, which include income tax and self-employment tax (Social Security and Medicare).

Why Tax Preparation is Especially Important for Owner-Operators

As an owner-operator, you’re not just a driver, you’re a small business owner. That means proper tax preparation is essential for keeping your business profitable and compliant with IRS regulations. Poor recordkeeping or missed deadlines can lead to costly penalties, interest, or even audits.

On the other hand, proactive tax preparation helps you:

- Maximize deductions for fuel, maintenance, per diem, and equipment purchases.

- Avoid surprises at tax time by planning for estimated payments.

- Ensure compliance with HVUT, income tax, and business reporting rules.

- Stay DMV compliant by filing Form 2290 and receiving your IRS-stamped Schedule 1 on time.

- Track profitability and make smarter business decisions throughout the year.

Whether you’re new to trucking or a seasoned owner-operator, understanding your tax responsibilities and preparing early can save time, stress, and money. In this guide, we’ll break down everything you need to know to simplify tax season and stay ahead of the curve.

Understanding Tax Responsibilities as an Owner-Operator

When it comes to taxes, company drivers and owner-operators are treated very differently by the IRS.

- Company drivers are classified as employees and receive a W-2 form from their employer at the end of the year. Taxes such as federal income tax, Social Security, and Medicare are automatically withheld from their paychecks.

- Owner-operators, on the other hand, are considered self-employed. You may be leased to a carrier or operate under your own authority, but either way, you’re running a business. That means you’re responsible for tracking all income and expenses, filing tax forms, and paying taxes on your own, with no automatic withholdings.

Self-Employment Tax Obligations

As a self-employed individual, you must pay:

- Income Tax – Based on your net earnings after deducting business expenses.

- Self-Employment (SE) Tax – Covers Social Security and Medicare. For 2025, this tax is 15.3% of your net earnings (12.4% for Social Security and 2.9% for Medicare). You’re responsible for both the employer and employee portions of these taxes, unlike W-2 employees.

Additionally, most owner-operators are required to make quarterly estimated tax payments to avoid penalties for underpayment. These are due in April, June, September, and January.

IRS Forms Required for Owner-Operators

To stay compliant, owner-operators typically need to file several key forms:

Form 2290 – Heavy Vehicle Use Tax (HVUT)

- Required for any highway vehicle with a gross weight of 55,000 lbs or more.

- Must be filed annually, with a deadline of August 31 for vehicles in service by July 1.

- Filing Form 2290 gives you the IRS-stamped Schedule 1, which is mandatory for registering your vehicle with the DMV.

- ExpressTruckTax makes this filing fast and simple, with guaranteed Schedule 1 delivery.

Schedule C – Profit or Loss from Business

- Used to report income and expenses for your trucking business.

- This form helps you calculate your net income, which is used to determine how much tax you owe.

- Deductions claimed here can include fuel, repairs, insurance, depreciation, and more.

Schedule SE – Self-Employment Tax

- Based on the net income reported on Schedule C.

- This form calculates the 15.3% SE tax owed for Social Security and Medicare.

Form 8849 – Claims for Refunds

- Used to claim a refund for:

- Sold, destroyed, or stolen vehicles

- Low-mileage or suspended vehicles

- Overpayment of HVUT

- Sold, destroyed, or stolen vehicles

- Only applicable in certain situations, but essential for recovering overpaid taxes.

- ExpressTruckTax offers simple e-filing for Form 8849 (Schedule 6) if needed.

The Importance of Having an EIN (Employer Identification Number)

As an owner-operator, you’re required to file taxes under a valid Employer Identification Number (EIN), not your Social Security Number.

- The IRS does not accept SSNs for Form 2290 filings.

- An EIN is like a Social Security number for your business and is required for all federal tax forms.

- You can apply for an EIN for free through the IRS website, but be aware that new EINs may take up to 10 business days to become active in the IRS e-file system.

By understanding these tax obligations and the forms required, you can better manage your finances, stay compliant, and avoid unnecessary penalties or delays, especially with important filings like Form 2290.

Key Deadlines to Know

As an owner-operator, keeping track of important IRS tax deadlines is critical for staying compliant, avoiding penalties, and keeping your business running smoothly. Missing even one deadline can result in late fees, interest charges, and potential issues with vehicle registration. Below are the key dates you need to know:

HVUT Filing Deadline – August 31

The Heavy Vehicle Use Tax (HVUT) is an annual tax required for any highway motor vehicle with a taxable gross weight of 55,000 pounds or more. It must be filed using IRS Form 2290, and the deadline depends on the vehicle’s first month of use.

- For vehicles that are first used in July (the start of the HVUT tax year), the filing deadline is August 31.

- For vehicles put into service during any other month, HVUT must be filed by the last day of the month following the first use month (e.g., if your truck was first used in October, your 2290 is due by November 30).

- Filing late may result in penalties of up to 4.5% of the total tax due per month, plus interest.

- You’ll need the IRS-stamped Schedule 1 as proof of payment to register your truck with the DMV, don’t wait until the last minute!

Pro Tip: Use ExpressTruckTax to file Form 2290 in minutes and get your stamped Schedule 1 instantly.

Quarterly Estimated Tax Payment Deadlines

As a self-employed owner-operator, you’re expected to pay taxes throughout the year, not just at tax time. This includes income tax and self-employment (SE) tax.

Because you don’t have taxes withheld from your earnings like a W-2 employee, the IRS requires you to pay quarterly estimated tax payments using Form 1040-ES.

Here are the due dates:

- April 15 – For income earned January 1 to March 31

- June 15 – For income earned April 1 to May 31

- September 15 – For income earned June 1 to August 31

- January 15 (of the following year) – For income earned September 1 to December 31

Failing to make these payments can result in underpayment penalties, even if you pay your full tax bill at the end of the year. A simple way to stay on track is to calculate your expected annual income and divide your tax obligation into four equal payments.

What Documents You Need to Gather

Proper tax preparation starts with having the right paperwork organized and ready to go. As an owner-operator, your tax return depends heavily on accurately reporting income and claiming all allowable deductions, which means documentation is everything.

Here’s a breakdown of the key documents you should collect and maintain throughout the year to ensure a smooth, accurate tax filing process:

Income Records (Invoices, Settlement Statements)

You need to report all income received from clients, brokers, and carriers. This includes:

- Invoices you’ve issued for completed loads

- Settlement statements from carriers or factoring companies

- 1099-NEC forms (if issued by brokers or carriers reporting your earnings)

Even if you didn’t receive a 1099, you’re still required to report all income. These records form the basis of your gross income on Schedule C.

Expense Receipts

Keeping detailed records of business expenses is essential for maximizing your tax deductions. Categories include:

- Fuel purchases

- Repairs and maintenance

- Truck washes

- Tolls and parking

- Truck insurance

- Meals and lodging

- Office supplies

- Load boards and dispatching services

- Tools, equipment, and uniforms

Use a scanning app or a document folder to keep receipts organized by category or month.

Tip: Many tax prep issues happen because receipts are missing. The IRS requires receipts for expenses over $75 and recommends keeping records for 3+ years.

Fuel Logs and Mileage Records

Fuel and mileage are two of the biggest expenses for truckers, and also among the most scrutinized by the IRS. Be sure to maintain:

- Fuel receipts

- Trip sheets or logs documenting start/end locations and total miles

- ELD or GPS mileage reports

- IFTA mileage summaries (if applicable)

These help substantiate fuel deductions and support mileage claims if you use the standard mileage rate (though most owner-operators deduct actual expenses).

Maintenance and Repair Records

Expenses related to the upkeep of your truck are fully deductible as business expenses. Be sure to keep:

- Invoices for oil changes, tire replacements, engine repairs, etc.

- Records for routine maintenance (e.g., brake checks, alignments)

- Service contracts and warranty work

Documenting these properly can make a big difference in your total deductions on Schedule C.

Asset Purchases (Trucks, Trailers, Equipment)

Major purchases may qualify for depreciation or Section 179 deductions. You’ll need:

- Purchase agreements

- Loan documents

- Title paperwork

- Payment receipts or financing terms

For example:

- A truck purchase can be depreciated over several years or fully expensed under Section 179.

- Items like trailers, APU units, or communication equipment may also be deductible.

Work with a tax professional to determine the best approach for depreciating or expensing high-value assets.

Bank Statements and Credit Card Summaries

Bank and credit card records serve as backup for income and expenses, especially if:

- You missed saving some receipts

- You’re audited and need additional documentation

- You need to cross-reference transactions

Keep both personal and business account statements, especially if you use separate business accounts (which is strongly recommended).

Previous Year’s Tax Return (If Applicable)

Having your prior year’s return can be helpful for:

- Comparing income and deductions

- Carrying forward depreciation schedules or losses

- Ensuring consistency and preventing audit flags

- Referencing your EIN, business name, and prior filing status

Keeping everything organized will reduce stress at tax time and may lower your tax prep fees if you work with a professional.

Top Tax Deductions for Owner-Operators

One of the biggest advantages of being an owner-operator is the ability to deduct a wide range of business expenses on your tax return. These deductions help reduce your net taxable income, lowering the amount of tax you owe. But to take full advantage of these deductions, it’s important to know what qualifies and to keep proper records.

Here’s a breakdown of the most common and valuable deductions for owner-operators:

1. Truck Lease or Purchase Payments (Depreciation or Section 179)

If you’ve leased your truck, you can deduct the lease payments as a business expense.

If you’ve purchased the truck:

- You may be able to depreciate the cost over several years using MACRS depreciation.

- Alternatively, you can deduct the full cost upfront using Section 179 (up to the IRS annual limit), provided the vehicle is used primarily for business.

Tip: A tax professional can help you determine whether depreciation or Section 179 gives you the best tax advantage.

2. Fuel and Maintenance

Fuel is often the largest ongoing cost for truckers and is 100% deductible if used for business purposes. Don’t forget to also deduct:

- Oil changes

- Tire replacements

- Routine maintenance

- Repairs and emergency roadside services

Be sure to keep all fuel receipts and maintenance invoices organized by date and truck.

3. Meals and Per Diem

Owner-operators who travel away from their tax home for work can deduct:

- Actual meal expenses (with receipts)

- Or use the IRS per diem rate, which simplifies the process and may result in a higher deduction

For 2025, the per diem for truckers is typically around $69 per full day in the continental U.S. (subject to IRS updates). You can deduct 80% of the per diem amount or meal costs.

4. Lodging and Travel Expenses

When you’re on the road and need to stay overnight:

- Hotel stays, motels, or Airbnb rentals are fully deductible

- Other travel expenses like laundry, showers, and even business-related airfare (e.g., for fleet purchases or training events) may be deductible

Keep all receipts and note the business purpose of the trip.

5. Licensing and Permits

Any licenses, permits, and registrations required to operate your trucking business are fully deductible. These may include:

- CDL renewals

- UCR (Unified Carrier Registration)

- IRP (International Registration Plan) fees

- Heavy Vehicle Use Tax (Form 2290)

- State-specific permits or fees

6. Insurance (Truck, Health, Liability)

As a business owner, insurance is both essential and deductible:

- Truck insurance (primary liability, physical damage, cargo)

- Occupational accident insurance

- Health insurance premiums (for self-employed individuals, if you meet IRS qualifications)

- Business liability insurance

Even premiums for bobtail or non-trucking liability can be deducted.

7. Tolls and Parking Fees

Costs for toll roads, bridges, or parking lots used during business travel are 100% deductible. Be sure to:

- Save toll receipts

- Document dates and locations

- Use a toll-tracking app or record if possible

8. Cell Phone and Internet (Business Portion)

If you use your cell phone or internet service for business (e.g., dispatching, GPS, logging hours):

- You can deduct a reasonable portion of the monthly bill

- For example, if 70% of your cell phone usage is for business, you can deduct 70% of the bill

Also deductible: business-use portion of hotspot devices or internet at home, if used for business operations.

9. Accounting and Tax Preparation Fees

If you use a tax professional or purchase software to help manage your books, those fees are deductible:

- Tax filing software (like ExpressTruckTax for Form 2290 or 8849)

- Bookkeeping and payroll services

- Business consulting related to taxes or compliance

10. GPS and ELD Equipment

If you purchased or leased:

- A GPS system used for navigation

- An ELD (Electronic Logging Device) used to stay compliant with FMCSA regulations

Those are deductible business tools. Also included: mounting hardware, subscriptions, and service fees related to the devices.

Bonus Tip: Keep Clear, Accurate Records

To claim any of these deductions, the IRS expects you to prove business use. Maintain:

- Receipts

- Invoices

- Spreadsheets or accounting software logs

- A clear separation of personal and business expenses

Claiming every legitimate deduction can lead to thousands of dollars in tax savings each year. If you’re unsure how to track or categorize these deductions, consider using a trucking-specific accounting tool or working with a tax professional who understands the industry.

As an owner-operator, you’re not just driving, you’re running a business. And like any successful business owner, staying organized, compliant, and proactive with your taxes is essential. From tracking income and claiming deductions to meeting deadlines for Form 2290 and quarterly estimated taxes, every detail matters.

When you keep accurate records and understand your responsibilities, you:

- Maximize your deductions

- Minimize your tax liability

- Avoid costly penalties and IRS audits

- Ensure your truck stays on the road without DMV registration delays

But trying to manage it all manually, especially with the demands of being on the road, can be overwhelming. That’s where trusted tools and partners come in.

File Smarter with ExpressTruckTax

When it comes to filing Form 2290, there’s no better option than ExpressTruckTax, the IRS-authorized, industry-leading e-file solution trusted by thousands of truckers and fleets nationwide.

With ExpressTruckTax, you get:

- Fast and guaranteed Schedule 1 or your money back

- Free VIN corrections if you originally filed with us

- Mobile access so you can file from anywhere

- Secure IRS transmission with built-in error checks

- Real U.S.-based customer support by phone, chat, or email, no bots

Whether you’re filing for a single vehicle or managing a large fleet, ExpressTruckTax makes HVUT filing quick, accurate, and stress-free.

Stay Ahead. Stay Compliant. Keep Rolling.

The best time to get organized for tax season is now, not when the deadlines hit. By staying on top of your documentation, knowing your deductions, and using trusted platforms like ExpressTruckTax, you can take control of your tax situation and focus on what you do best: keeping America moving.

Need help getting started with your 2290 filing? Visit ExpressTruckTax.com or call our support team at 877-520-8640.