Get Your 2290 Stamped Schedule 1 Now

File your 2290 for the 2025-2026 tax period and get your stamped Schedule 1 in minutes!

The 2025-2026 Form 2290 Tax Season Has Arrived File Now

When you e-file 2290 with ExpressTruckTax, we will accurately calculate your Heavy Vehicle Use Tax (HVUT). The IRS offers several ways for filers to pay their tax amount.

Guaranteed Schedule 1 or Your Money Back

Free VIN Checker & VIN Corrections

Copy Details From Your Last Return

US-Based Customer Support in Both English & Spanish

File Your 2025-26 Form 2290 Now with ExpressTruckTax!

Form 2290 filers can pay their HVUT using any of the following options.

The IRS has a credit/debit card payment option available for making your HVUT payment. You also have the option to make your payment directly to the IRS through ExpressTruckTax. The transaction will include your HVUT taxes (along with a processing fee) and filing fees.

You also have the option to make your HVUT payment at IRS.gov/payments but the filing fees and the HVUT tax payment will be separate transactions. You will also have to re-enter all of your information into the other

processor site.

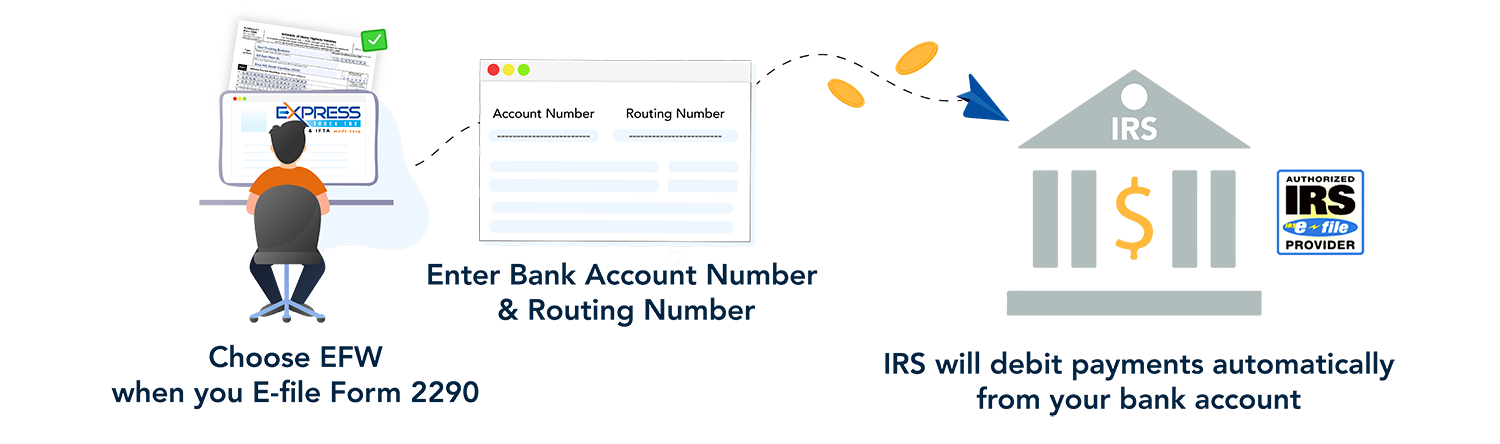

EFW is the preferred e-pay option offered by the IRS exclusively for taxpayers who e-file their tax returns. If you choose this option, the IRS will debit the HVUT amount you owe directly from your bank account within 1 or 2 business days after your Form 2290 is transmitted.

You will be required to provide your bank account number and your bank routing number. Make sure to double-check your bank information, as errors in your bank routing number may lead to 2290 rejections.

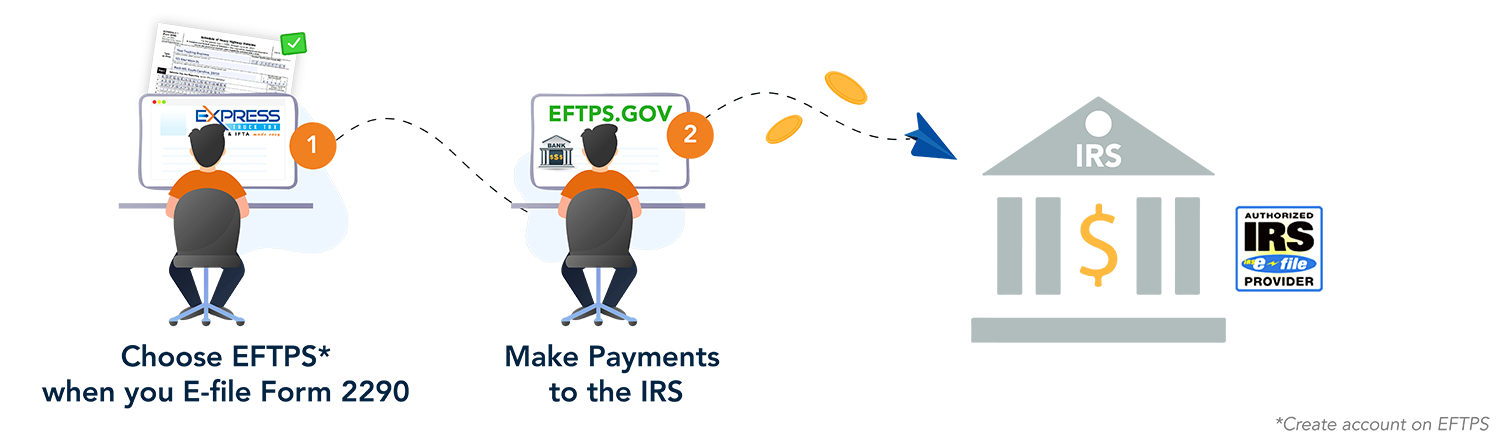

For the EFTPS payment option, it is the filer’s responsibility to schedule the payment. To do that, you must visit www.eftps.gov and schedule to initiate the payment yourself, after you file 2290 online. You will receive your stamped Schedule 1 instantly irrespective of your payment status.

If you do not have an EFTPS account, create one for free by visiting www.eftps.gov or contacting 1-800-555-4477. It might take up to 10-15 days to set up an EFTPS account. You must schedule your EFTPS payment by at least 8 p.m. EST on the day before the due date, to make sure your payment goes through within the deadline.

You can send your HVUT payment directly to the IRS if you choose Check or Money Order as the payment option. You will receive your stamped Schedule 1 immediately irrespective of your payment status. But make sure the payment reaches the IRS before the 2290 deadline.

The deadline to file your Form 2290 return is on the last day of the month following your First Used Month (FUM) in a tax year. The current tax year begins on July 1, 2025, and ends on June 30, 2026.

For the truckers operating from the beginning of the tax year, August 31, 2025, is the Form 2290 due date. If you do not file Form 2290 or pay the required taxes within the filing deadline, you will be subjected to HVUT penalties.

Online IRS-Authorized HVUT E-Filing Software You Can Trust