Form2290

Guaranteed Schedule 1 or Your Money Back

Free VIN Checker & VIN Corrections

Copy Details From Your Last Return

US-Based Customer Support in Both English & Spanish

The 2025-2026 Form 2290 Tax Season Has Arrived File Now

The IRS suggests filers e-file Form 2290 for quick processing to receive Schedule 1 instantly.

Guaranteed Schedule 1 or Your Money Back

Free VIN Checker & VIN Corrections

Copy Details From Your Last Return

US-Based Customer Support in Both English & Spanish

File Your 2025-26 Form 2290 Now with ExpressTruckTax!

Receive IRS e-file watermarked schedule 1 within minutes of your filing

The chances of errors are low as they can be identified and corrected immediately

Protect your data with advanced security standards

Your Form copies will be available for you for up to 3 years

Know your heavy vehicle use tax that you owe and when it is due with the IRS.

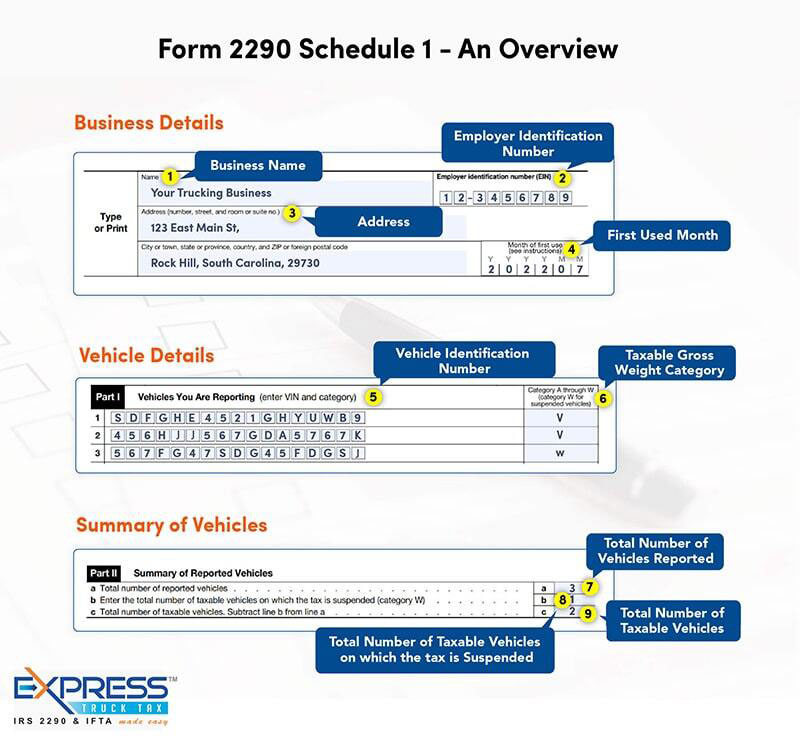

Business Details: Name, EIN, and Address

Vehicle Details: VIN, and gross weight of the vehicle.

Type of Return: In case if you are filing a 2290 VIN Correction or amended return, be sure to choose the type of amendment.

Suspended Vehicle Details: If your vehicle is tax suspended choose the mileage category and enter the VIN.

Paid Preparer Details: If you are Tax Professional filing for your clients, Enter your Firm name, address, EIN, name, and PTIN.

Online IRS-Authorized HVUT E-Filing Software You Can Trust