In celebration of International Women’s Day and Women’s Month, we thought we’d take a look back at four women who broke ground in the trucking industry.

These women helped pave the way for female truck drivers by fighting stereotypes, sexism, and harassment. Here are five inspiring stories of early women in trucking.

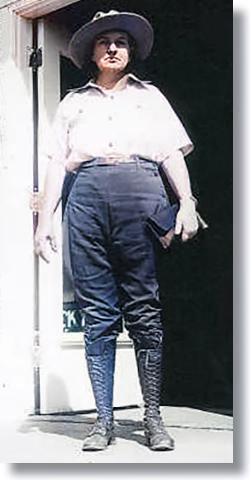

Lillie Elizabeth Drennan

The jury is out on which woman was the first licensed female truck driver. However, Lillie Elizabeth Drennan is certainly in the running, having obtained her CDL in 1929.

She and her husband started the Drennan Truck line in 1928. At first, only her husband drove a Model-T Ford but eventually they purchased a second Chevy that Lille drove.

When she and her husband later divorced, Lillie maintained sole ownership of the company they had started. Until 1952, she ran the business and drove a truck with an apparently perfect safety record (despite lack of HOS regulations at the time).

She received much acclaim throughout her career for her colorful personality and strict training methods for new drivers.

Adriesue “Bitsy” Gomez

In 1976, Time Magazine featured an article about Bitsy’s game-changing activism on behalf of women in trucking. She formed her own coalition of women truck drivers and fought against sexual harassment and the exclusion of women from truck stops. Through legal action and just plain persistence she helped break down barriers for women truck drivers.

Luella Bates

According to some sources, Luella Bates was actually the very first woman to get her CDL in 1920. But what is certain is that she was the first woman to consistently drive trucks professionally, having been a test driver during the first world war. By most accounts, she is also the first woman to drive across the United States in a truck.

Mazie Lanham

Mazie Lanham was the first female UPS truck driver. She began working for them during World War II as many women began filling in for men in America. UPS continued hiring women as truck drivers during and after the war.

Rusty Dow

Rusty Dow was another woman who was called into service during World War II. She was employed by the Alaska Defense Command and drove over the treacherous ice roads and through the largely untamed wilderness. She became the first woman to drive the entirety of the Alaska Highway in 1944.

Like us on Facebook for more

Like us on Facebook for more trucking industry news and information!