If you own or operate a heavy vehicle weighing 55,000 pounds or more, chances are you’ve heard of IRS Form Schedule 1—but you may not know exactly what it is or why it matters so much. Whether you’re an owner-operator, a fleet manager, or a leasing company, understanding this document is essential for staying compliant with federal tax laws and ensuring your trucks stay on the road legally.

IRS Form Schedule 1 is the official proof that you’ve filed and paid the Heavy Vehicle Use Tax (HVUT), which is reported annually on IRS Form 2290. Once the IRS accepts your 2290 filing, they issue a stamped or e-file watermarked Schedule 1 as confirmation. This document is required by most Department of Motor Vehicles (DMVs) for truck registration and tag renewals—and without it, your vehicle could be grounded due to non-compliance.

In this article, we’ll break down what IRS Form Schedule 1 is, why it’s important, who needs it, and how to get it quickly and easily.

What Is IRS Form Schedule 1?

IRS Form Schedule 1 is the official proof of payment for the Heavy Vehicle Use Tax (HVUT), which is reported annually using IRS Form 2290. When you file Form 2290 and the IRS accepts it, they issue Schedule 1 with either a watermark or a physical stamp as confirmation that the tax has been paid (or that the return has been accepted in the case of tax-exempt vehicles).

This document is essential because it acts as your tax receipt for the HVUT and is often required to:

- Register or renew your vehicle tags with the DMV,

- Lease or finance heavy trucks,

- Maintain compliance records for audits or inspections.

The stamped Schedule 1 includes important information such as:

- The business name and EIN (Employer Identification Number),

- Vehicle Identification Numbers (VINs) of all reported trucks,

- The tax period covered (typically July 1 through June 30),

- The IRS e-file watermark (if filed electronically) or stamp (if paper filed).

Without a valid Schedule 1, you cannot legally operate your heavy vehicle on public highways in the U.S. It’s not just a form—it’s your IRS-issued confirmation that you’ve met a major federal tax requirement.

Purpose of IRS Form Schedule 1

The IRS Form Schedule 1 serves a critical role in the trucking industry, acting as the IRS-stamped proof that you’ve either paid or properly filed for the Heavy Vehicle Use Tax using Form 2290. This single document helps ensure legal compliance at both the federal and state levels, and it’s used in several key situations:

Required Proof To:

- Register Heavy Vehicles with the DMV: Most state Departments of Motor Vehicles require a stamped Schedule 1 before they will issue or renew vehicle registration, plates, or tags for trucks with a gross taxable weight of 55,000 pounds or more. Without it, truck owners can face delays that keep vehicles off the road.

- Comply with Federal HVUT Requirements: Filing Form 2290 and receiving Schedule 1 ensures compliance with IRS regulations related to HVUT. This tax helps fund highway infrastructure and maintenance, and failure to comply can lead to fines, interest charges, and audits.

- Stay in Good Standing with the IRS: Schedule 1 is proof that your tax filings are current. Keeping your HVUT filings up to date helps you maintain good standing with the IRS, which is essential for avoiding future tax complications or penalties.

Required By:

- Truck Owners & Owner-Operators: Independent drivers and small business owners need Schedule 1 to keep their vehicles legally registered and operating on U.S. highways.

- Fleet Operators: Companies managing multiple vehicles (25 or more must e-file) must obtain a Schedule 1 for each taxable vehicle to meet both IRS and DMV requirements.

- Leasing Companies & Carriers: Businesses that lease or finance heavy vehicles typically require a valid Schedule 1 from the lessee as a condition of their lease or service agreements.

In short, IRS Form Schedule 1 is more than just a receipt—it’s a compliance document that ensures you meet all federal HVUT obligations and allows your business to keep moving legally and without disruption.

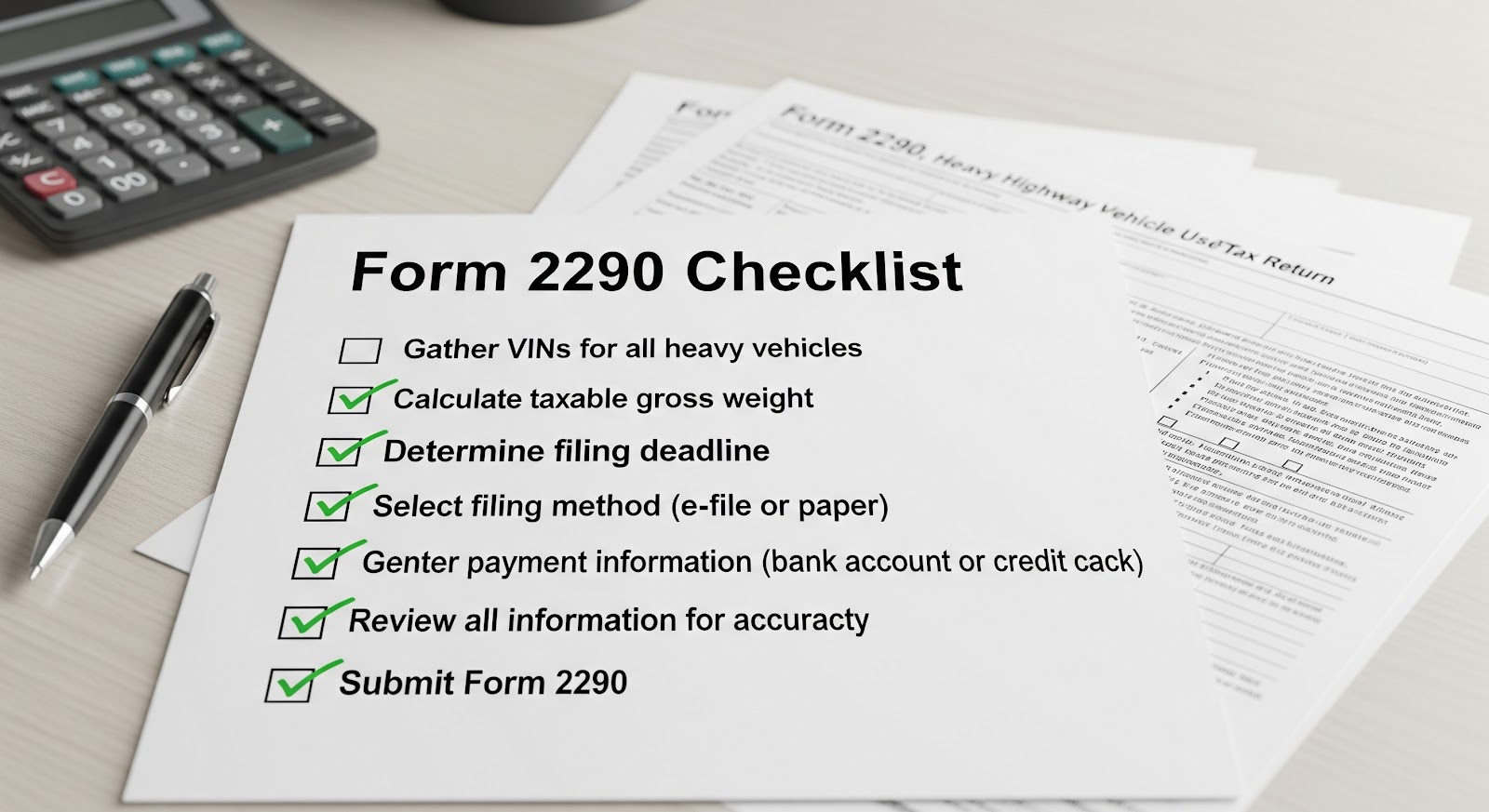

When and How Do You Receive IRS Form Schedule 1?

Once you submit IRS Form 2290, the IRS will issue Form Schedule 1 as your official confirmation that your Heavy Vehicle Use Tax return has been received and accepted. The speed and method by which you receive Schedule 1 depends on how you choose to file:

E-Filing – Instant and Reliable

When you e-file Form 2290 using an IRS-authorized e-file provider like ExpressTruckTax, your Schedule 1 is typically issued within minutes of IRS approval. This is the fastest, safest, and most recommended method, especially during the peak filing season when time is critical for renewing vehicle registrations.

After acceptance:

- You will receive a digitally stamped Schedule 1 via email.

- You can also download it instantly from your e-file account.

- If needed, you can choose to receive it via fax or postal mail as a backup.

Paper Filing – Slow and Risky

If you choose to mail Form 2290 to the IRS, the turnaround time is significantly longer. In most cases, it can take 4 to 6 weeks (or more) to receive your Schedule 1 by regular mail. This delay can impact your ability to register your vehicle with the DMV or meet business deadlines, especially if any errors or missing information cause the return to be rejected.

Because of these delays and risks, paper filing is not recommended, especially when e-filing is faster, more secure, and IRS-mandated for fleets with 25 or more vehicles.

What’s on the IRS Form Schedule 1?

The Schedule 1 you receive—whether electronic or paper—contains all the key details that confirm your HVUT filing, including:

- An IRS e-file watermark or physical stamp as proof of acceptance.

- Your business name and Employer Identification Number.

- The Vehicle Identification Number(s) of all taxable vehicles reported.

- The tax period covered (typically from July 1 to June 30 of the following year).

This document must be presented to the DMV when registering or renewing your vehicle tags. It’s also a vital record for compliance and recordkeeping purposes.

What If You Lose or Don’t Receive Your Schedule 1?

Losing your IRS Form Schedule 1 or not receiving it after filing can be stressful—especially if you’re facing deadlines for vehicle registration or renewal. The good news is, if you filed electronically, retrieving your Schedule 1 is usually quick and easy. However, certain filing issues can delay or prevent issuance altogether. Here’s how to resolve those problems and stay on track.

How to Retrieve a Lost Schedule 1

If you filed electronically using a service like ExpressTruckTax:

- Simply log into your account and go to your dashboard to download or reprint your stamped Schedule 1 at any time.

- You can also request to have it re-sent via email or fax, or even mailed to you for physical documentation.

- If you need help, ExpressTruckTax offers bilingual U.S.-based support by phone, chat, and email to assist immediately.

If you paper filed:

- You must contact the IRS directly at 866-699-4096 (Form 2290 Help Line).

- Be prepared to verify your identity and provide your EIN, business name, and VIN.

Note: The IRS cannot email Schedule 1s—they’ll fax or mail it to you.

Troubleshooting Common Filing Issues

If you haven’t received your Schedule 1, it could be due to one of the following filing mistakes:

1. Incorrect EIN or VIN

- Using the wrong Employer Identification Number or a mistyped Vehicle Identification Number can cause IRS rejection or delay in processing.

- EINs must be active and at least 14 days old before filing.

- ExpressTruckTax includes free VIN checks and validation tools to help avoid this issue.

2. IRS Rejection of Form 2290

- If your Form 2290 was rejected, the IRS does not issue a Schedule 1 until the errors are corrected.

- Common reasons for rejection:

- Inactive EIN.

- Duplicate filings.

- Incorrect tax period or vehicle category.

- Inactive EIN.

- With ExpressTruckTax, you can re-transmit rejected returns for free after fixing the error.

3. Filing Under the Wrong Business Name

- The business name and EIN must match IRS records exactly.

- A mismatch will lead to rejection or IRS processing delays.

- If you’re unsure of your exact IRS-registered business name, you can verify it before filing or contact the IRS for clarification.

Pro Tip: Stay Organized

Always save both digital and printed copies of your Schedule 1. Keep them accessible for:

- DMV registration renewals.

- Business records and audits.

- Insurance or leasing verification.

Why Use ExpressTruckTax for Your Schedule 1?

When it comes to filing Form 2290 and getting your IRS Form Schedule 1 quickly and reliably, ExpressTruckTax stands out as the trusted leader in the trucking industry. Whether you’re an owner-operator, fleet manager, or tax professional, ExpressTruckTax offers a faster, safer, and more convenient way to e-file and stay compliant with HVUT regulations.

Here’s why over 5 million filers choose ExpressTruckTax year after year:

IRS-Authorized and Secure

ExpressTruckTax is an IRS-authorized e-file provider, directly integrated with the IRS for real-time processing and status updates. Your data is protected using SSL encryption and is Comodo Hacker Safe certified, giving you peace of mind that your personal and business information is secure during every step of the filing process.

Instant IRS Schedule 1 – Guaranteed or Your Money Back

Need your Schedule 1 fast? With ExpressTruckTax, you’ll receive your IRS-stamped Schedule 1 within minutes of IRS acceptance—guaranteed. If, for any reason, your return isn’t processed or accepted and you don’t receive your Schedule 1, you’ll get a full refund—no questions asked.

Free VIN Correction

Mistyped your VIN? No problem. If you originally filed your Form 2290 through ExpressTruckTax and need to correct a VIN, you can submit a VIN correction at no additional charge. It’s fast, easy, and helps you avoid registration delays with the DMV.

U.S.-Based, Bilingual Support

Tired of automated systems or offshore call centers? ExpressTruckTax offers live, U.S.-based support in both English and Spanish. Our expert team is available by phone, email, and live chat, ready to help you file accurately and resolve any issues—even during peak tax season.

Mobile App for On-the-Go Filing

On the road? No problem. With the ExpressTruckTax mobile app, you can:

- File your Form 2290 from anywhere,

- Upload vehicle details,

- Choose a payment method,

- Instantly receive and store your Schedule 1,

- Get push notifications with filing status updates.

Perfect for truckers who need flexibility and speed without sacrificing accuracy or security.

Additional Features That Make a Big Difference

- Bulk upload for fleets – Add up to 40,000 vehicles at once with built-in error checks.

- Pre-filled Ready Returns – Returning users get pre-populated forms to save time and reduce errors.

- Re-transmit rejected returns for free – Fix and refile at no cost if the IRS rejects your return.

- Tax calculator & Form 8849 credits – Know your tax ahead of time and claim overpayments or credits easily.

Ensure your heavy vehicle remains road-ready and compliant with federal tax laws by filing your HVUT using IRS Form 2290 today. With ExpressTruckTax, you can enjoy a faster, safer, and more convenient way to obtain your IRS Form Schedule 1—your essential compliance document. Trust our IRS-authorized e-filing system to provide instant confirmation, free VIN corrections, and expert support.

Choose ExpressTruckTax and stay on top of your compliance without delay. Visit ExpressTruckTax.com now and keep your vehicles moving legally and hassle-free.