The IRS has recently started sending postcards to 2290 filers who filed their 2020-21 Form 2290 on paper. The IRS suggests that truckers file Form 2290 electronically as the backlog at the IRS may delay the processing of Form 2290 and sending Schedule 1s to truckers.

It’s time for truckers to switch to electronic filing and get their Schedule 1 in minutes! The IRS won’t be able to process your paper Form 2290 in a timely manner.

What’s Next?

Get Started with the IRS authorized e-file provider like ExpressTruckTax.

When you e-file your Form 2290 with ExpressTruckTax, you will be walked through a simplified, interview-style process that makes your filing easy. We also have a wealth of FAQs and resources and a US-based customer support team to guide you through the filing process.

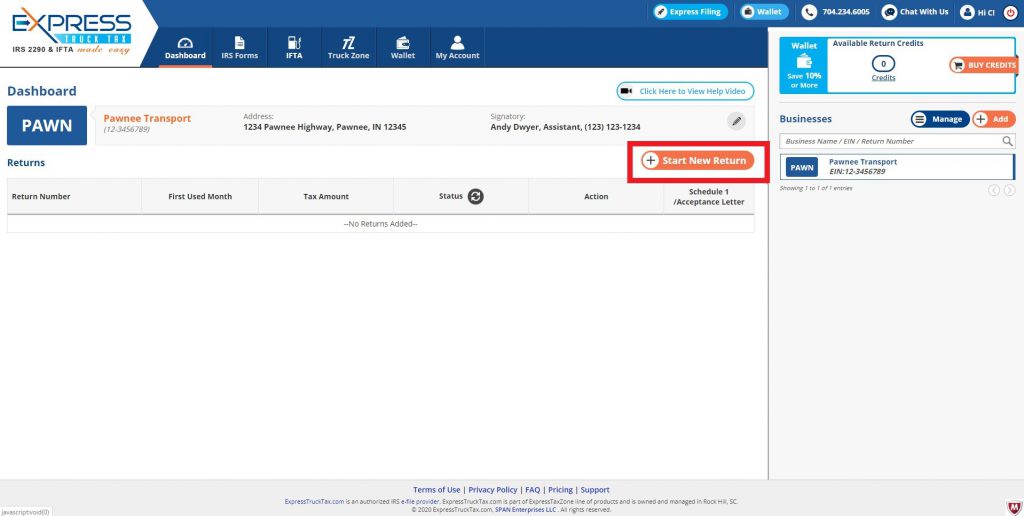

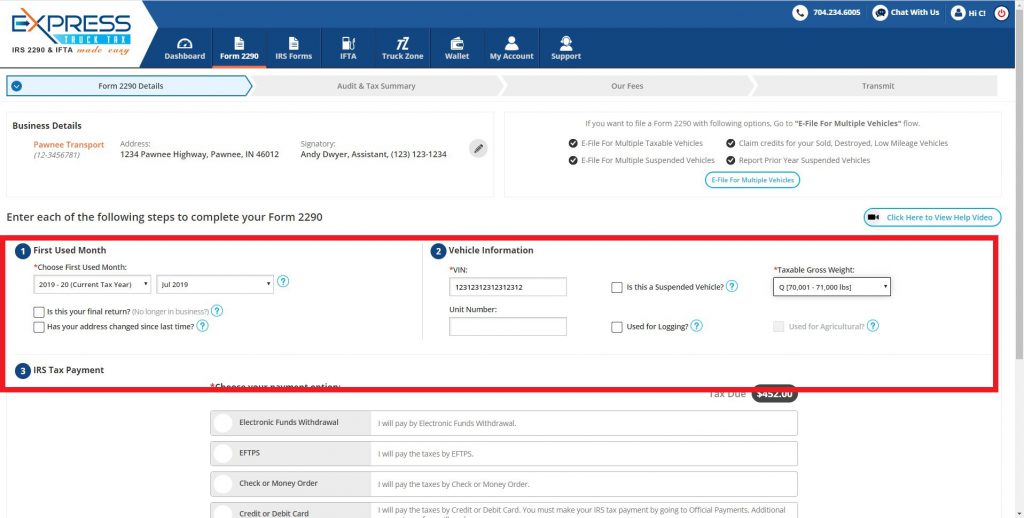

You will be able to complete your filing like a pro. Just follow the steps mentioned below to complete your filing in less than 10 minutes.

Step 1: Add Business Details.

Step 2: Enter Form Details (FUM, VIN, Weight Category, and the IRS Payment Method)

Step 3: Review Form Summary and make any changes if required.

Step 4: E-file it with the IRS and get your Schedule 1 back in minutes.

Why should you choose ExpressTruckTax?

ExpressTruckTax is loaded with great features like our Free VIN checker and automatic error check, so you can be sure that your return has the correct information before you transmit.

Plus with our exclusive ExpressGuarantee, we guarantee that the IRS will accept your return and you will get your stamped Schedule 1, or your money back. In the event that you do make any errors, we will work with you to get your return accepted! And If the return was rejected by the IRS for any reason, you can always make the necessary corrections and re-transmit it for free.

Once you transmit your return, you will receive instant updates on your IRS status. Most of our clients get their stamped Schedule 1 back in a matter of minutes. You can also opt to receive your Schedule 1 directly to your mailing address or through fax.

It’s Easy! Get Started Today!