Form 2290 Due Date and Filing Requirements

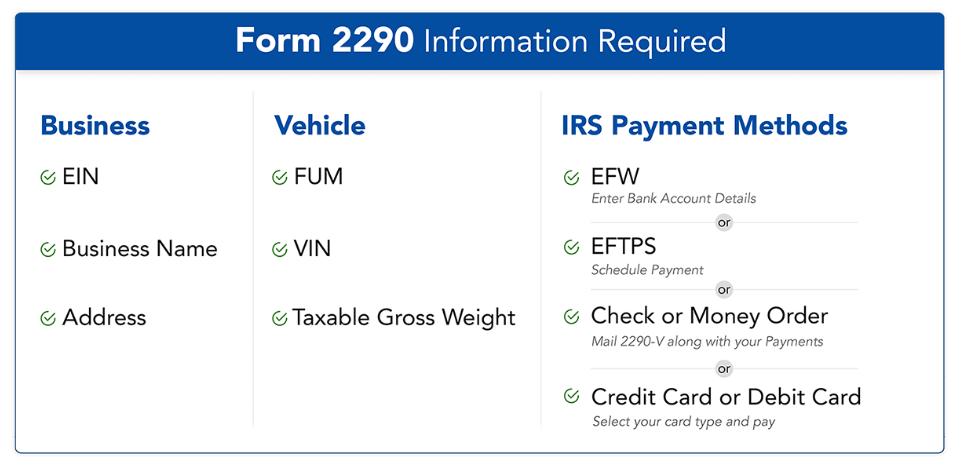

Form 2290, is also known as HVUT Form used to report the HVUT payments made for the taxable vehicle that has a gross weight of 55,000 pounds or more. The due date for Form 2290 depends upon the first used month of the taxable vehicle. Usually, the tax periods beginning on July 1 and end on next year June 30.