We always try to keep the trucking nation up-to-date with industry news. And telling you about the latest in IRS regulations is an important part of that. After all, we are ExpressTruckTax!

According to the updated 2015-16 IRS regulations, when filing HVUT for a vehicle you recently purchased from a private owner (i.e. not from a dealership or auction), the previous owner is responsible for paying tax on the partial month in which you purchase the vehicle.

For example, if you purchase a vehicle from a private seller today, your tax would be calculated starting August 1st.

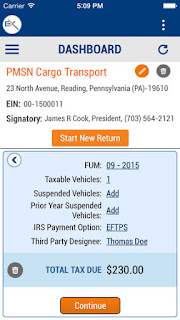

Luckily, the ExpressTruckTax program has been updated to make this process super simple, so all you have to do is follow the same three simple steps which will create a new split return for the tax year, giving you prorated tax.

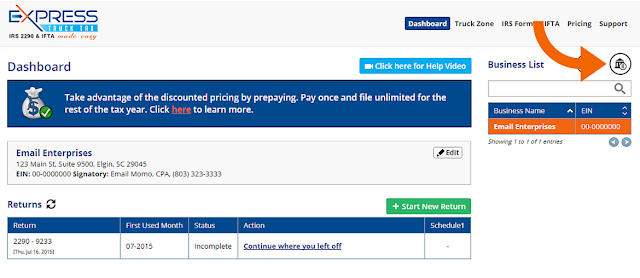

Step 1: Login or Create Account

- If you’ve previously filed with us or if you have an account already, login to your account and resume or start your return.

- If this is your first time filing, choose to create an account.

- Pro-tip #1: To save time, you can choose to login with your Google+ or Facebook account.

- Then you will either enter your business details or use the FastTransfer Feature to copy them from your previous return.

Step 2: Vehicle Details

- In order to enter details for a vehicle you purchased from a private seller, simply choose to add a vehicle and enter all the information including gross vehicle weight and VIN.

- Then check “This is a previously privately-owned vehicle” at the bottom of the “Add Truck” popup window.

- Then click next and add any other trucks you may need to file for before moving on.

- Pro-tip #2: There are several different types of vehicles to file for. Know the difference between Taxable Vehicles, Suspended Vehicles, Logging Vehicles, and Agricultural Vehicles.

- Now you’ve created a split return in our system, meaning you pay a prorated heavy vehicle use tax amount on the new vehicle, instead of having to pay for the entire tax year.

Step 3: Pay and Transmit!

- Now all you have to do is enter your payment information and securely transmit your return to the IRS.

- Pro-tip #3: The IRS only accepts three payment methods, Direct Debit, EFTPS, and check or money order. No credit or debit cards.

- Select your payment method, review your vehicles, and then transmit your return. It’s just that easy!

If you need any help with any step of the filing process, our dedicated support legends are here for you. Don’t hesitate to call them at 704.234.2005 during our new extended business hours from 8AM-8PM EST or send them at email at support@expresstrucktax.com for 24/hour support.

E-file today! In just ten minutes, you can be finished, and get back to your life.

We’ve got another giveaway for you, Trucking Nation. If you e-file with us and “Like” us on Facebook, you’ll be entered to win a portable blender to take on the road with you!