Get Your 2290 Stamped Schedule 1 Now

File your 2290 for the 2025-2026 tax period and get your stamped Schedule 1 in minutes!

The 2025-2026 Form 2290 Tax Season Has Arrived File Now

E-file your 2025-26 Form 2290 with ExpressTruckTax for fast, secure, and affordable filing—get your Schedule 1 in minutes!

Guaranteed Schedule 1 or Your Money Back

Free VIN Checker & VIN Corrections

Copy Details From Your Last Return

US-Based Customer Support in Both English & Spanish

File Your 2025-26 Form 2290 Now with ExpressTruckTax!

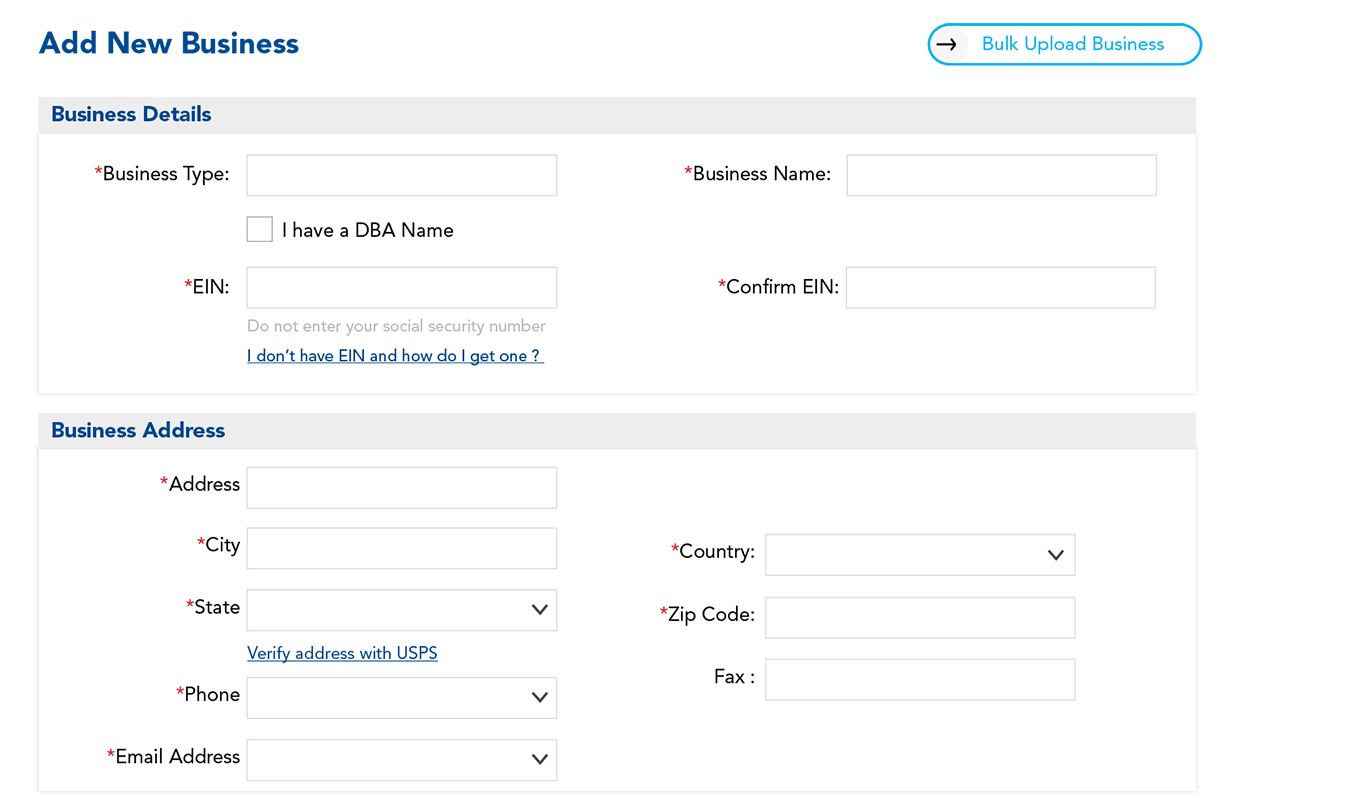

1. Enter Business Details

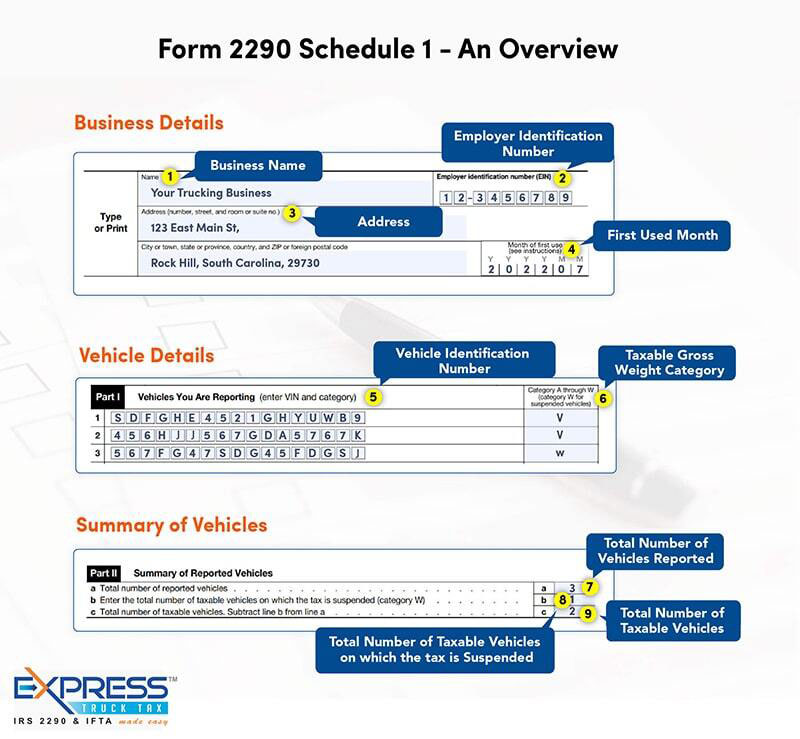

2. Enter Vehicle Details

3. Choose HVUT Payment Methods

4. Review & Transmit Form 2290

5. Receive 2290 Schedule 1 in Minutes

Our e-file solution includes filing for Form 2290, 2290 Amendments, Free 2290 VIN Corrections and Free Re-transmission of Rejected 2290 return.

Ensure that your 2290 Forms are error free before transmitting them to the IRS. Our instant error check helps avoid rejection due to basic and common errors.

Get your Schedule 1 (Form 2290) the way you prefer. Receive a digital copy in minutes by Email or opt to get a paper copy through Fax or Postal Mail.

As an IRS-authorized e-file provider, you can rest assured that all your information is kept secure and protected with the latest data encryption model.

Get instant updates about your IRS filing status through your registered email, phone or fax.

Save time and simplify your 2290 reporting by uploading all your vehicle information in an instant with our Bulk Upload Templates.

Our e-filing solution for Form 8849 (Schedule 6) is available if you need to request a claim for refund on the vehicles that you previously reported on your Form 2290.

No need to enter vehicle information each time you file 2290. Store all your vehicle information within our application under “TruckZone” & select the required vehicle when you need to file again.

Make sure that you have the following information before getting started with your 2290 filing. Having these information handy will helps you complete your 2290 in less than 5 minutes.

1. Business Name & Address.

2. EIN (Employer Identification Number).

3. VIN (Vehicle Identification Number).

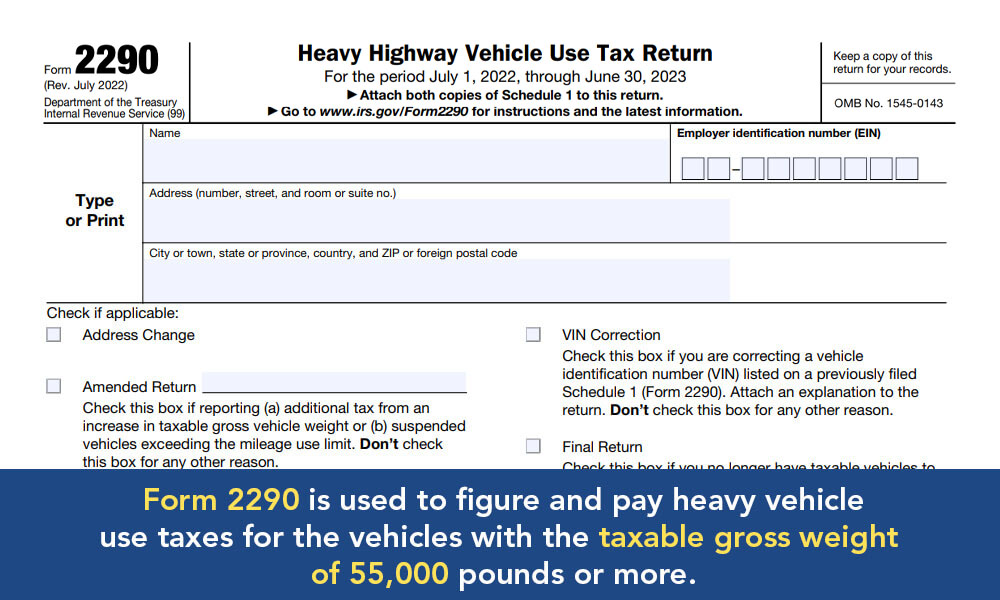

4. Taxable Gross Weight of Vehicle.

5. First Used Month (FUM) of Vehicle.

Online IRS-Authorized HVUT E-Filing Software You Can Trust