ExpressTruckTax loves the trucking community! We know how hard all truckers work and how busy they are keeping our nation moving forward. Because of this, we also understand how their free time on the road is very limited.

No one wants to spend all their free time filling out a mandatory tax return form. ExpressTruckTax aims to make filing Form 2290 fast and easy for all truckers so they can get back on the road.

Many features have been added to ExpressTruckTax to simplify the process of filing for all of our clients. By simplifying our program and making it more accessible to truckers, we hope to give them peace of mind that it’s completed and give them their stamped Schedule 1 back in minutes.

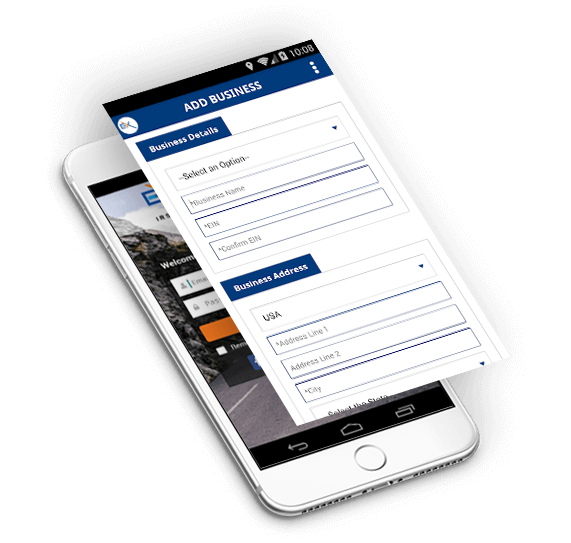

Easy Accessibility with Mobile App

ExpressTruckTax knows how much time truckers spend on the road. Being on the move may make it hard to sit down and fill out a complicated tax return form, so we have made our program as easy to access as possible.

By creating our free mobile app, we make it easy for truckers to safely and securely file their Form 2290 from anywhere. The ExpressTruckTax mobile app can be downloaded in both the Apple store and Play store for all Apple and Android devices.

When you file with the mobile app, you will receive a notification once the IRS accepts the return. The app will also have your tax amount automatically calculated for you and a copy of the stamped Schedule 1 can be accessed at any time!

The ExpressTruckTax also allows you to take advantage of bulk and unlimited filing options, use prepaid return credits, and add multiple businesses and EIN’s with one account!

Our app was created to give truckers all of the great features that ExpressTruckTax has to offer, from the convenience of their own mobile device!

Filing Features to help simplify the process

To keep the process of filing simple and easy to use, ExpressTruckTax offers many helpful features to our clients. These features are incorporated into our program to assist our clients when filing and making their HVUT payments.

Some features that ExpressTruckTax offers our clients include an instant error check, free VIN corrections, free 2290 VIN checker, auto-generated Form 8849, and bulk information download. These features were created to help ensure that all the information is correct on Form 2290 and nearly eliminated the possibility of the IRS rejecting the tax return.

Even if the return is rejected, ExpressTruckTax will help you fix the error and retransmit the return at no additional charge. With our ExpressGuarentee, we ensure that Form 2290 will be accepted and you will receive the stamped Schedule 1 within minutes or your money back!

Live Locally-based Support Team

ExpressTruckTax will always be there to help you through every step of the process with our U.S.-based support team!

Our support team will answer your call whenever you need assistance. When calling ExpressTruckTax, you will never talk to an automated machine, only real people who are happy to help!

Our support team also offers bilingual help in both English and Spanish. We offer this because we want to make sure we can successfully communicate and help every client we can!

File your Form 2290 Now!

This year’s tax season is here and the deadline is approaching fast. It’s important to file your Form 2290 and make your HVUT payment by August 31st, 2021 to avoid any unwanted penalties.

ExpressTruckTax has been the leading e-filing provider for Form 2290 for years. We are an IRS-authorized e-file provider and ensure that, after filing, you will receive your stamped Schedule 1 within minutes!

Sign in to your ExpressTruckTax account here or call our support team at (704)234-6005 for any additional help!