We get it and so does the IRS. Things happen and you just aren’t able to meet those deadlines.

It can be pretty tough to get everything together that you need when filing your tax return. Lucky for you, there is a way to ask the IRS for up to 6 months more time.

The personal income tax deadline is typically April 15, but with an extension, you may not have to submit your forms until October 15th.

Due to COVID-19 Pandemic, the IRS has extended the 2020 Form 1040 deadline to May 17, 2021.

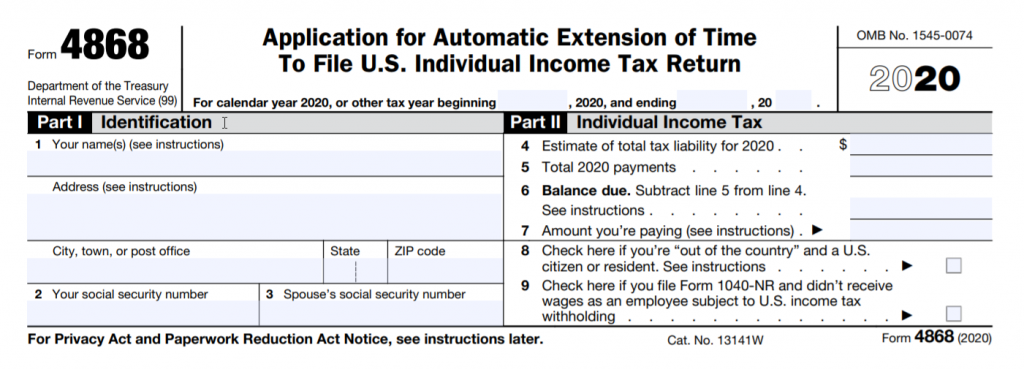

If you don’t think you can complete your 2020 federal 1040 tax return by the May 17 deadline, you’ll want to think about filing a Form 4868 now! The Form 4868 is used to ask the IRS for extra time to file personal income taxes.

Please note, Form 4868 only pushes back the filing deadline for your tax documents. It doesn’t give you extra time to pay any taxes that you might owe. If you think you may owe money this year, you’ll need to estimate the amount after filing for your extension.

Penalty Threats

Filing late can get pretty costly. The penalty can be up to 5% of the unpaid tax amount for each month you are late. If the return is more than 60 days late, the minimum penalty is $135 or 100% of the unpaid tax, whichever is less.

Filing Form 4868 will give you ample amount of time to get your ducks in a row. If you know you may late, go ahead and file for an extension and get until October 15th to file your tax return.

Form 4868 is an automatic Form, which means the IRS doesn’t require any explanation.

Form 4868 is made up of two parts. Identification information is included in part I and individual income tax information is in part II.

Part I & II

- Name(s)

- Mailing addresses

- Social Security number (SSN)

- Employer Identification Number (EIN)

Part II – Individual Income Tax

- Estimate of Total Tax Liability (be sure to be as accurate as possible)

- Total Payments

- Balance Due

- Amount You’ll Be Paying

If you’re thinking of filing a personal tax extension, here are steps to make completing it a little bit simpler.

Filing Form 4868 Electronically

E-filing is the quickest and easiest way to submit your tax extension to the IRS. By filing Form 4868 electronically, the IRS will process your return quickly and provide you with the return status instantly.

Get started with the leading IRS-Authorized e-file provider, ExpressExtension, and complete your extension in minutes.

- Enter Personal Details

- Enter balance tax due details

- Review your Form 4868

- Transmit your return to the IRS

Check with the demo video on how to complete Form 4868 with ExpressExtension:

E-file Tax Extension Form 4868 now and extend your 1040 filing deadline to avoid late filing penalties.