Well, for starters:

- No other IRS-authorized E-File Provider offers a price this low.

- Priced at just $9.90, we truly are the best value in the industry. And with us, you get more than just e-filing: you get a great product and superior customer service.

- We have the best customer support team in the industry.

- In fact, we call them Support Legends because no matter who you get connected to, they can handle your questions with ease. All of them are fully trained and here all year around—whether it’s HVUT season or not.

- We work closely with truckers, owner-operators, and trucking associations.

- That means we understand the industry and the frustration that comes with filing heavy vehicle use tax. Unlike other providers, we can provide you the best value and the best product specifically for the trucking industry!

And all of that comes free! We haven’t even scratched the surface of everything ExpressTruckTax can do for you—and for just $9.90! We’ll be saving you some dolla dolla bills y’all.

What You Get For the Price

- The Ability to E-file Your 2290 With Ease

- ExpressTruckTax provides you with a great and easy-to-use product. In fact, we have the most efficient e-filing process out there! All you have to do is follow three easy steps, and then you’re done. You can get your Stamped Schedule 1 in minutes and get back to your life. It really is as easy as 1-2-3!

- Stamped Schedule 1 (in Minutes!)

- Getting your Stamped Schedule 1 with ExpressTruckTax is really easy! From start to finish, your journey to your Stamped Schedule 1 should take less than 10 minutes. Then you have your proof of filing and you’re well on your way to renewing your vehicle registration for the coming year. You can access your Stamped Schedule 1 with ExpressTruckTax one of three ways:

- 1. We will automatically email it to you

- 2. There will be a copy in your ExpressTruckTax account on your Dashboard page

- 3. You can have us fax or mail it to you, or anywhere you want.

- Truck Zone

- Truck Zone is a virtual garage that has been integrated into ExpressTruckTax. Whether you have one truck or a multitude, Truck Zone can help you securely organize all of your vehicle information. That way you only have to enter it once, and Truck Zone will remember it for you year after year.

- Email Notifications

- As soon as your Form 2290 is accepted by the IRS, you will get an email from us containing your Stamped Schedule 1. If your Form 2290 is rejected, we will also send you an email notification immediately with the exact reason for the rejection. That way you can pinpoint the exact error, correct it, and then you can re-transmit your 2290 to the IRS free of charge!

- Form 2290 Archive

- We also archive your Form 2290 and Stamped Schedule 1 on our secure server year after year. That means you can use our FastTransfer feature to copy your HVUT from a previous year so you don’t have to start over from scratch. Or if you ever lose your Stamped Schedule 1 and need to pull up a new one, we’ve got you covered.

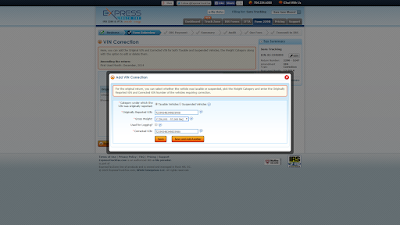

- Free VIN Corrections

- Sometimes you can make some mistakes. Maybe you mixed up a letter or a number, or maybe you’re confusing one VIN with a different truck. It happens! That’s why we give you free VIN corrections. And it only takes a few minutes to file your correction with ExpressTruckTax.

- Credits for sold/destroyed/stolen vehicles

- If you sold your truck during the tax year and purchased a different vehicle, you can claim the credit for the sold truck and file your 2290 for your new truck on one return! The credit from the truck you sold will be automatically applied to the amount of Heavy Vehicle Use Tax you owe on your new truck.

- Our Support Legends

- They’re so good, I had to list them twice! If you have any questions about any part of the e-filing or amendment process, we have an amazing support team. Just give them a call at 704.234.6005 or shoot them an email at support@expresstrucktax.com for 24/hour support in both English and Spanish. There is no problem they can’t solve!