Year after tax year, scam artists seem to crop up, claiming they’re CPA’s that can file your 2290 for you. They may even go so far as to print out a fake Stamped Schedule 1 right before they close up shop and disappear.

Unfortunately these types of scams are very common, especially taking advantage of truckers who speak English as a second language.

Here at ExpressTruckTax, we guarantee you a safe, secure, and completely 100% scam-free experience when you file with us. Not to mention we are an IRS Authorized E-file Provider and a link to our website can be found directly on the IRS’s website.

How To Identify A Scam

Trying to identify a scam isn’t always easy, but you should always look for these two red flags.

“Cash Only” E-filing

E-filing providers who claim they only accept cash for their e-filing fee are most definitely not playing by the rules. Those who go by the book will have several payment options available, none of which are “cash only”. And you should definitely never have to pay cash for your taxes. The IRS only accepts three payment methods: Direct Debit, EFTPS, and Check or Money Order. If they ask for anything else, it’s a scam!

Not Listed on IRS Website

You may not always check, but you should. One of the easiest ways to identify and avoid being scammed is to check the IRS website for verified e-filers. If they’re not on that list, the risk they’re a scam goes up. So only use e-filer providers that you trust!

Unless you know and trust a company completely, avoid anyone who isn’t an IRS-certified e-file provider. And you should definitely avoid any company who only wants you to pay in cash! Always know who you’re giving your money to.

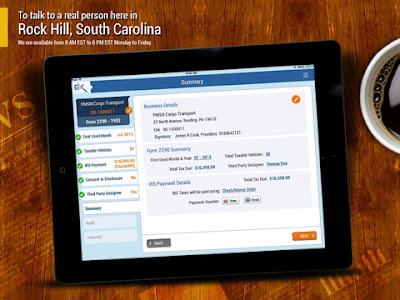

Beware of fake Stamped Schedule 1’s! A legitimate Stamped Schedule 1 from the IRS will look like this, complete with the IRS’s real watermark:

It will be that clear and crisp and will contain all of your correct information and vehicles. Anything that doesn’t look like this is not legitimate and will not be accepted by the DMV.

The Secure Promise from ExpressTruckTax

As an industry leader and an IRS-authorized e-file provider, ExpressTruckTax can promise security and peace of mind when you e-file through us.

Our product is McAfee Certified HackerProof and we utilize SSL, which securely encrypts communications between your device and our US-based servers.

With us, you’ll get a legitimate Stamped Schedule 1 emailed right to you within minutes after your return is accepted! Your tax payment will always go straight through us and to the right place—the IRS—in minutes.

With the help of our US-based support legends (operating from right here in Rock Hill, South Carolina!), you can rest assured that your taxes will be filed quickly and correctly. So if you have any questions or need any help, just give them a call at 704.234.6005 or sent them an email at support@expresstrucktax.com for 24/hour support in English and Spanish.