If your Form 2290 was rejected by the IRS, there’s always a good reason for it. And there’s a good chance it was for one of three very common reasons.

If your Form 2290 was rejected after you filed with ExpressTruckTax, we will send you an email detailing exactly why it was rejected and what you need to do.

You can address the issue and retransmit your Form 2290 as many times as your need until it is accepted by the IRS for no additional charge.

So that you know what to do in the event of IRS rejection, here are the three most common Form 2290 rejections:

Form 2290 E-file Error Code R0000-922

This Form 2290 error code R0000-922 means that the Business Name you entered does not match with the EIN listed in the IRS database.

Most of the time, this error occurs because a new Form 2290 filer applied for an EIN but that number hasn’t become active. It may take up to ten business days for a new EIN to become active.

How to fix it:

Make sure to check your EIN and Business Name to see if what you entered is correct. If you cannot find any errors in the information you have provided, you can contact the IRS at (800) 829-4933 and verify your EIN or Business Name. International users will need to call (267) 941-1099.

Here’s how you correct your EIN or Business Name:

1. Log in to your ExpressTruckTax account.

2. Edit your Business details using the pencil icon and provide the correct EIN or Business Name.

3. Identify the rejected return from the Dashboard.

4. Click on “Fix Errors & Resubmit” on the rejected return.

5. Click “Go to Review”. Check your return again and transmit it to the IRS.

If you do not have an EIN, you may contact ExpressTruckTax Plus at (803) 386-0320. You can also apply for an EIN online by visiting the IRS website (www.irs.gov) or over the phone by calling the IRS business hotline at (800) 829-4933. It may take up to ten business days for a new EIN to become active in the IRS e-file database.

E-file Error Code R0000-906-01

This Form 2290 error code R0000-906-01 means that the Bank Routing Number that you have entered in the Electronic Funds Withdrawal (EFW) payment option to pay your HVUT is invalid.

Resolution:

Check the payment details you entered. Make sure you have the correct Bank Routing Number. This is a nine-digit code you can find on the bottom left of your check. You can re-enter this information and transmit your return to the IRS again.

Here’s how you can change your Bank Routing Number:

1. Log in to your ExpressTruckTax account.

2. Identify the rejected return from the Dashboard.

3. Click on “Fix Errors & Resubmit” on the rejected return.

4. You can now edit information in the IRS Tax Payment.

5. Enter your correct Bank Routing Number and transmit your return to the IRS.

E-file Error Code R0000-194

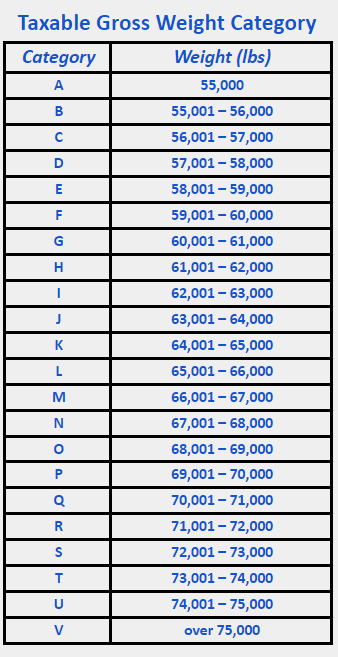

This Form 2290 error code R0000-194 means that the return is a duplicate of a previously accepted return. Typically, this is because either the EIN or VIN is incorrect.

Resolution:

Make sure you used the correct EIN, VIN, weight category, and first use month. Check to make sure you have the right tax year for your return.

File Form 2290 Now with ExpressTruckTax

When you file with us, fixing rejection errors is easy! Plus, if you have any questions, our US-based customer support team will answer any questions you have!