It is easy to file IRS Form 2290 with ExpressTruckTax?

Only 3 Simple Steps to get Schedule 1

Filing your IRS HVUT 2290 can be stressful and confusing, especially if you’re not using a 2290 online solution.

PRE-FILING IS NOW OPEN for 2290 Tax Year 2025-2026 File Now

Guaranteed Schedule 1 or Your Money Back

Free VIN Checker & VIN Corrections

Copy Details From Your Last Return

US-Based Customer Support in Both English & Spanish

File Your 2025-26 Form 2290 Now with ExpressTruckTax!

Only 3 Simple Steps to get Schedule 1

Filing your IRS HVUT 2290 can be stressful and confusing, especially if you’re not using a 2290 online solution.

Quickly E-file IRS Form 2290 (HVUT) with ExpressTruckTax and receive your stamped Schedule 1 in minutes once the IRS accepts your return.

Express Guarantee that your 2290 return will be accepted by the IRS, or you will get your money back.

Check VIN using our VIN checker on IRS Form 2290 before transmitting it to the IRS for error-free filing.

Correct your Form 2290 VIN errors online. If you had e-filed your original Form 2290 return with ExpressTruckTax, file your Form 2290 VIN Correction for FREE!

Reduce expenses and increase profitability through simplified operations and toll management by Bestpass.

File your Form 2290 in two steps. If you already filed with us our system will automatically generate return to make your filing faster than ever.

ExpressTruckTax provides the reason for 2290 rejection and allows you to retransmit a rejected return for FREE or you get your money back.

Purchase prepaid credits with the Wallet System and you can receive a 10% or more discount on your 2290 filing fees.

Get instant updates about your IRS filing status through your registered email, phone, or fax.

All your vehicle information will be automatically stored under “TruckZone” to help simplify your future filings. You can continue filing without entering the details each time.

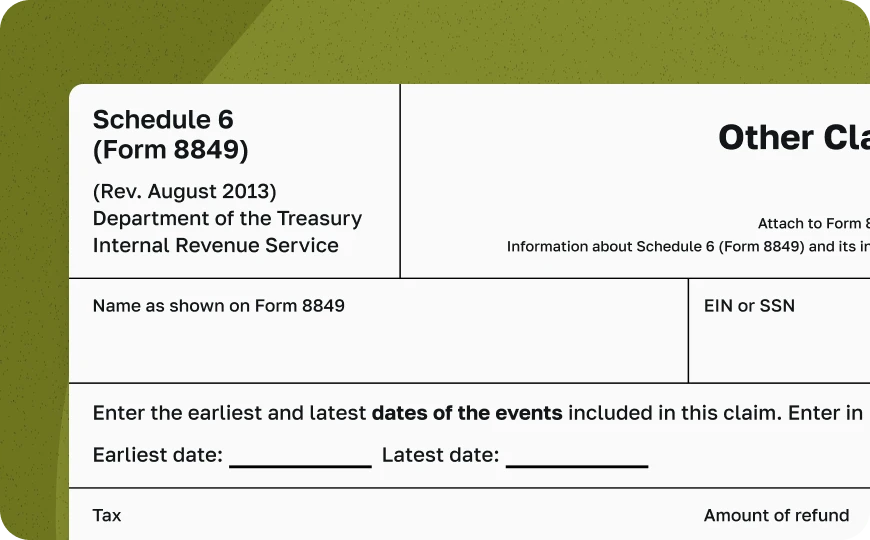

ExpressTruckTax helps you claim tax credits on the vehicles that you were previously reported on your Form 2290 using Form 8849 (schedule 6).

Bulk upload information about 40,000 trucks at once using our Bulk Upload Template while filing your Form 2290 return for multiple vehicles.

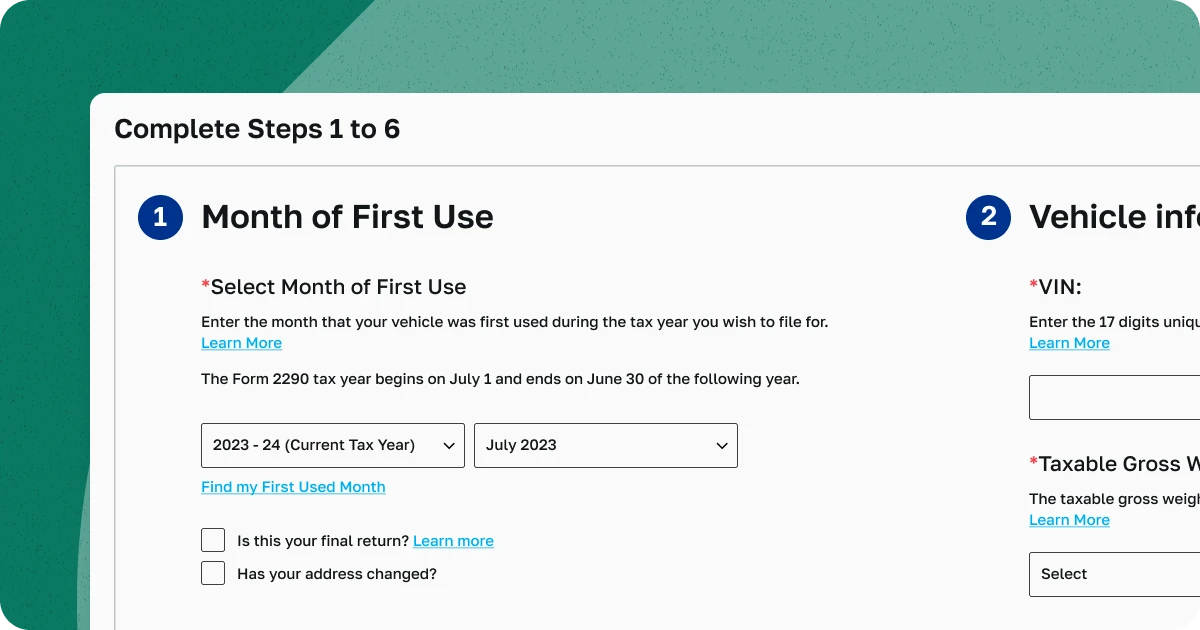

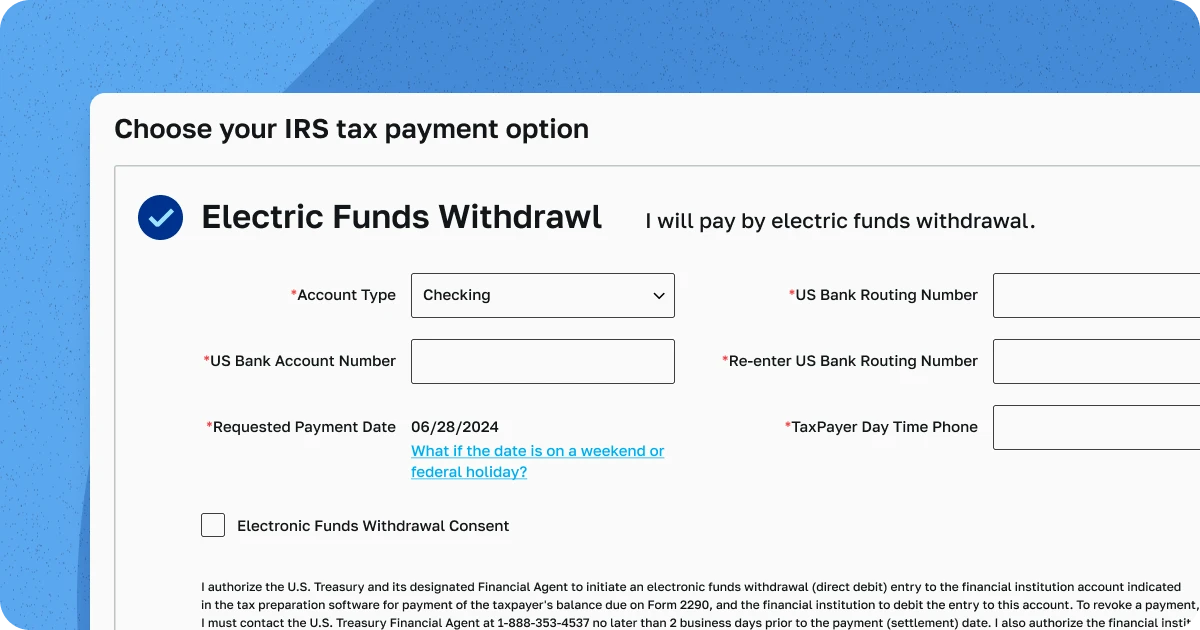

Its quick and simple to e-file Form 2290 with ExpressTruckTax. Just create an account or if you have an account already, Sign In to continue adding your Form information. Once added, you can review the Form summary and transmit the return to the IRS.

Enter Business and Vehicle Details

Choose HVUT Payment Methods

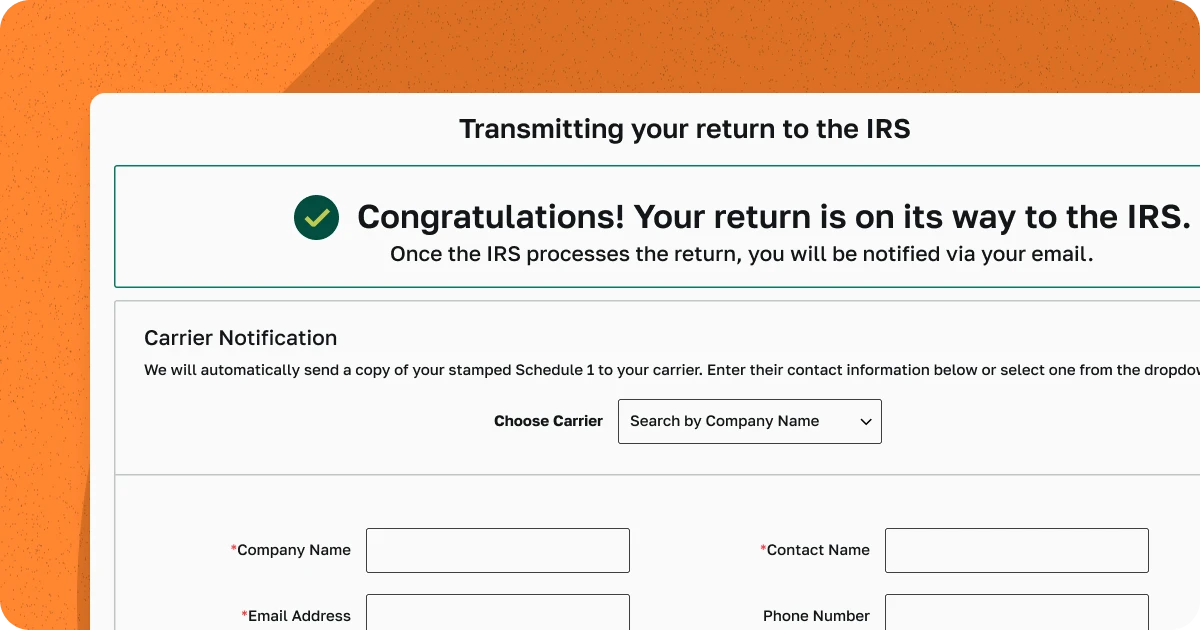

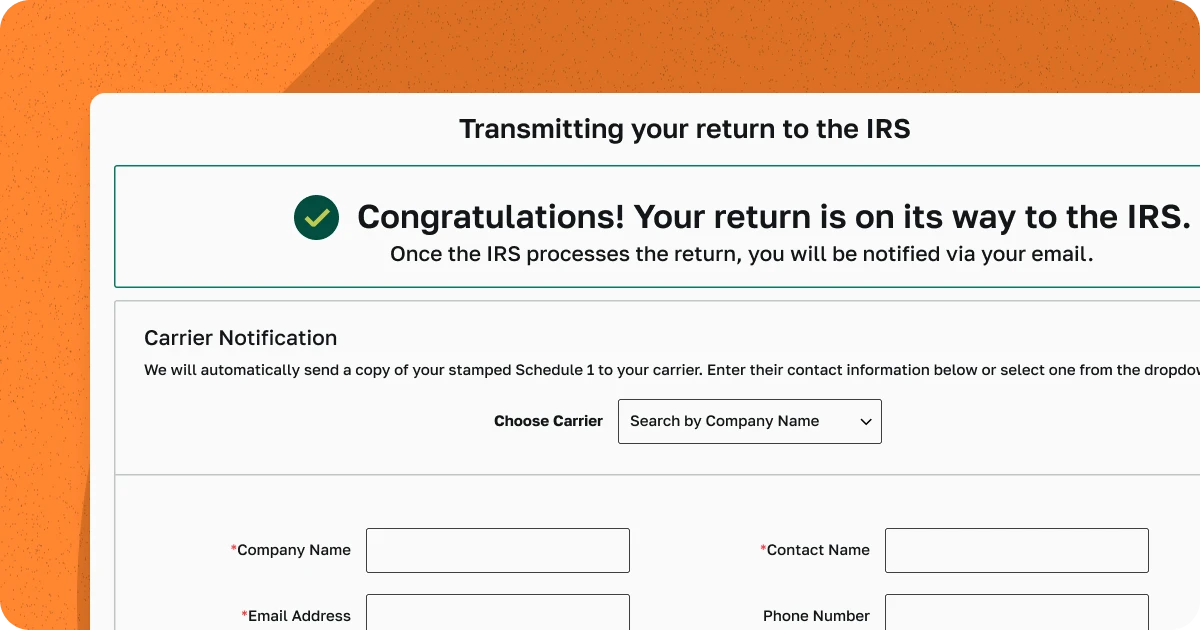

Transmit & Receive Schedule 1 in minutes

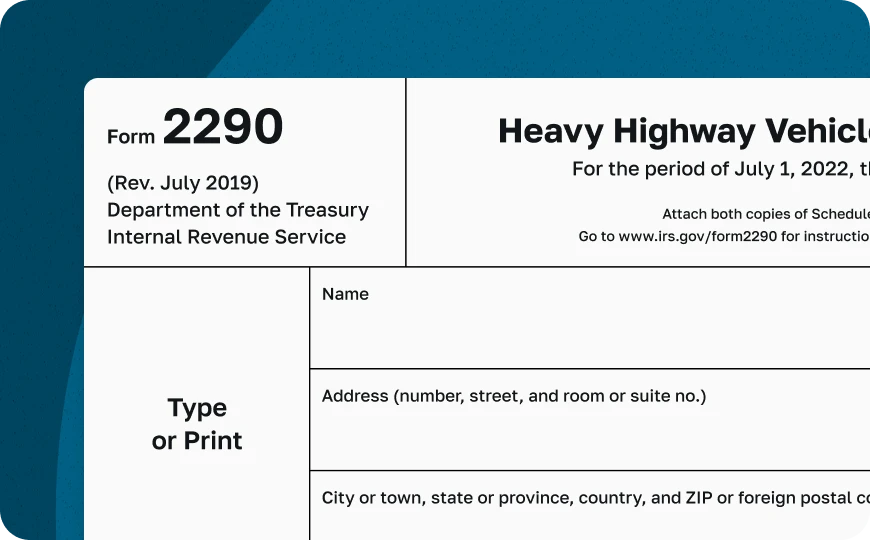

Form 2290 is the Heavy Vehicle Use Tax Return. It is the form used to figure out and pay the tax due on motor vehicles operating on public highways with a taxable gross weight of 55,000 pounds or more. The taxation period runs from July 1st to June 30th of the following year and is due by August 31st. However, for first used vehicles your HVUT is due the last day of the month following the first used month. For example, if you first use a new vehicle in April then your 2290 is due by May 31st.

Anyone who is filing a return for 25 or more vehicles is required to file electronically.

The electronic version of IRS Form 2290 will improve excise tax processing, expedite refunds, save personal resources (e.g., time & postage), and reduce preparation and processing errors. Your 2290 Schedule 1 will be available almost immediately (once your return is accepted by the IRS).

E-file online with ExpressTruckTax to put an end to waiting for your form to come in the mail or standing in long lines at the IRS office!

Once you have transmitted your return to the IRS, and it is accepted, you will receive your stamped Schedule 1 in minutes! It’s that simple.

To learn more about Form 2290, please visit at https://www.irs.gov/forms-pubs/about-form-2290

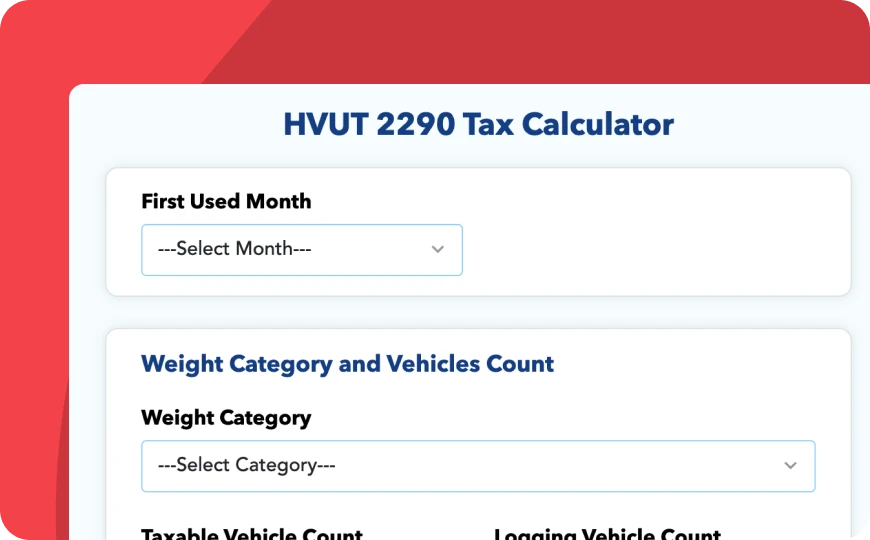

The Heavy Vehicle Use Tax is paid by Form 2290 annually for heavy vehicles operating on public highways with registered gross weights equal to or exceeding 55,000 pounds.

If the gross taxable weight is between 55,000 to 75,000 pounds, the HVUT is $100, plus $22 per 1,000 pounds over 55,000 pounds. For over 75,000-pound vehicles, the maximum HVUT is $550 per year. The taxes are lower for logging vehicles—vehicles primarily used for exclusive transport of products harvested from the forest and that are registered with a state agency as such.

| Taxable Gross Weight | Heavy Vehicle Use Tax Rate | Logging Vehicle Rate |

|---|---|---|

| Below 55,000 lbs | No Tax | No Tax |

| 55,000 to 75,000 lbs | $100 plus $22 per 1000 lbs over 55,000 lbs | $75 plus $16.5 per 1000 lbs over 55,000 lbs |

| Over 75,000 lbs | $550 | $412.50 |

For any vehicles placed into service after July, the taxes are prorated.

Online IRS-Authorized HVUT E-Filing Software You Can Trust