|

| E-Filing Form 2290 Amendments |

As we move further away from 2290 deadline season, it becomes more clear that filers might need to make amendments, corrections, and changes to the 2290’s they’ve already filed.

Of course, we’re not going to cover all of those corrections that can be made in one post. As part of our ongoing discussion about e-filing Form 2290 Amendments, we’re focusing on what to do when you Exceed the Mileage Use Limit.

Mileage Limits on IRS Form 2290

Mileage use limit for a heavy vehicle on public highways is 5,000 miles (or) less (7,500 miles (or) less for agricultural vehicles). The mileage use limit applies to the total mileage a vehicle is on the road during a period, regardless of the number of owners.

Just like when we talked about VIN corrections, ExpressTruckTax has an option for those who exceed the mileage use limit.

Exceeding the Limit

What should you do when your suspended vehicles exceeds the mileage use limit?

It’s not unusual for a suspended vehicle to exceed its mileage use limit, which is why the IRS allows you to file an amendment if your vehicle exceeds the mileage use limit.

So how do you do it? Traditionally, you to need to calculate the tax on Form 2290, page 2, based on the month the vehicle was first used in the period. After that, you file the amended Form 2290 and Schedule 1 by the last day of the month following the month in which the mileage use limit was exceeded.

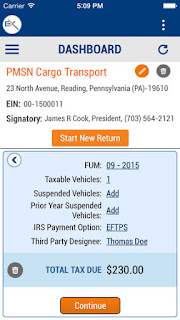

However, if you want to file your amendment fast, login to ExpressTruckTax.com, where it’s easy to file a mileage limit amendment and accurately calculate the tax due to IRS. Best of all, you will get your Schedule 1 for the new claim within minutes.

If you’ve e-filed with us before, you can select that return from our system. We also accept new filers, as well.

If you have questions about e-filing a 2290 amendment, please call us at 704.234.6005 – we’re here ready to answer your call in Rock Hill, SC, Monday through Friday, 9 a.m. to 6 p.m.

.png)