When it comes to filing Form 2290, accuracy is everything—especially when entering your Vehicle Identification Number (VIN). The VIN is a unique 17-character code that acts like your vehicle’s fingerprint. It identifies your specific truck and is used by the IRS, DMVs, and other agencies to track tax compliance, registration, and more.

For heavy highway vehicles weighing 55,000 pounds or more, filing Form 2290 is a legal requirement. But even a single typo in your VIN can cause your return to be rejected by the IRS, delay your Schedule 1, and prevent you from renewing your tags or getting your vehicle registered on time. And for owner-operators or fleet managers, delays mean downtime—and downtime means lost revenue.

This article covers the most common VIN mistakes truckers make when filing Form 2290 and how you can easily avoid them. Whether you’re an experienced filer or doing it for the first time, catching these errors upfront will save you time, money, and a whole lot of frustration.

Why Accuracy Matters: The Role of VIN in Form 2290

The Vehicle Identification Number is more than just a random string of letters and numbers—it’s your truck’s official identity. Every vehicle has a unique 17-character VIN that contains key information like the manufacturer, model year, and vehicle features. When filing Form 2290, the IRS requires you to enter this number exactly as it appears to associate the tax payment with the correct vehicle.

Where to Find Your VIN

Your VIN can typically be found in several places, including:

- Dashboard: On the driver’s side, near the windshield.

- Driver’s side door frame or pillar.

- Vehicle title or registration documents.

- Insurance card or policy.

- Truck lease or loan agreements.

Always make sure to reference the official vehicle documents when entering your VIN to ensure accuracy.

Why the IRS Requires an Accurate VIN

The IRS uses the VIN on Form 2290 to:

- Match the Heavy Vehicle Use Tax (HVUT) payment to the correct truck.

- Generate your stamped Schedule 1, which serves as proof of tax payment.

- Prevent duplicate filings or fraudulent claims.

If the VIN is incorrect, even by a single digit, the IRS may reject your return—or worse, they may process it under the wrong vehicle, leading to compliance issues down the road.

How the IRS and DMVs Use the VIN for Compliance

Once your 2290 is accepted, the stamped Schedule 1 includes your VIN, and this document is required for:

- Registering your vehicle with your state’s Department of Motor Vehicles (DMV).

- Renewing your tags or apportioned plates.

- Proving HVUT compliance during DOT audits or inspections.

Many DMVs now cross-reference the VIN on your Schedule 1 with IRS records before allowing registration, so even a small error could lead to registration delays or temporary denials.

In short, your VIN connects all the dots between your vehicle, your tax return, and your legal ability to operate on U.S. highways. That’s why it’s crucial to get it right the first time.

Top VIN Mistakes Truckers Make

Even the most experienced truckers and fleet managers can make simple but costly mistakes when it comes to entering the Vehicle Identification Number (VIN) on Form 2290. These errors can lead to IRS rejections, delays in receiving your Schedule 1, and potential compliance issues with the DMV. Let’s break down the most common VIN-related mistakes and how they happen:

1. Incorrect Characters

One of the most frequent mistakes is entering incorrect characters—especially when it comes to numbers and letters that look similar.

- Common mix-ups:

- The letter “O” confused with the number “0”

- The letter “I” confused with the number “1”

- The letter “Q”, which isn’t used in standard VINs but may be mistakenly added

- Wrong length:

VINs must be exactly 17 characters long—no more, no less. Entering 16 or 18 characters will immediately flag your return and likely result in a rejection from the IRS.

Pro Tip: Double-check your VIN against the vehicle’s title or registration, and avoid using handwriting or unclear scans as your source.

2. Transposed Numbers

A simple switch of two digits—say, typing “67” instead of “76”—can invalidate the entire VIN. These errors usually happen due to fast typing or distractions and can be hard to catch without double-checking.

- Why it matters:

Transposed numbers can make the VIN point to a completely different vehicle, which means your tax payment may not apply to the correct truck.

Solution: Always recheck the VIN after typing it in and consider reading it out loud digit-by-digit to catch mistakes.

3. Using a Fleet or Internal ID Instead of the Actual VIN

In busy operations, especially for larger fleets, drivers or admins may accidentally input:

- Internal asset numbers

- Fleet management IDs

- Truck unit numbers

These numbers might be familiar for tracking trucks internally but are not valid VINs and will be rejected by the IRS.

Reminder: The VIN is always 17 characters and must come from the truck’s official documentation.

4. Copy/Paste Errors in Bulk Uploads

For fleet operators using Excel or CSV files to bulk upload vehicle data:

- Copy/paste mistakes, such as shifting cells or overwriting the wrong rows

- Hidden formatting issues that add spaces or characters

- Pasted VINs from the wrong source column

These errors can go unnoticed until the IRS rejects the return—or worse, accepts it with the wrong VINs filed.

Tip: Always use ExpressTruckTax’s bulk upload template and preview your return before submitting.

5. Outdated VIN

Sometimes, a trucker might reuse a VIN from a previously sold vehicle or from one that was taken out of service before the current tax period.

- Why it’s an issue:

Filing for a truck that’s no longer in your fleet can result in:

- Unnecessary tax payments

- A mismatch between IRS records and your actual operation

- Denied tax credits if not corrected properly

Fix: Keep your records up to date and verify the active status of every truck before filing.

How VIN Mistakes Impact Your Filing

Even a minor VIN error on Form 2290 can create a domino effect of delays, frustration, and unnecessary costs. Whether you’re an owner-operator or managing a large fleet, the consequences of a simple typo can disrupt your operations in big ways. Here’s how VIN mistakes can affect your tax filing and beyond:

1. IRS Rejection = Delayed Stamped Schedule 1

The IRS requires a valid, correctly entered 17-character VIN to process your Form 2290. If there’s a mistake—even one incorrect digit—your return may be rejected automatically.

- Without an accepted return, you won’t receive your stamped Schedule 1, which serves as your official proof of payment for the Heavy Vehicle Use Tax (HVUT).

- For time-sensitive filings, like during peak renewal seasons or before road inspections, this delay can throw off your entire schedule.

Reminder: You need the stamped Schedule 1 to renew your tags or operate legally on the road, so even a short delay can impact your income.

2. DMV Registration and Tag Renewal Delays

Most state Departments of Motor Vehicles (DMVs) require a valid, IRS-stamped Schedule 1 to:

- Register a new truck

- Renew existing plates or IRP tags

- Transfer ownership

If your Schedule 1 has a VIN mismatch or was rejected due to an error, the DMV will not process your request. This can leave your truck off the road until the issue is corrected.

For fleets: One incorrect VIN in a batch filing can delay multiple registrations if it causes confusion or triggers compliance reviews.

3. Wasted Time, Stress, and Extra Work

Correcting a VIN error isn’t the end of the world—but it does take time:

- You’ll need to file a VIN correction or completely re-submit your return.

- You may need to contact support, reprint documents, or re-upload data if you filed in bulk.

- If the mistake delays your filing past the due date, you could be subject to IRS penalties or interest.

For busy truckers and fleet managers, this means extra admin time, stress, and the possibility of downtime for your vehicle—all because of a single keystroke.

Good news: If you originally filed with ExpressTruckTax, you can correct your VIN for free and retransmit your return at no additional cost.

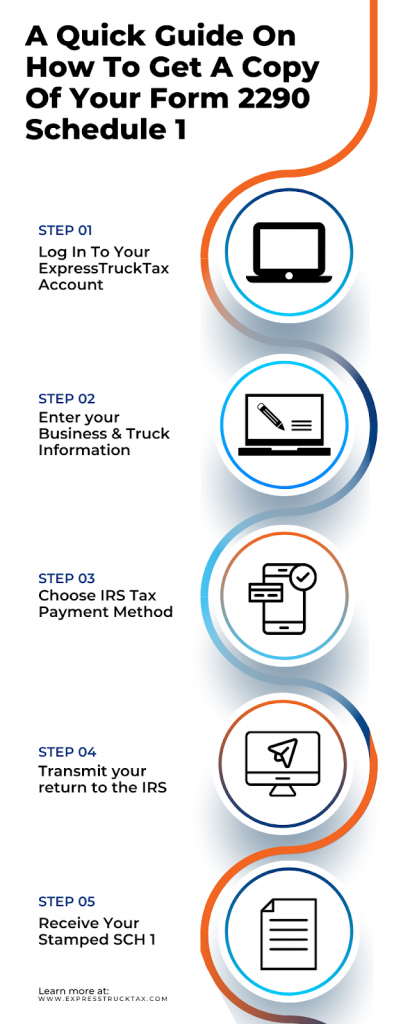

How ExpressTruckTax Helps You Stay Accurate

At ExpressTruckTax, we understand how frustrating and costly VIN mistakes can be—especially when you’re up against tight registration deadlines or busy hauling schedules. That’s why we’ve built our platform with truckers in mind, offering features and support designed to help you catch and fix errors before they become a problem.

Here’s how we help you stay on track and file with confidence:

Free VIN Correction Service (If You Filed With Us)

Made a mistake in your VIN after filing? No problem. If you originally filed your Form 2290 with ExpressTruckTax, you can submit a VIN correction at no extra cost.

- No need to repay the Heavy Vehicle Use Tax.

- Quickly generate a corrected Schedule 1 with the accurate VIN.

- Corrections are processed fast—so you can get back on the road without delay.

Pro Tip: If your VIN error led to a Schedule 1 rejection, you can refile as many times as needed for free until it’s accepted.

Step-by-Step Help from Real Humans

Filing taxes can feel overwhelming, especially with all the regulations and number-heavy details. That’s why ExpressTruckTax offers:

- Guided, step-by-step instructions throughout the filing process.

- Access to a bilingual, U.S.-based support team (English & Spanish).

- Live help via phone, chat, or email from real people who understand trucking—not bots.

Whether you’re filing for one truck or managing a fleet of thousands, our team is here to walk you through every step and double-check that everything looks right before you transmit to the IRS.

Instant Notifications for Rejections or Approvals

Waiting for your stamped Schedule 1 can be nerve-wracking, especially during peak filing periods. ExpressTruckTax keeps you in the loop with real-time filing status updates, including:

- Instant IRS approval notifications by email, text, or fax

- Alerts for IRS rejections with clear reasons and next steps

- Quick access to your stamped Schedule 1 once it’s approved

With instant notifications, you’ll know within minutes whether your filing went through—giving you peace of mind and saving you time.

Mobile App Convenience

On the road or out of the office? No worries. The ExpressTruckTax mobile app puts your 2290 filing power in your pocket.

- Check your filing status on the go

- Access and download your stamped Schedule 1 anytime

- File VIN corrections or make amendments from your phone or tablet

- Get push notifications for important updates

It’s the perfect tool for owner-operators, fleet admins, or anyone who needs flexibility while managing tax filings from the road.

With ExpressTruckTax, you don’t just get an IRS-authorized e-filing service—you get a full-service partner that’s committed to helping truckers stay compliant, avoid penalties, and keep moving forward.

Don’t Let VIN Errors Put your Operations in Jeopardy

Our intuitive platform, complimentary VIN correction tool, instant service notifications, and dedicated bilingual support team will help you swiftly navigate Form 2290 filing without costly errors, delays, or headaches.

File confidently, drive safely, and keep your business moving forward with ExpressTruckTax today!