There are three types of amendments you can e-file when it comes to your Form 2290. The second of those amendments (since we’ve already addressed the VIN Corrections), is the mileage limit amendment.

What is a Mileage Limit?

Keep in mind that this limit only applies to the total miles your vehicle drives on public highways during the tax year, regardless of the number of owners.

The Form 2290 Mileage Increase Amendment is for suspended vehicles that exceeded the mileage use limit for the tax year, so if you filed as suspended, but just went over that limit, then it’s time to start e-filing!

I’m Over the Mileage Limit! Now What?

So what happens when you go over the mileage limit? Well, Trucking Nation, that’s when you start e-filing your handy dandy Form 2290 Amendment!

Now you don’t have to worry about filing amendments just yet, but you should be pre-filing. However, there’s a chance you might need to e-file an amendment in the near future. But that’s why we’re here!

And at ExpressTruckTax, as e-filing industry leaders, our amendment process is quick and easy!

Step 1: Log In or Create New User

- If you are a returning user, log in to your account.

- If you are a new user, choose to create an account.

- Pro-tip: If you don’t want to go through and create a whole new account, you can also choose to link your ExpressTruckTax account with Facebook or Google+.

- Then, click “Start” under Form 2290 Amendments.

- After that, choose the kind of amendment and click start under “Mileage Exceeded.”

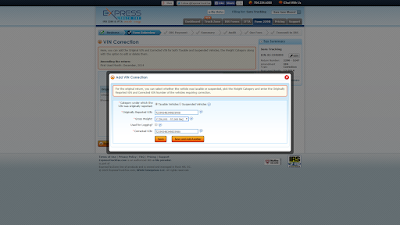

Step 2: Make Your Corrections

- If you are a returning user, you can choose to amend a return you e-filed with us.

- If you are a new user, you can choose to amend a return that was paper-filed or e-filed elsewhere.

- Next, choose the vehicle you are filing the amendment for.

- Again, if you haven’t filed with us, enter the vehicle’s information, such as the VIN, taxable gross weight, and whether or not it’s used for logging.

- Finally, hit “Save” or “Save & Add Another” if you’re e-filing an amendment for more than one vehicle.

Step 3: Review & Submit!

- The prorated tax is then calculated for you!

- Click “Next,” and enter your method of payment. The IRS accepts Direct Debit (EFW), EFTPS, and check or money order (The IRS does not accept credit/debit cards).

- Then, just review your information one last time, and then let our system perform an Instant Audit to make certain everything is correct.

- Finally, securely transmit your amendment to the IRS, and you should get your Stamped Schedule 1 in minutes!

When it comes time to e-file Form 2290 Amendments, we’ll be here for you! So if you have any questions or need any help when it comes to e-filing, you can talk to us.

Just give us a call at 704.234.6005 or send us an email at support@expresstrucktax.com for 24/hour support in English and Spanish!

And don’t forget, that there are only 8 days left to pre-file your HVUT! That means there’s still time to get a sweet discount on e-filing when you use the promocode PREFILE, and you can still be entered in our Swag Bag Giveaway. So don’t delay, pre-file today!

.png)

.png)