Sure, Heavy Vehicle Use Taxes aren’t due until August, but do you know the most common errors?

While we have audit and error checks built into ExpressTruckTax, there are always a some user-end errors you need to watch out for.

The last thing you want is for one to slip by the cracks and go unnoticed until it’s too late!

Hopefully you haven’t made any of these, but we will do our best to guide you through these troubled waters.

Your VIN Was Mistyped

Honestly, this is one of the most common errors we hear about. With vehicle identification numbers being a 17-digit string of characters, who can be blamed?

Since these codes are frequently entered wrong, we know that plenty of truckers have to deal with this.

Now, really this is between you and the IRS, because you might file with the wrong VIN and never know. Yeah, that’ll be bad if you need to present your schedule 1 to some aspect of the law.

And don’t forget, your VIN numbers will never contain an O, I, or Q, unless the truck is over 20 years old.

So if you entered the wrong VIN and filed with ExpressTruckTax, log back in and get a free VIN correction. If you didn’t file with us, you can still file for a VIN correction after paying a small fee.

You Are Paper Filing… Because It’s the Stone Age

Sorry, we kid. We are a little gung-ho about e-filing, so we like to rag on paper every now and then.

But really, paper filing puts you and your trucking profession in unnecessary danger. The error rate on typical paper filing sits around 21%, while e-filing is less than 1%.

What other reasons should you e-file? I dunno, you hate doing paperwork by hand, and you’re not a mathematician. That counts for us, at least.

Plus you will get your stamped Schedule 1 in minutes.

You Don’t Need a New 2290, You Paid on Your Old Truck

Oh yeah, you paid. For your last truck, not your new one!

Just because you have 2290s for your old vehicle, doesn’t mean you’re set on your new one. The IRS does not believe in a 1-1 truck transference, so you can’t either.

That means you need to register your new truck like you would your old one, except you e-file your 2290 based on the first month you use it.

Speaking of First Month

If you bought your truck this year, you will have a first used month unique to the purchase at a prorated amount.

Basically, you’re only charged from the first month you use the truck instead of your typical July/August filing date.

Since August is the deadline, you will still have to pay that deadline, even if you bought your truck in May or June.

Don’t make this common mistake! And if you did, it’s better to file late than never.

And One More, as a Bonus…

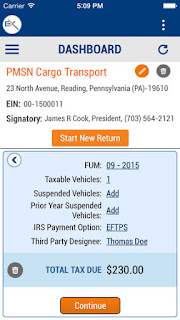

You’re not e-filing with ExpressTruckTax! With our built-in error checks, easy to use e-filing system, and Truck Zone business center, you have plenty of reasons to e-file with us.

Plus you get your stamped Schedule 1 in minutes, so you can get back on the road in no time.

If you have any questions, give us a call at 704.234.6005. Or shoot us an email at Support@ExpressTruckTax.com.

Are YOU making these 2290 errors?