HVUT payments don’t have to be complicated. Don’t know how much you will owe the IRS? Don’t know how to make your 2290 payment? We can help with that!

Here are our top three tips and tricks to help simplify your HVUT payments.

1. Figure out your HVUT Payment

With the HVUT 2290 tax payment calculator from ExpressTruckTax, you can figure out exactly how much HVUT you will owe the IRS.

Simply enter your First Use Month and Weight Category and we will calculate precisely how much HVUT you owe!

Take the guesswork and the stress out of your HVUT tax payment this year!

2. Choose the best method to make your HVUT payments

There are three IRS HVUT 290 payment methods available to truckers for the 2020-21 tax year.

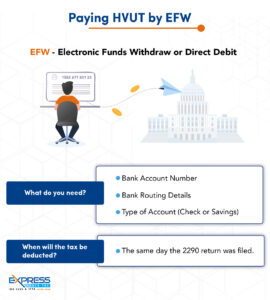

Electronic Funds Withdrawal (EFW)

EFW is just your standard bank account transfer. You’ll need to provide your bank account number and routing number to the IRS. Typically they will withdraw your payment within one or two business days.

Electronic Federal Tax Payment Service (EFTPS)

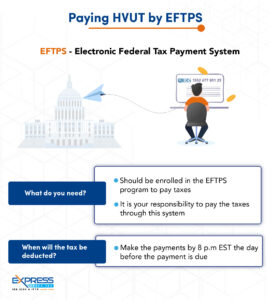

EFTPS is a service offered by the IRS to simplify tax payments. It is a highly secure solution that allows you to schedule out payments in advance

If you choose EFTPS to pay your IRS 2290 payment, you’ll need to create an account by enrolling in the program here.

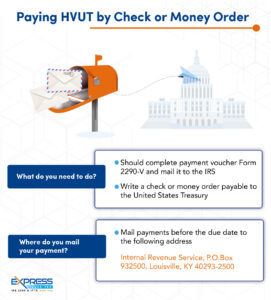

Check or Money Order

If you choose to make your 2290 payment by check or money order, you’ll need to remember to mail it to them. The responsibility to be on time is entirely on you.

Mail your check or money order to:

Internal Revenue Service,

P.O. Box 804525,

Cincinnati, OH 45280-4525

3. Choose the right 2290 E-file provider

Many e-file providers have confusing processes for filing out HVUT returns. In most cases, the structure makes it hard to know how much you will need to pay them and how you can pay the IRS.

However, with ExpressTruckTax, everything is upfront. Our pricing is transparent. Our interview-style e-filing process makes filing easy. And we make sure you know how and when you need to pay the IRS.

Plus, if you have any questions you can always call our US-based customer support team!