There’s nothing worse than having to file your annual truck taxes twice.

Avoid IRS Form 2290 mistakes this year when you e-file 2290 with ExpressTruckTax.

We’ve got a few tips to make the process as painless as possible and save you from any unnecessary corrections.

Filing IRS Form 2290 before the deadline will save you tons of money, but mistakes could keep you from meeting the Form 2290 due date and cost you a sweet penny.

Avoid frustration and confusion by double-checking some information that commonly delays IRS Form 2290 approval.

The Most Common IRS Form 2290 Mistakes to Avoid

5 Common IRS Form 2290 Mistakes

Here are some things to be extra cautious about when filing your 2290 Form.

How to Check These Areas For Error

- 1) EIN (Employer Identification Number) or VIN (Vehicle Identification Number)

A unique EIN is assigned to each company operating in the US as a form of identification for tax purposes. Your EIN should be a string of 9 numbers, presented in this format: 12-3456789.

Since this number looks similar to a social security number, filers often confuse the two, causing the IRS to reject the 2290 Tax Form.

Keep in mind that it takes 10 business days for the IRS to update its database with a new EIN. If you’re applying for a new EIN, do so at least a month before you e-file IRS 2290 to avoid delays.

Your VIN should be 17 characters long and include both numbers and letters. Check your VIN before submitting your 2290 Tax Form. If incorrect, your IRS Form 2290 will be rejected.

The best online tax filing is quick. Don’t waste unnecessary time with mistakes. When you e-file 2290, double-check your Form 2290 and ensure that your EIN and VIN are correct.

- 2) First Used Month or Filing Year

When filing IRS Form 2290, make sure you use the correct filing year.

Note: If you’ve used an online filing service before, the drop-down menu could be set to a previous 2290 Tax Form file year. Double-check!

Secondly, choose an accurate first used month.

The first used month is the month you first used the truck on the highway during the tax period, which runs from July 1 to June 30 of the next year. Your Truck Tax form is due on the last day of the month after your first used month.

This means if you first used your vehicle in July, as most drivers do during the tax season, then you will need to file your IRS 2290 Tax Form by August 31.

IRS Form 2290 tax calculations can be tricky, but don’t sweat it. At ExpressTruckTax, our system automatically calculates your owed tax amount. Leave all 2290 tax form math to us.

It’s important to find the best online tax filing service to save yourself time and money. ExpressTruckTax can help!

- 4) Authorized Signatory Details

It’s super easy to sign your IRS 2290 online. All you need is a 5-digit authorized signature code. Still, no matter how simple it sounds, please just… double-check.

- 5) Business Name & Address

You’d be surprised at how many returns are rejected for this information being incorrect!

The wrong business name and address is the most common error on the heavy vehicle use tax form 2290. Don’t let it happen to you!

Double-check your business name and address before submitting your IRS Form 2290.

Why is it so Important to Avoid IRS 2290 Mistakes?

Even the simplest mistake on your IRS Form 2290 can cause serious problems. For starters, your 2290 Tax Form will definitely be rejected by the IRS.

This is a huge time waster and may cause you to miss the HVUT 2290 Tax Form Deadline.

If this happens and you miss the deadline, you’ll need to correct your Form 2290 and file again, attaching an explanation to show reasonable cause for the delay of your heavy vehicle use tax.

There’s no guaranteeing that your statement will be accepted by the IRS, and if it’s not, you’ll face heavy IRS 2290 Tax Form penalties.

The penalty for failing to file IRS Form 2290 by August 31st is 4.5% of the total tax amount owed. Plus, you still have to pay the base HVUT 2290 amount you owe.

In addition, this penalty will increase monthly for up to 5 months, with an additional .54% interest added for each month that it remains unpaid.

Save yourself while you can and double-check your Form 2290 before you e-file 2290 online.

The Best Online Tax Filing Service to Use

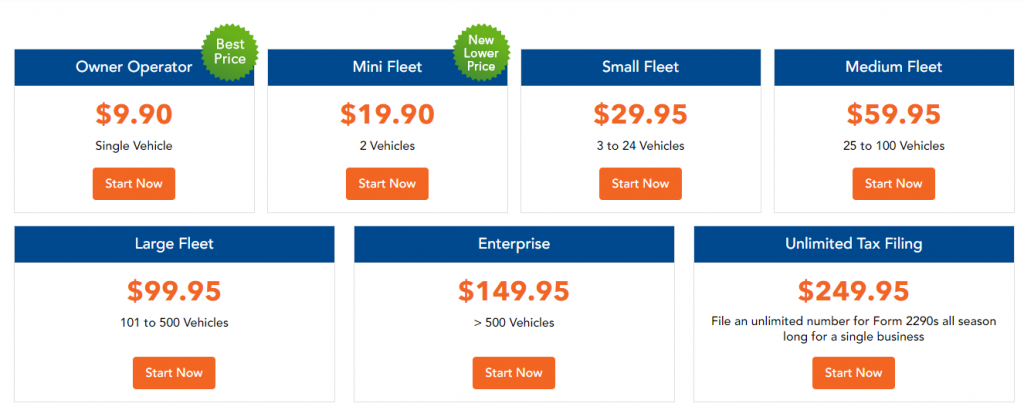

ExpressTruckTax makes filing easy. When it comes down to it, we simply don’t believe that filing IRS Form 2290 should be so difficult.

We include an instant error check to help catch any mistakes hidden in your 2290 Tax Form. We also have a US-based customer support team ready to help you every step of the way.

With features like bulk upload, free VIN corrections, and a mobile app, we’re committed to hosting your best filing experience yet.

Sign up for a free account today and you’ll agree that ExpressTruckTax is the best online tax filing option for Form 2290.