Here at ExpressTruckTax, we understand that trucking is not easy. In addition to long hours on the road, truckers have to keep up with many forms of registration and many different taxes.

There are HVUT, IFTA, IRP, MC, and DOT registrations, just to name a few.

That’s why we have several free mobile apps with solutions for HVUT and IFTA to keep truckers compliant and save them time.

IFTA calculator

Calculating IFTA taxes is one of the most complex things truckers have to do. You have to use all of your miles, and all your fuel purchases to calculate what you owe. You have to know the correct tax rates. You have to know if there are exemptions.

Our free IFTA calculator app takes the guesswork out of IFTA calculations. Simply enter your mileage and fuel and the app takes care of the rest. Figuring out what you owe has never been easier.

Download the IFTA Calculator

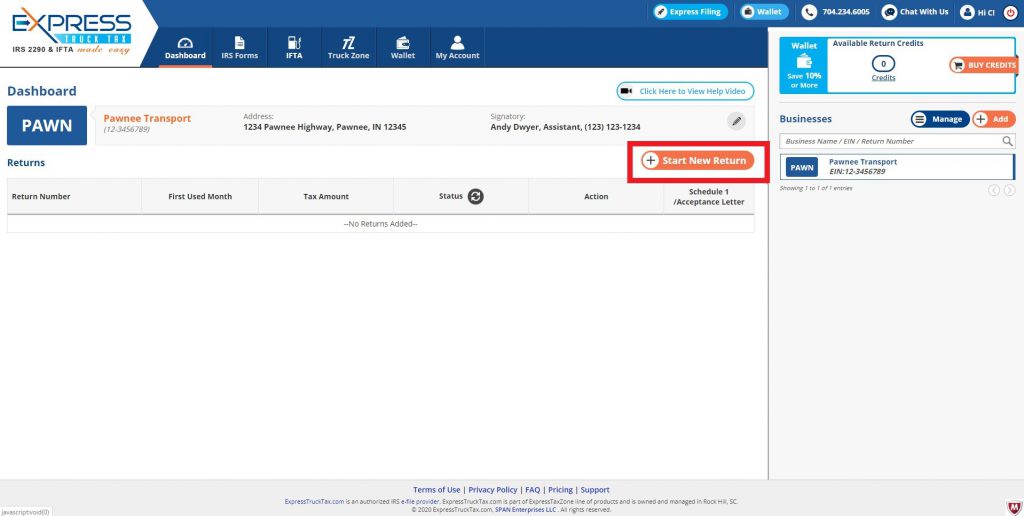

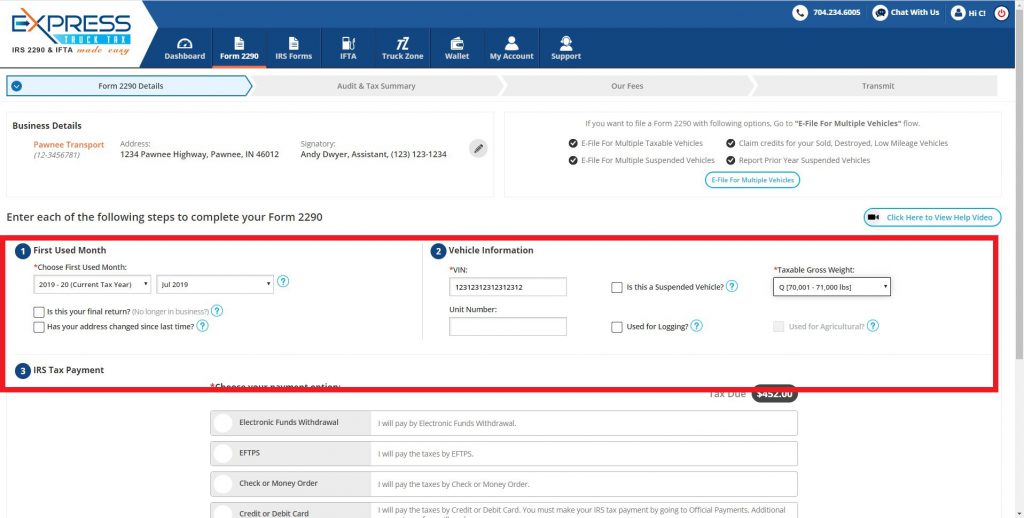

HVUT Calculator

Take the guesswork out of your yearly HVUT tax cost with our free HVUT Calculator app. Just input your first use month and gross taxable weight and the HVUT Calculator app will tell you what you owe.

No need to worry about not having enough money to cover your payment. Just calculate ahead of time and start saving!

Download the HVUT Calculator

TruckLogics

TruckLogics is a Trucking Management Software designed to help you keep track of your entire business.

For a small monthly fee, you will be able to track dispatches, invoices, expenses, and much more with real-time reports! TruckLogics even helps with IFTA calculation and has DAT Load Board integration.

And, you’ll get access to the TruckLogics Mobile App at no extra cost! With it, you can manage your business from anywhere!

Download TruckLogics

Give TruckLogics a test drive today! There’s no obligation and no credit card information required.