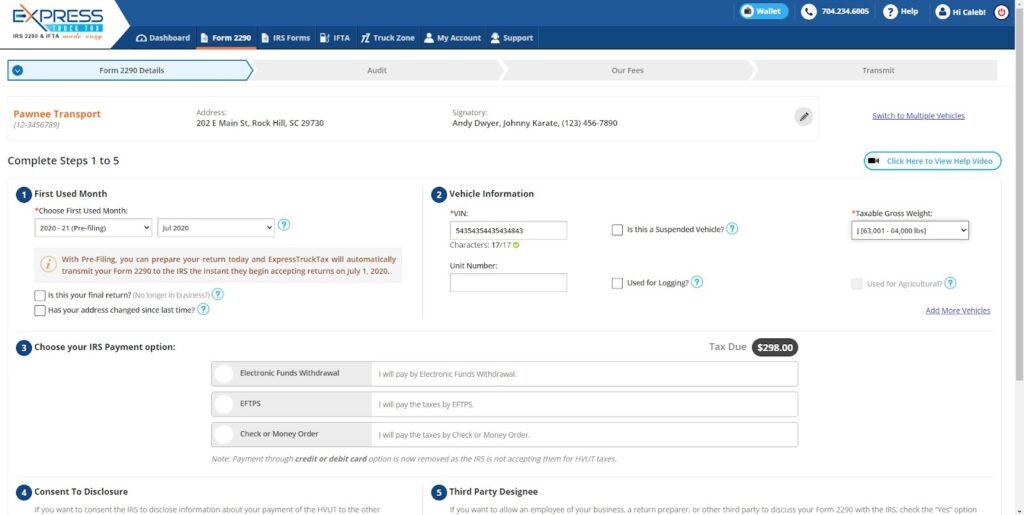

The Form 2290 deadline is less than a week away. It is important that you file the Form 2290 and make the HVUT payment before August 31st, 2021 to avoid unwanted penalties.

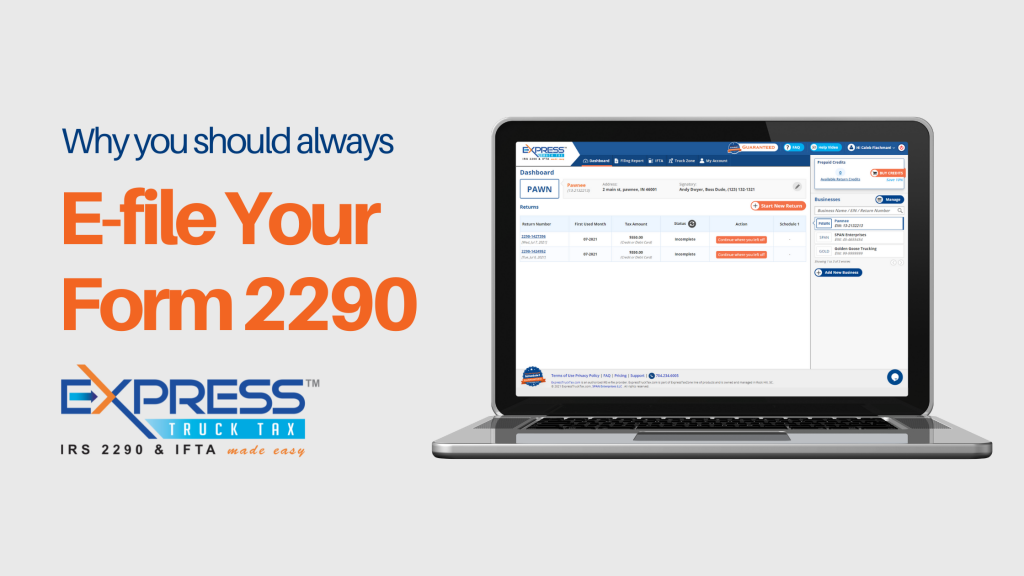

To avoid long delays in your return processing and receive your stamped Schedule 1 within minutes of submission, the best option is to e-file.

But which e-filing program should you use? It’s important to find one that’s affordable with the most bang for your buck,

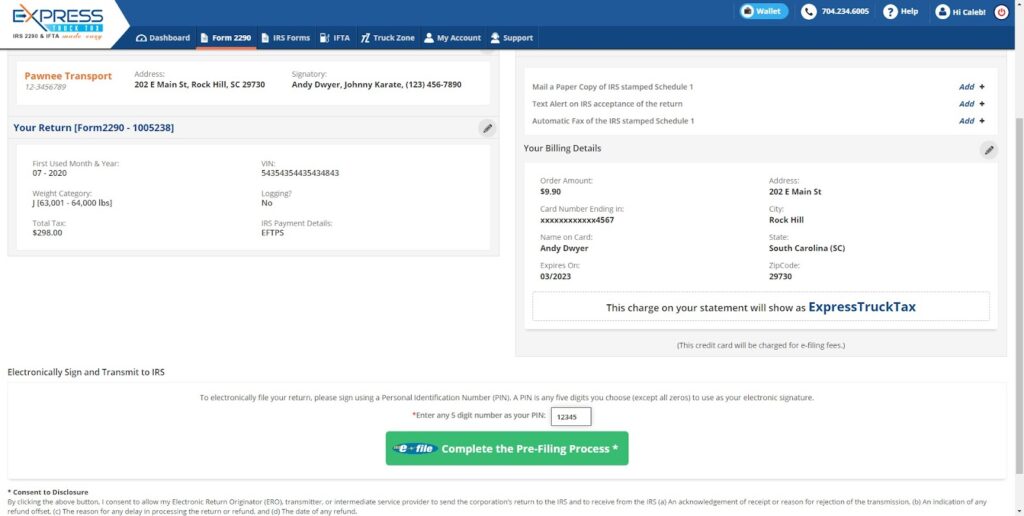

ExpressTruckTax offers many great features for a filing fee as low as $9.90!

Free Features ExpressTruckTax Include

Features that simplify the process

ExpressTruckTax offers a large number of features at no extra cost. These features are provided in order to make the process easier and quicker to complete.

Some features that help to simplify the filing process include Multi-user access, Auto-generated Form 8849s, Bulk information upload, and the use of our free mobile app.

ExpressTruckTax also allows filers to copy last year’s return if they have filed with us. This way, if none of the information has changed, you are able to just resubmit the form without having to reenter the information every year!

Features to check for correct information

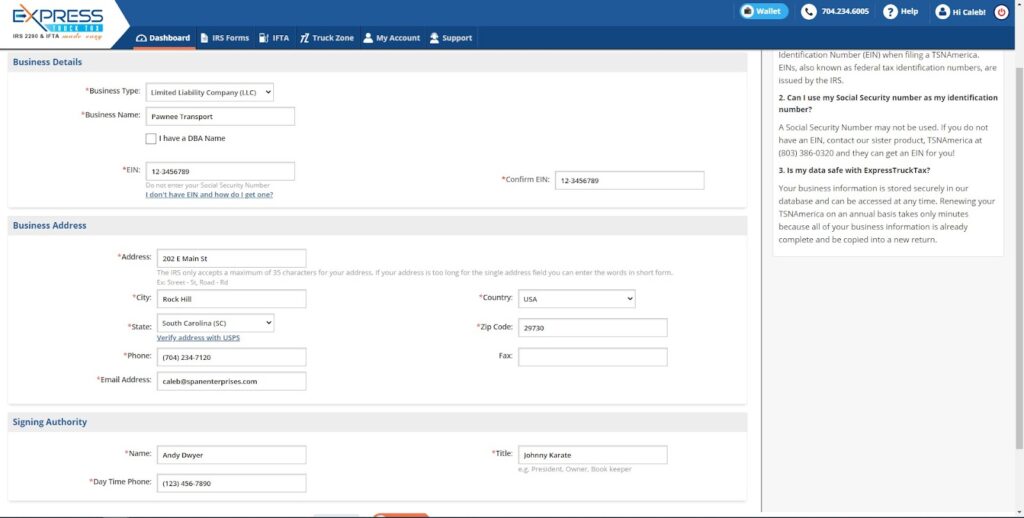

To help ensure that the tax return is accepted by the IRS, ExpressTruckTax offers features to make sure all your information is correct.

No one wants to deal with the hassle of having to resubmit their Form 2290 because it was rejected by the IRS. To avoid rejection, it is important to make sure the information is correct on your Form 2290.

Some features that ExpressTruckTax offers to help avoid rejected returns include instant error checks, Free VIN corrections, and a Free VIN checker.

If the return is rejected, our Express Guarantee is our assurance that, with the help of our support team, we will get you Form 2290 accepted or your money back!

File With ExpressTruckTax Now!

ExpressTruckTax has been the industry-leading IRS-authorized e-file provider for years. Our support team knows all the ins and outs of e-filing Form 2290 and are happy to help.

Our support team offers help and guidance in both English and Spanish. The team has also extended their hours and are available to help 8am-7pm Monday-Friday and 9am-1pm Saturday/Sunday (8/28-8/29 only).

To contact our team, give them a call at 704-234-6005 or send them an email at support@expresstrucktax.com.

To sign in or register with ExpressTruckTax, click here and start filing your return now!