Category: IRS

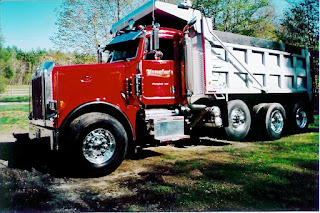

Trucking Spotlight

Trucking Spotlight

Trucking Spotlight

IRS Form 2290 – Heavy Vehicle Use Taxes

Express Truck Tax Offers Top Quality Customer Support to e-file IRSForm 2290!

Express Truck Tax Overview Video (E-file IRS form 2290)

Stay Alert for Internal Revenue Service Phishing Scams

Here is the plain text version of one of the emails:

- A copy of this letter

- Notification letter

- A photocopy of valid U.S. Federal or State Government issued identification.

Keep this notice for your records.

Be very careful with these emails. Most of them try to get you to reveal your personal or financial information. Do not reveal any of this information via e-mail. Better yet, Do Not reply to the email at all. Don’t follow any links from these e-mails to any web sites where you might be asked for the same information.

Other e-mails may have attachments or links which download viruses or other malware onto your computer. Some of this malware, has the capabilities to retrieve financial and other personal information from your computer. Even if you don’t manually input personal information into these sites, the malware allows the scammers to track your personally identifiable information.

Key Point to Remember: the IRS will never initiate contact with you via email. They will not ask you to click links to fix your tax information or verify your tax account. Neither will you be advised of a mistake in your refund via email. If you are concerned that you need to contact the IRS, then you should call them (1.800.829.1040). Don’t click on an attachment or reply to an email claiming to be from the IRS.

So to recap: delete, delete, delete. Do Not open links. Do Not open any attachments. Do Not investigate on your own. The IRS can handle any investigation if necessary. If you would like to make the IRS aware of it, you can forward the e-mail to the IRS at phishing@irs.gov then DELETE the email.

This Information has been provided by the Truck Tax Team at www.ExpressTruckTax.com

New PTIN Requirements for Tax Return Preparers

Beginning January 1, 2011 the IRS will require paid tax return preparers who prepare all or substantially all of a tax return to register and obtain a Preparer Tax Identification Number (PTIN). The requirements are intended to ensure tax preparers are competent and qualified.

Tax return preparers may apply for a PTIN using the IRS PTIN online application system at irs.gov. Individuals who currently possess a PTIN will need to reapply under the new system but generally will be reassigned the same number.

The IRS has also set up a special toll-free telephone number, 1-877-613-PTIN (7846), that tax professionals can call for technical support related to the new online registration system. Applicants will pay a $64.25 fee to obtain a PTIN, which will be valid for one year.

Receipt of a PTIN will be immediate after successful online registration. Tax preparers may also submit a paper application (Form W-12: IRS Paid Preparer Tax Identification Number Application). Paper applications will be processed in four to six weeks. Before registration, applicants should consider that the date the PTIN is assigned is established as the annual renewal date.

PTIN applications will require a Social Security number. Individuals without a Social Security number may apply but will be required to provide one of the following: Form 8945 (PTIN Supplemental Application for U.S. Citizens Without a Social Security Number Due to Conscientious Religious Objection) or Form 8946 (PTIN Supplemental Application for Foreign Persons Without a Social Security Number.)

Check the Express2290 blog soon for more information regarding the IRS PTIN requirements.

File 2290 – Month end is here

Express2290.com is the best solution for filing your Form 2290 (Heavy Truck Use Tax) Always double check the tax information you enter in your 2290 returns.

Few points to keep in mind while e-filing.

* E-file your 2290 returns with Express2290.com

* Review Federal Tax ID# or EIN# [Employer Identification Number]

* Review your Tax Year and Month

* Review your VIN# [Vehicle Identification Number]

* Sign and date your return electronically

* Choose IRS payment option

* Review all the information

* Double check your Business Name

* E-File Your 2290 Return

Choose IRS payment option:

There are several options to pay the HVUT taxes with the IRS.

Direct Debit or EFW: IRS will debit directly from your bank account.

EFTPS: You have to schedule the payment to the IRS by going to EFTPS.gov.

Check/Money Order: IRS also supports Check/Money Order if you have can schedule it in time. We strongly advice our Canadian customers to use this option as EFW option may not work for canadian banks.

Just a reminder, if you choose Direct Debit (EFW) as a payment method, the IRS will not process your return during the weekends, or on federal holidays, but on the next business day.

Review Tax ID Numbers

Carefully check Tax Identification numbers on your return.

Review Your Return

Express 2290.com is a very smart program, it automatically checks for any errors before you transmit your 2290 return to IRS, but its always good to double check everything before you hit the ‘Transmit to IRS’ button.

We are always available to help if needed. We are one of the few companies which is locally based to offer customer support. Call 704.234.6005