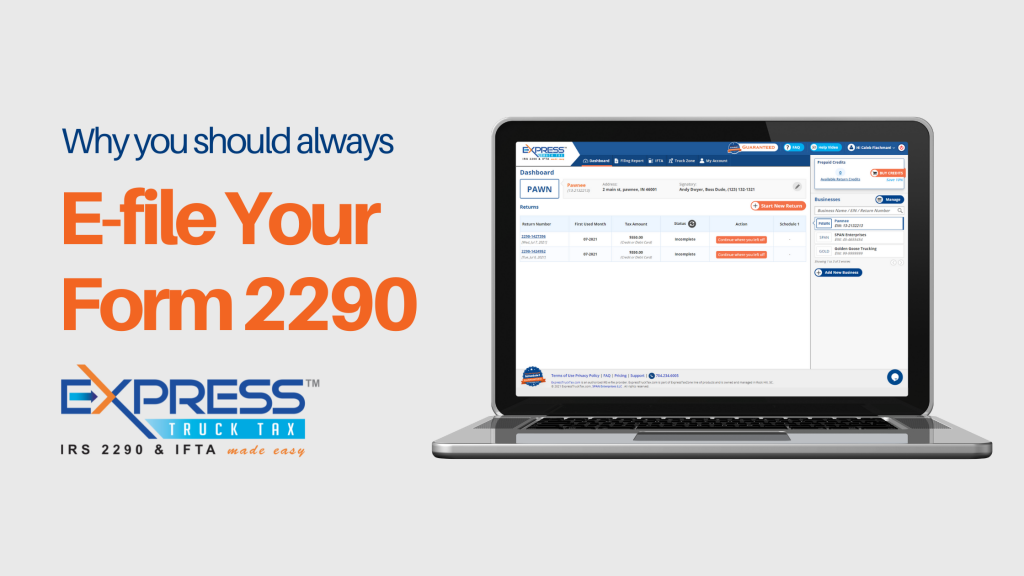

September is here meaning that the Form 2290 deadline has passed. Even if you still haven’t filed or are putting a truck on the road for the first time, you are still able to file Form 2290. At ExpressTruckTax we value all of our clients and want to make sure they all get the best filing experience possible.

September 15th marks the start of Hispanic Heritage Month. The trucking industry has seen a large increase in diversity with Hispanic-owned trucking businesses. A lot of the businesses that make up this growth are also women-owned. Over half of the foreign-born drivers in the country are from Spanish-speaking countries. Because of this, we want to make sure that all of our clients have the best filing experience that meets their needs.

Here at ExpressTruckTax, we value our Hispanic clients by offering a button that translates the site and informational material regarding Form 2290 into Spanish. Our outstanding customer support team also offers support available in Spanish to answer any questions related to Form 2290 you may have to ensure you file everything correctly.

ExpressTruckTax has a sister company, TruckLogics, a Trucking Management Software. TruckLogics caters to trucking companies located in Mexico, Canada, and the United States. It offers an all-in-one trucking management solution to help you manage every aspect of your trucking business, including dispatching drivers, creating loads, managing trucks and equipment, recording truck maintenance, IFTA reporting, and much more.

In honor of Hispanic Heritage Month, ExpressTruckTax wants to take the time to highlight some of our amazing Hispanic clientele and business owners that have generated their 2290 or 8849 Forms with us. We want to hear about your filing experience and if you’ve had a chance to talk to our amazing Spanish-Speaking agents.

If you would like your business featured, or want to shout out a Hispanic-owned trucking company you love, reach out to support@expresstrucktax.com.

We will feature these businesses through a Facebook post upon your approval.

Also, don’t forget to follow us on TikTok @espanolexpresstrucktax and on YouTube at TruckingMundo.